- South Korea

- /

- IT

- /

- KOSDAQ:A124500

The one-year returns for ITCENGLOBAL's (KOSDAQ:124500) shareholders have been incredible, yet its earnings growth was even better

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. For example, the ITCENGLOBAL CO., Ltd. (KOSDAQ:124500) share price rocketed moonwards 576% in just one year. It's also good to see the share price up 292% over the last quarter. It is also impressive that the stock is up 557% over three years, adding to the sense that it is a real winner. It really delights us to see such great share price performance for investors.

Since the stock has added ₩229b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

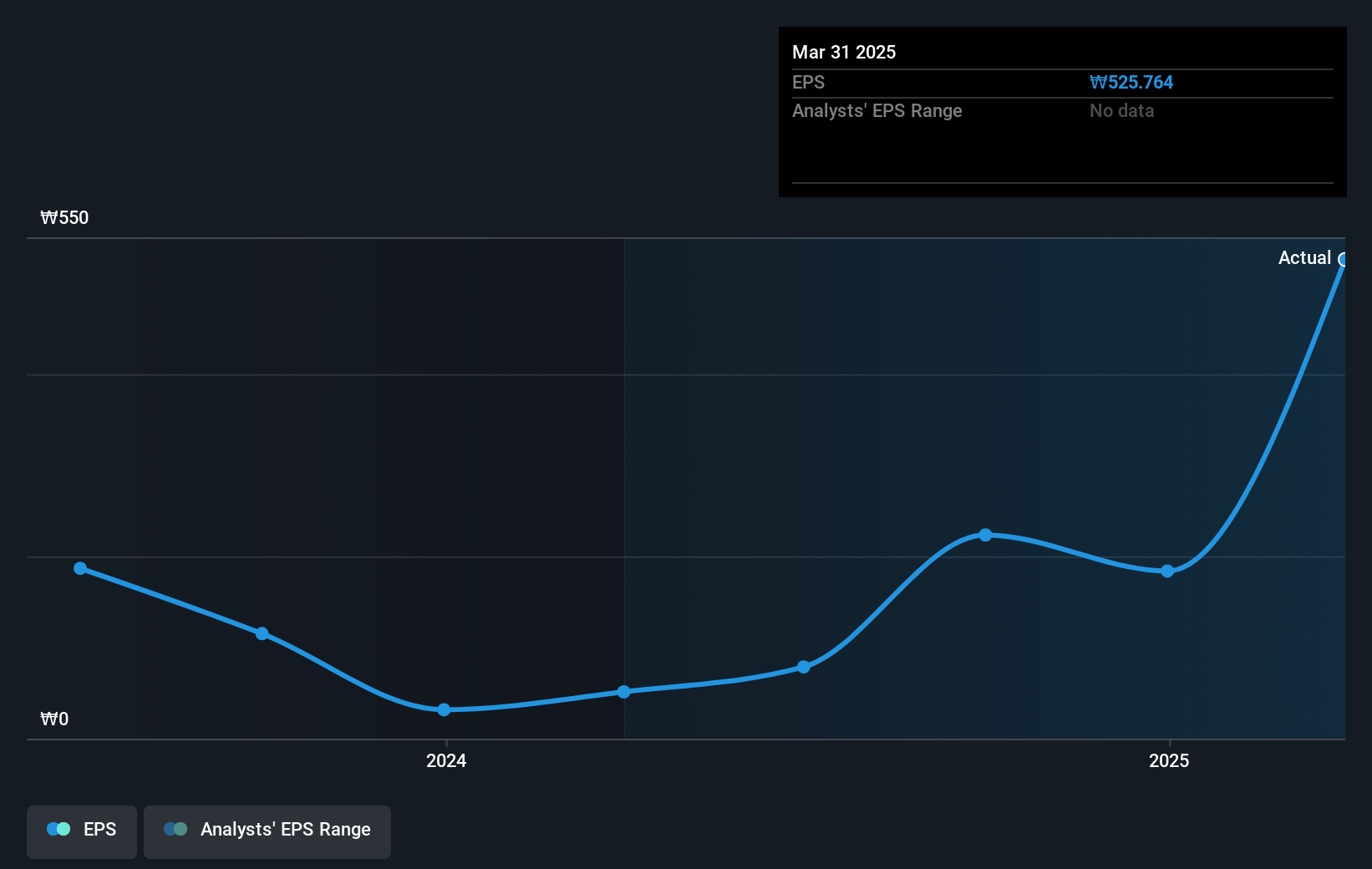

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year ITCENGLOBAL saw its earnings per share (EPS) increase strongly. While that particular rate of growth is unlikely to be sustained for long, it is still remarkable. We are not surprised the share price is up. To us, inflection points like this are the best time to take a close look at a stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on ITCENGLOBAL's earnings, revenue and cash flow.

A Different Perspective

It's good to see that ITCENGLOBAL has rewarded shareholders with a total shareholder return of 576% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 37% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand ITCENGLOBAL better, we need to consider many other factors. For example, we've discovered 1 warning sign for ITCENGLOBAL that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A124500

ITCENGLOBAL

Provides consulting, ICT, and outsourcing services and solutions in South Korea.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives