- South Korea

- /

- Software

- /

- KOSDAQ:A047560

ESTsoft Corp.'s (KOSDAQ:047560) 27% Price Boost Is Out Of Tune With Revenues

The ESTsoft Corp. (KOSDAQ:047560) share price has done very well over the last month, posting an excellent gain of 27%. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

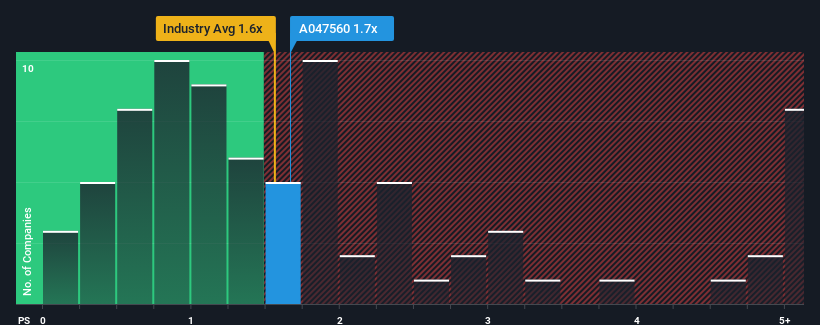

Although its price has surged higher, it's still not a stretch to say that ESTsoft's price-to-sales (or "P/S") ratio of 1.7x right now seems quite "middle-of-the-road" compared to the Software industry in Korea, where the median P/S ratio is around 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for ESTsoft

How Has ESTsoft Performed Recently?

Recent times haven't been great for ESTsoft as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on ESTsoft will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

ESTsoft's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen a 15% overall rise in revenue, aided extensively by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 14% over the next year. With the industry predicted to deliver 18% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that ESTsoft is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

ESTsoft's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that ESTsoft's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 2 warning signs we've spotted with ESTsoft.

If these risks are making you reconsider your opinion on ESTsoft, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if ESTsoft might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A047560

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026