- South Korea

- /

- Software

- /

- KOSDAQ:A322180

Even though LS THiRA-UTECH (KOSDAQ:322180) has lost ₩23b market cap in last 7 days, shareholders are still up 209% over 3 years

The LS THiRA-UTECH Co., Ltd. (KOSDAQ:322180) share price has had a bad week, falling 13%. But that doesn't change the fact that the returns over the last three years have been very strong. In three years the stock price has launched 209% higher: a great result. It's not uncommon to see a share price retrace a bit, after a big gain. The thing to consider is whether the underlying business is doing well enough to support the current price.

In light of the stock dropping 13% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

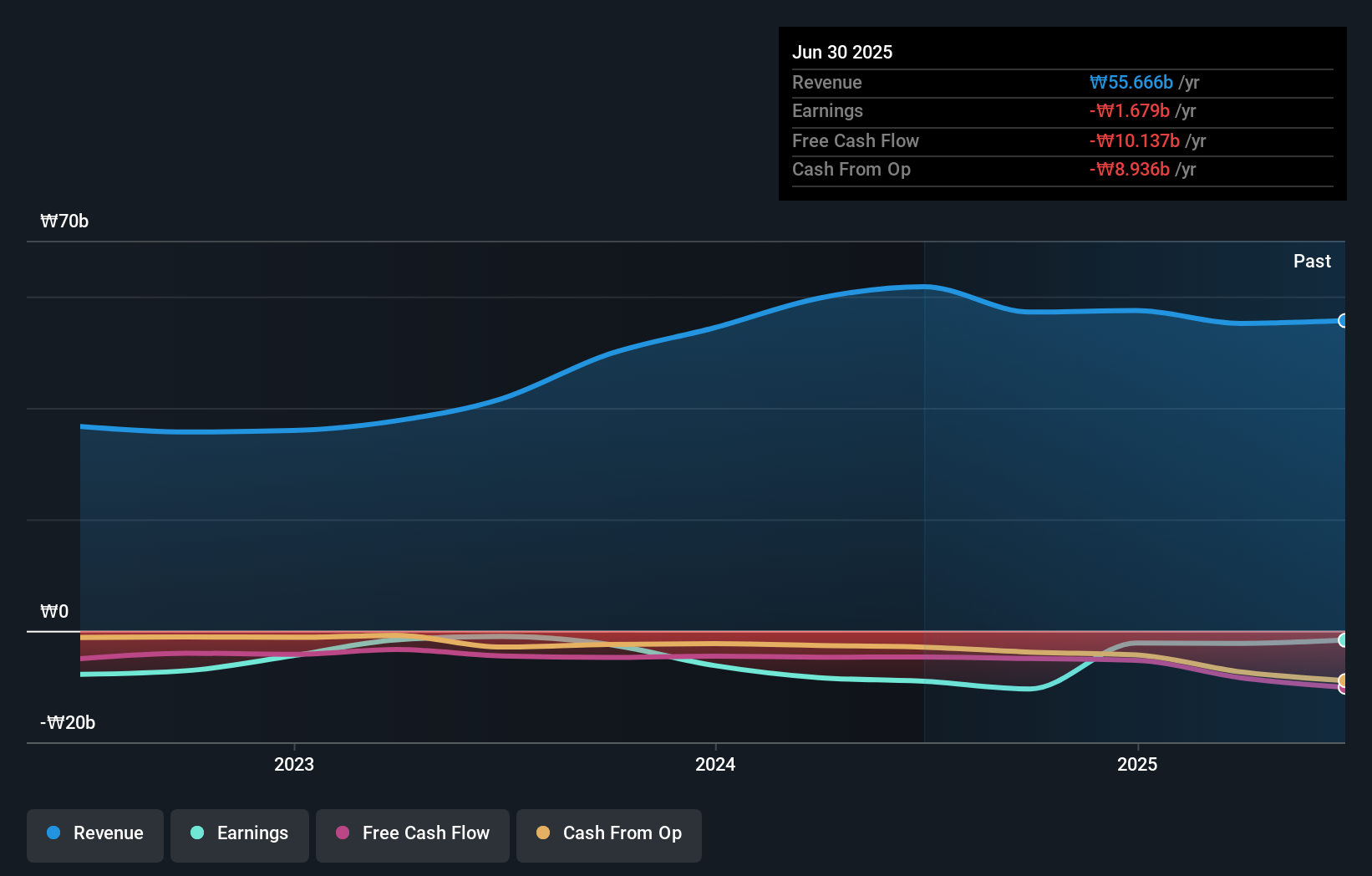

LS THiRA-UTECH isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

LS THiRA-UTECH's revenue trended up 18% each year over three years. That's pretty nice growth. Broadly speaking, this solid progress may well be reflected by the healthy share price gain of 46% per year over three years. The business has made good progress on the top line, but the market is extrapolating the growth. It would be worth thinking about when profits will flow, since that milestone will attract more attention.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

LS THiRA-UTECH shareholders gained a total return of 39% during the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 11% per year over five year. It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand LS THiRA-UTECH better, we need to consider many other factors. For example, we've discovered 2 warning signs for LS THiRA-UTECH (1 is concerning!) that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A322180

LS THiRA-UTECH

Operates as a smart factory and smart logistics specialized solution provider in South Korea.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives