- South Korea

- /

- IT

- /

- KOSDAQ:A042500

Does RingNet's (KOSDAQ:042500) Statutory Profit Adequately Reflect Its Underlying Profit?

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. That said, the current statutory profit is not always a good guide to a company's underlying profitability. In this article, we'll look at how useful this year's statutory profit is, when analysing RingNet (KOSDAQ:042500).

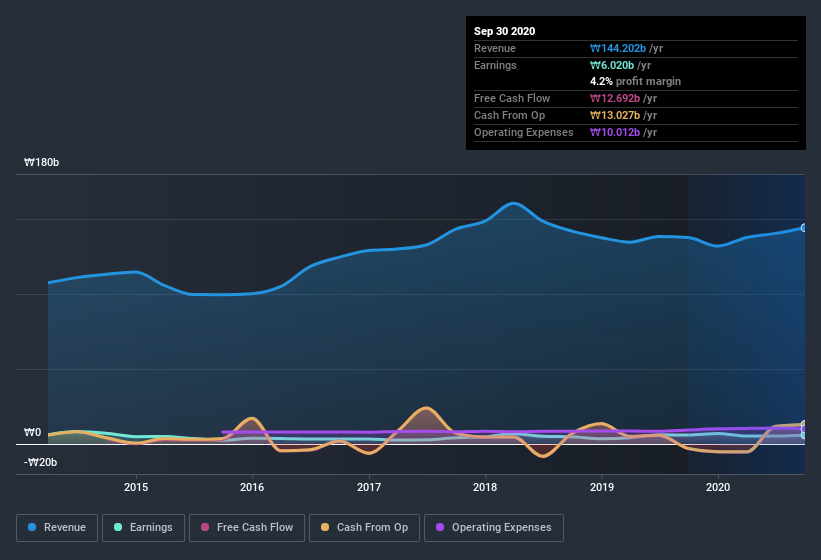

While RingNet was able to generate revenue of ₩144.2b in the last twelve months, we think its profit result of ₩6.02b was more important. The chart below shows that revenue has been pretty flat over the last three years, but profit has increased.

See our latest analysis for RingNet

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. Therefore, today we'll take a look at RingNet's cashflow, share issues and unusual items with a view to better understanding the nature of its statutory earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of RingNet.

A Closer Look At RingNet's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Over the twelve months to September 2020, RingNet recorded an accrual ratio of -0.30. That indicates that its free cash flow quite significantly exceeded its statutory profit. Indeed, in the last twelve months it reported free cash flow of ₩13b, well over the ₩6.02b it reported in profit. Notably, RingNet had negative free cash flow last year, so the ₩13b it produced this year was a welcome improvement. Having said that, there is more to consider. We must also consider the impact of unusual items on statutory profit (and thus the accrual ratio), as well as note the ramifications of the company issuing new shares.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, RingNet increased the number of shares on issue by 5.2% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of RingNet's EPS by clicking here.

A Look At The Impact Of RingNet's Dilution on Its Earnings Per Share (EPS).

As you can see above, RingNet has been growing its net income over the last few years, with an annualized gain of 44% over three years. While we did see a very small increase, net profit was basically flat over the last year. Earnings per share are pretty much flat, too over the last twelve months, but EPS growth came in below below net income growth. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If RingNet's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

The Impact Of Unusual Items On Profit

While the accrual ratio might bode well, we also note that RingNet's profit was boosted by unusual items worth ₩473m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. If RingNet doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On RingNet's Profit Performance

In conclusion, RingNet's accrual ratio suggests its earnings are well backed by cash but its boost from unusual items is probably not going to be repeated consistently. Meanwhile, the dilution was a negative for shareholders. Given the contrasting considerations, we don't have a strong view as to whether RingNet's profits are an apt reflection of its underlying potential for profit. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. While conducting our analysis, we found that RingNet has 3 warning signs and it would be unwise to ignore these.

Our examination of RingNet has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade RingNet, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A042500

RingNet

Engages in the implementation of information and communication technology (ICT) services and solutions in South Korea.

Adequate balance sheet second-rate dividend payer.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion