- South Korea

- /

- Software

- /

- KOSDAQ:A430690

Hanssak Co., Ltd.'s (KOSDAQ:430690) Financials Are Too Obscure To Link With Current Share Price Momentum: What's In Store For the Stock?

Hanssak's (KOSDAQ:430690) stock is up by a considerable 14% over the past week. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. In this article, we decided to focus on Hanssak's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Hanssak

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hanssak is:

4.2% = ₩1.5b ÷ ₩34b (Based on the trailing twelve months to June 2024).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each ₩1 of shareholders' capital it has, the company made ₩0.04 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Hanssak's Earnings Growth And 4.2% ROE

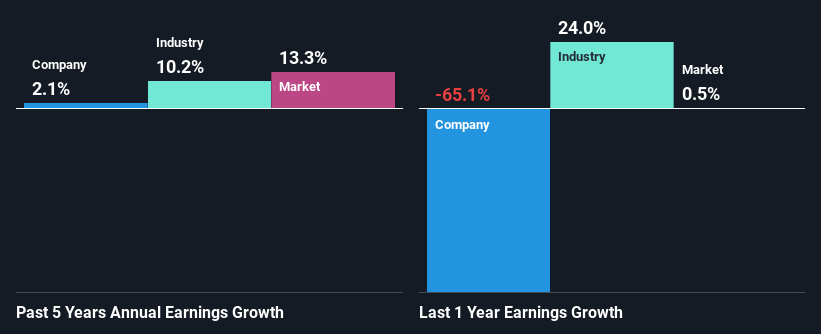

It is hard to argue that Hanssak's ROE is much good in and of itself. Not just that, even compared to the industry average of 7.4%, the company's ROE is entirely unremarkable. Accordingly, Hanssak's low net income growth of 2.1% over the past five years can possibly be explained by the low ROE amongst other factors.

As a next step, we compared Hanssak's net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 10% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Hanssak fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Hanssak Using Its Retained Earnings Effectively?

Hanssak doesn't pay any regular dividends, meaning that potentially all of its profits are being reinvested in the business. However, there's only been very little earnings growth to show for it. So there could be some other explanation in that regard. For instance, the company's business may be deteriorating.

Conclusion

In total, we're a bit ambivalent about Hanssak's performance. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. You can see the 4 risks we have identified for Hanssak by visiting our risks dashboard for free on our platform here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hanssak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A430690

Imperfect balance sheet with very low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion