- South Korea

- /

- Software

- /

- KOSDAQ:A090850

Improved Revenues Required Before Hyundai Ezwel Co.,Ltd. (KOSDAQ:090850) Shares Find Their Feet

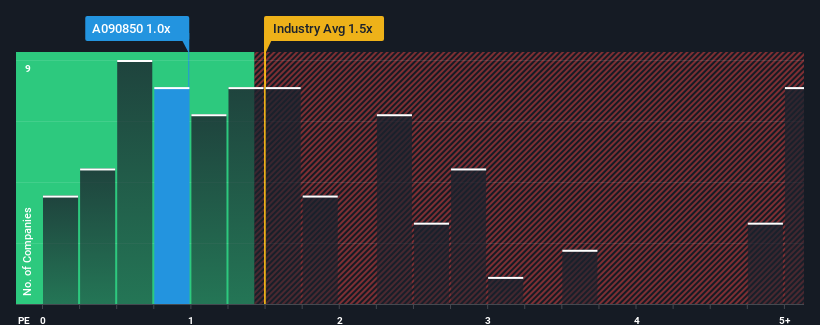

When you see that almost half of the companies in the Software industry in Korea have price-to-sales ratios (or "P/S") above 1.5x, Hyundai Ezwel Co.,Ltd. (KOSDAQ:090850) looks to be giving off some buy signals with its 1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Hyundai EzwelLtd

How Has Hyundai EzwelLtd Performed Recently?

Hyundai EzwelLtd could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hyundai EzwelLtd.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Hyundai EzwelLtd's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 9.2% gain to the company's revenues. Pleasingly, revenue has also lifted 34% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 7.3% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 18%, which is noticeably more attractive.

With this information, we can see why Hyundai EzwelLtd is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Hyundai EzwelLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Hyundai EzwelLtd, and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai EzwelLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A090850

Hyundai EzwelLtd

Engages in the development, consulting, and sale of selective welfare systems in South Korea.

Flawless balance sheet and good value.

Market Insights

Community Narratives