- South Korea

- /

- Software

- /

- KOSDAQ:A039290

We Think That There Are Some Issues For InfoBank (KOSDAQ:039290) Beyond Its Promising Earnings

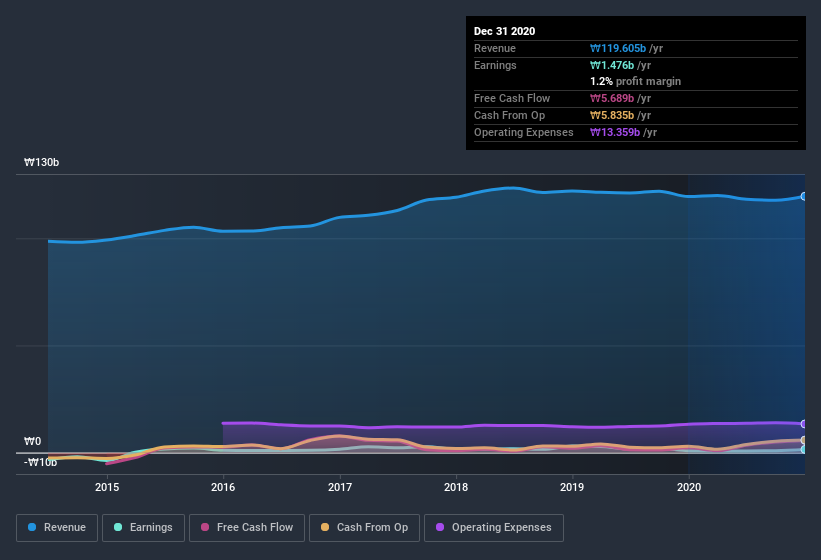

Following the solid earnings report from InfoBank Corporation (KOSDAQ:039290), the market responded by bidding up the stock price. While the profit numbers were good, our analysis has found some concerning factors that shareholders should be aware of.

See our latest analysis for InfoBank

Examining Cashflow Against InfoBank's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Over the twelve months to December 2020, InfoBank recorded an accrual ratio of -0.10. Therefore, its statutory earnings were quite a lot less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of ₩5.7b, well over the ₩1.48b it reported in profit. InfoBank shareholders are no doubt pleased that free cash flow improved over the last twelve months. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of InfoBank.

The Impact Of Unusual Items On Profit

Surprisingly, given InfoBank's accrual ratio implied strong cash conversion, its paper profit was actually boosted by ₩195m in unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. InfoBank had a rather significant contribution from unusual items relative to its profit to December 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On InfoBank's Profit Performance

InfoBank's profits got a boost from unusual items, which indicates they might not be sustained and yet its accrual ratio still indicated solid cash conversion, which is promising. Based on these factors, we think it's very unlikely that InfoBank's statutory profits make it seem much weaker than it is. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, InfoBank has 3 warning signs (and 1 which is concerning) we think you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you decide to trade InfoBank, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A039290

InfoBank

Provides corporate messaging services, interactive media services, smart car services, and mobile solutions in South Korea.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion