- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A033240

High Growth Tech Stocks in South Korea for October 2024

Reviewed by Simply Wall St

The South Korean stock market has recently experienced a slight downturn, with the KOSPI index dipping just below the 2,610-point mark amid mixed performances across sectors such as chemicals and automobiles. Despite these fluctuations, global forecasts suggest potential mild upside driven by positive earnings and economic news, providing a cautiously optimistic backdrop for investors considering high-growth tech stocks in the region. In this environment, identifying promising tech stocks involves looking for companies that demonstrate resilience and innovation amidst broader market challenges.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 47 stocks from our KRX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cafe24 Corp. operates an e-commerce platform globally and has a market cap of ₩609.29 billion.

Operations: The company generates revenue primarily from its Internet Business Solution segment, contributing ₩230.51 billion, and also earns from Transit and Clothing segments with ₩42.97 billion and ₩21.03 billion, respectively.

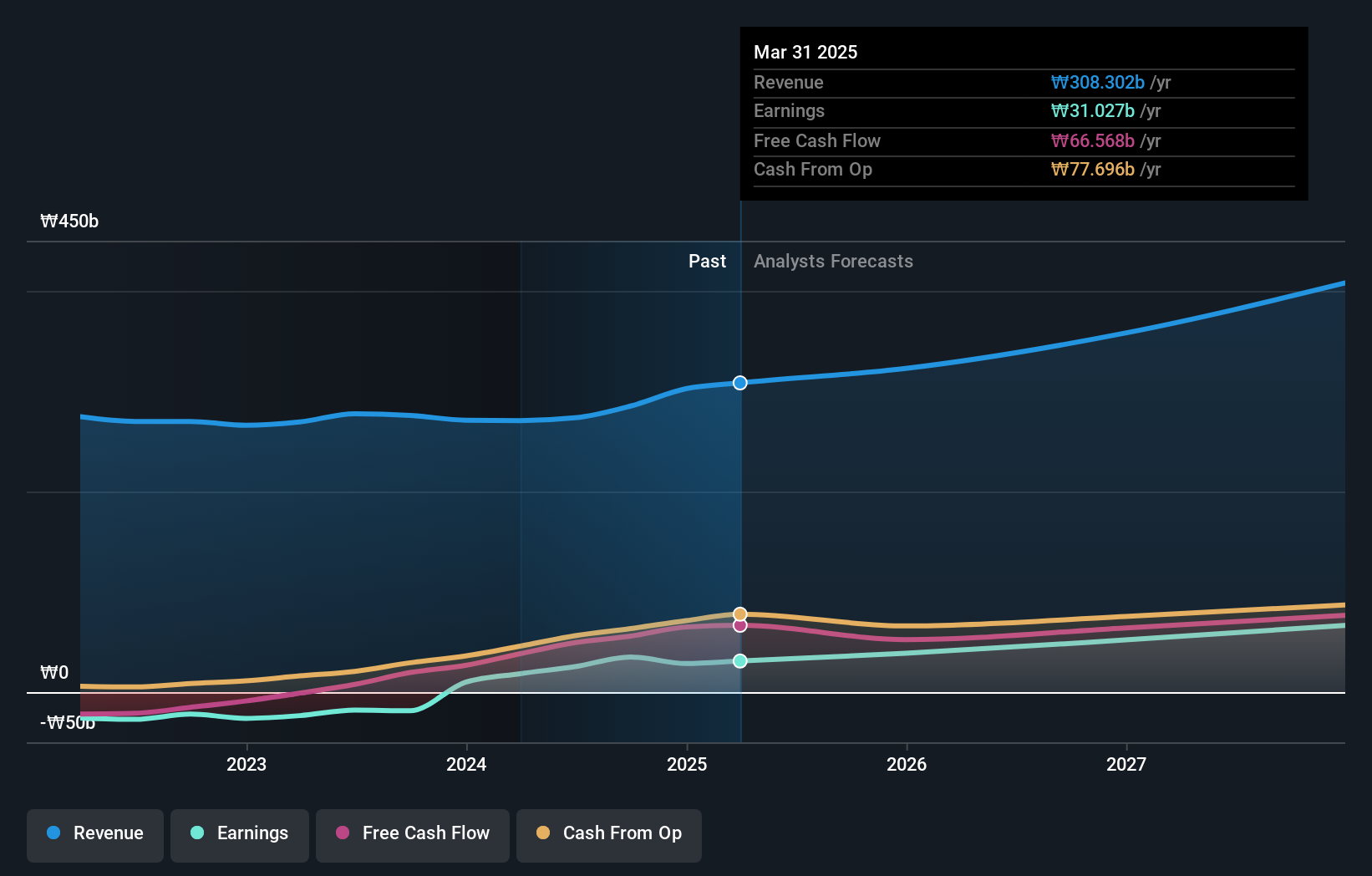

Cafe24, a South Korean tech firm, recently turned profitable, showcasing its potential in a competitive market. With an impressive expected annual earnings growth of 42.8%, the company outpaces the local market forecast of 29.4%. This financial uplift is supported by robust research and development investments, which are critical as they navigate through tech innovations and market demands. Despite facing challenges like a highly volatile share price and a significant one-off loss of ₩13.1 billion affecting its recent financial results, Cafe24's revenue growth projection stands at 11% annually, slightly above Korea's average of 10.3%. These figures highlight both the opportunities and hurdles ahead but suggest Cafe24 is positioning itself strategically for future growth in high-tech sectors.

- Unlock comprehensive insights into our analysis of Cafe24 stock in this health report.

Examine Cafe24's past performance report to understand how it has performed in the past.

Sang-A FrontecLtd (KOSDAQ:A089980)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sang-A Frontec Co., Ltd. focuses on the research, development, production, and sale of engineering plastic materials and parts both in South Korea and internationally, with a market cap of ₩342.99 billion.

Operations: Sang-A Frontec Co., Ltd. generates revenue primarily through its Plastics & Rubber segment, which accounted for ₩176.42 billion. The company is involved in the research and development, production, and sale of engineering plastic materials and parts.

Sang-A FrontecLtd, amidst a dynamic South Korean tech landscape, is leveraging its substantial R&D investments to stay competitive. With revenue poised to increase by 20.3% annually, the company outstrips the national growth average of 10.3%, underscoring its effective market adaptation strategies. Moreover, its earnings are expected to surge by 39.4% per year, reflecting a robust operational framework and innovation-driven approach that could significantly shape its industry standing. These financial indicators not only highlight Sang-A FrontecLtd's forward-thinking but also suggest it is adeptly navigating through technological advancements and evolving market demands.

- Delve into the full analysis health report here for a deeper understanding of Sang-A FrontecLtd.

Assess Sang-A FrontecLtd's past performance with our detailed historical performance reports.

Jahwa Electronics (KOSE:A033240)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jahwa Electronics Co., Ltd is a company that specializes in the manufacturing and sale of precision electronic components both in South Korea and internationally, with a market cap of ₩344.13 billion.

Operations: Jahwa Electronics Co., Ltd generates revenue primarily from the manufacturing and sales of mobile phone parts and other electronic components, amounting to approximately ₩639.33 billion. The company's operations are focused on both domestic and international markets, contributing significantly to its financial performance.

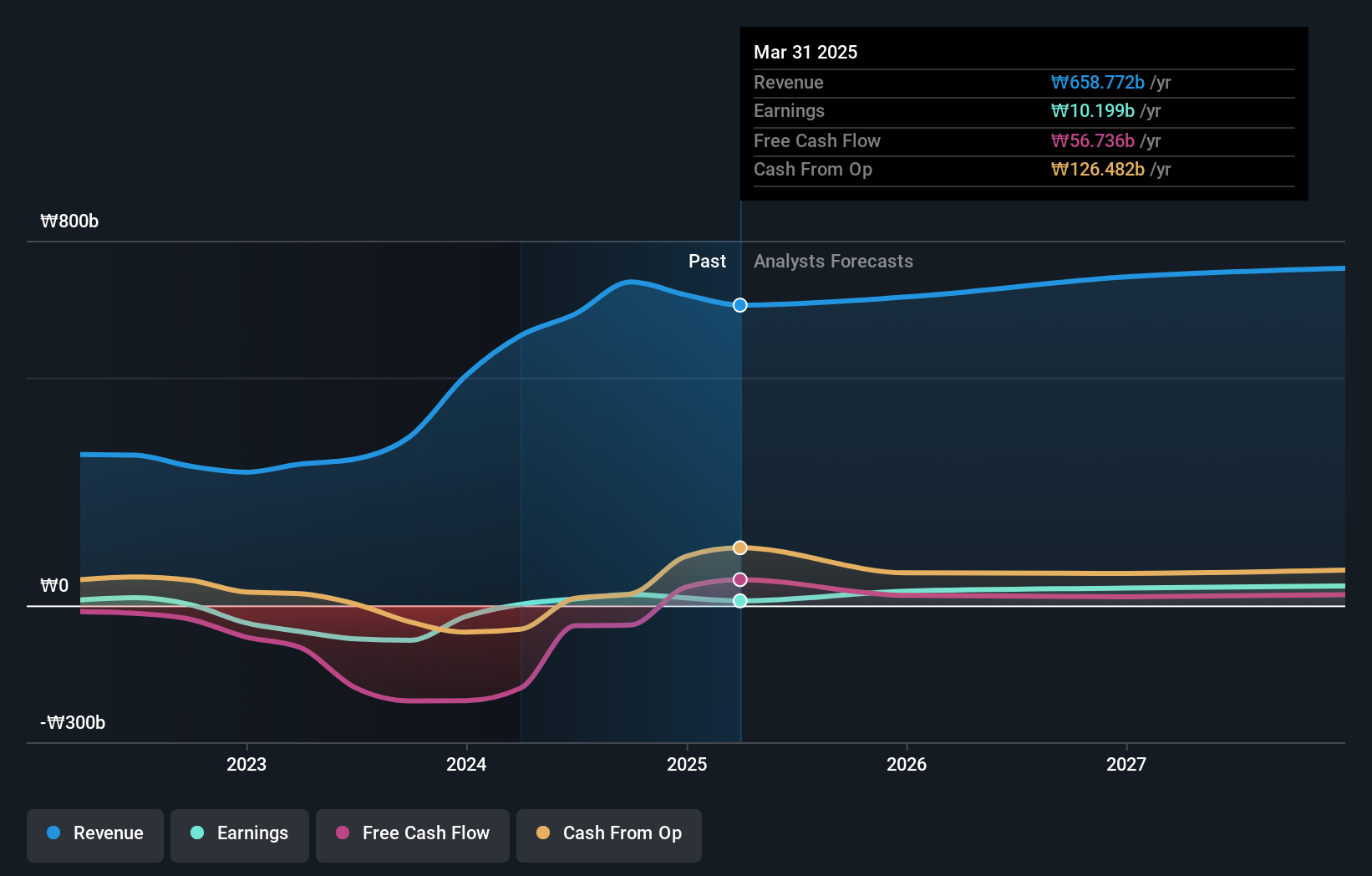

Amidst the vibrant tech sector in South Korea, Jahwa Electronics stands out with its strategic emphasis on R&D, investing 15.6% of its revenue back into research and development. This dedication is reflected in an impressive projected annual earnings growth of 39.1%, significantly outpacing the broader market's growth rate. Moreover, Jahwa's recent pivot towards semiconductor technologies has not only expanded its market reach but also solidified its position against competitors, ensuring sustained relevance in a rapidly evolving industry landscape. These factors collectively underscore Jahwa’s commitment to innovation and market responsiveness, promising robust future prospects despite fierce competition within the high-tech arena of South Korea.

- Navigate through the intricacies of Jahwa Electronics with our comprehensive health report here.

Explore historical data to track Jahwa Electronics' performance over time in our Past section.

Next Steps

- Investigate our full lineup of 47 KRX High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A033240

Jahwa Electronics

Manufactures and sells precision electronic components in South Korea and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives