- South Korea

- /

- Diversified Financial

- /

- KOSDAQ:A036800

Is Nice Information & Telecommunication, Inc.'s (KOSDAQ:036800) 1.7% Dividend Worth Your Time?

Could Nice Information & Telecommunication, Inc. (KOSDAQ:036800) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

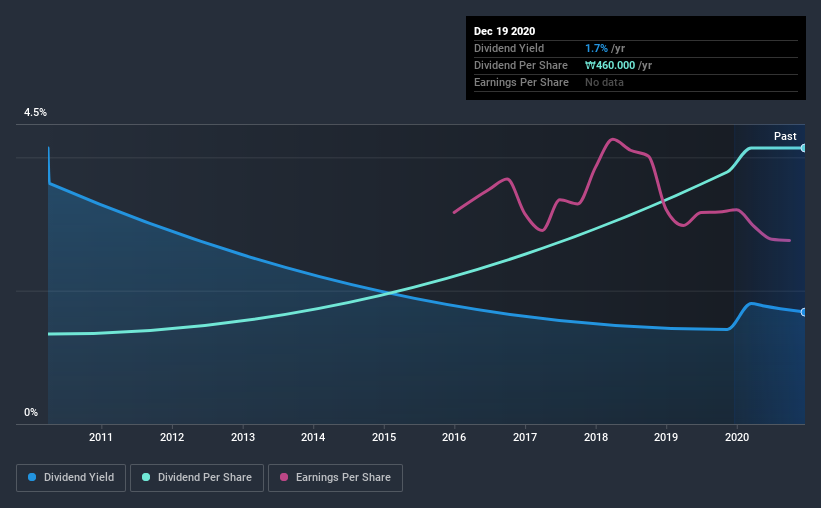

A slim 1.7% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, Nice Information & Telecommunication could have potential. Some simple research can reduce the risk of buying Nice Information & Telecommunication for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on Nice Information & Telecommunication!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Nice Information & Telecommunication paid out 17% of its profit as dividends, over the trailing twelve month period. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Nice Information & Telecommunication's cash payout ratio last year was 12%. Cash flows are typically lumpy, but this looks like an appropriately conservative payout. It's positive to see that Nice Information & Telecommunication's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

While the above analysis focuses on dividends relative to a company's earnings, we do note Nice Information & Telecommunication's strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on Nice Information & Telecommunication every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Nice Information & Telecommunication's dividend payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past 10-year period, the first annual payment was ₩150 in 2010, compared to ₩460 last year. Dividends per share have grown at approximately 12% per year over this time.

It's rare to find a company that has grown its dividends rapidly over 10 years and not had any notable cuts, but Nice Information & Telecommunication has done it, which we really like.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. It's not great to see that Nice Information & Telecommunication's have fallen at approximately 2.8% over the past five years. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we like that the company's dividend payments appear well covered, although the retained capital also needs to be effectively reinvested. Second, earnings per share have actually shrunk, but at least the dividends have been relatively stable. Nice Information & Telecommunication has a number of positive attributes, but it falls slightly short of our (admittedly high) standards. Were there evidence of a strong moat or an attractive valuation, it could still be well worth a look.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Nice Information & Telecommunication that investors should take into consideration.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Nice Information & Telecommunication or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nice Information & Telecommunication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A036800

Nice Information & Telecommunication

Nice Information & Telecommunication, Inc.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion