- South Korea

- /

- Software

- /

- KOSDAQ:A058970

The Price Is Right For EMRO., Incorporated. (KOSDAQ:058970) Even After Diving 29%

EMRO., Incorporated. (KOSDAQ:058970) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 141% in the last twelve months.

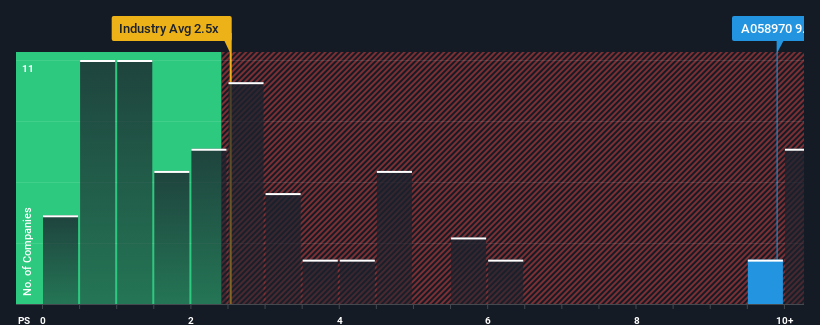

In spite of the heavy fall in price, you could still be forgiven for thinking EMRO is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.9x, considering almost half the companies in Korea's Software industry have P/S ratios below 2.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for EMRO

How Has EMRO Performed Recently?

EMRO could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on EMRO.How Is EMRO's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as EMRO's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 3.7% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 35% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 77% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 43%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why EMRO's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From EMRO's P/S?

Even after such a strong price drop, EMRO's P/S still exceeds the industry median significantly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that EMRO maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for EMRO that you should be aware of.

If you're unsure about the strength of EMRO's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if EMRO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A058970

EMRO

Provides supply chain management software in South Korea and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives