- South Korea

- /

- Software

- /

- KOSDAQ:A072770

Yulho Co., Ltd.'s (KOSDAQ:072770) Shares Leap 31% Yet They're Still Not Telling The Full Story

Yulho Co., Ltd. (KOSDAQ:072770) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. But the last month did very little to improve the 55% share price decline over the last year.

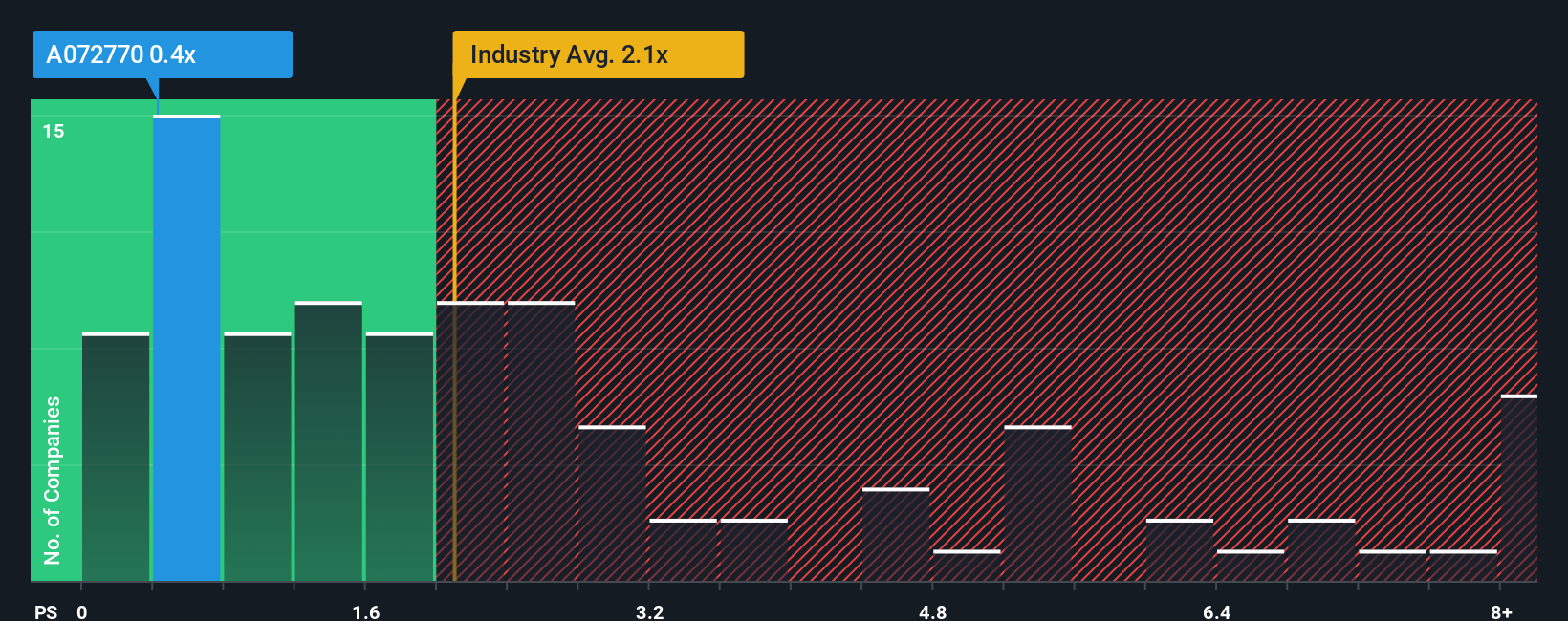

In spite of the firm bounce in price, it would still be understandable if you think Yulho is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in Korea's Software industry have P/S ratios above 2.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Yulho

How Yulho Has Been Performing

Recent times have been quite advantageous for Yulho as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for Yulho, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Yulho's Revenue Growth Trending?

In order to justify its P/S ratio, Yulho would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 59%. Pleasingly, revenue has also lifted 44% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 14% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, we find it intriguing that Yulho's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Yulho's P/S

Yulho's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Yulho revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

You should always think about risks. Case in point, we've spotted 3 warning signs for Yulho you should be aware of, and 2 of them make us uncomfortable.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A072770

Yulho

Engages in the development of industrial automation and embedded software solutions in South Korea.

Adequate balance sheet with low risk.

Market Insights

Community Narratives