- South Korea

- /

- Semiconductors

- /

- KOSE:A042700

Earnings Tell The Story For HANMI Semiconductor Co., Ltd. (KRX:042700) As Its Stock Soars 26%

Those holding HANMI Semiconductor Co., Ltd. (KRX:042700) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 59% in the last year.

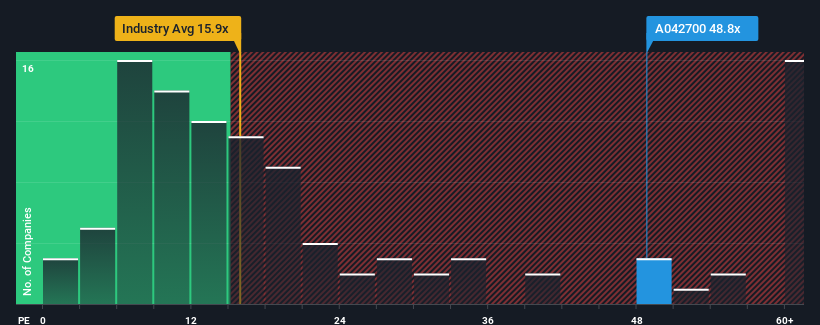

Since its price has surged higher, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 11x, you may consider HANMI Semiconductor as a stock to avoid entirely with its 48.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent earnings growth for HANMI Semiconductor has been in line with the market. It might be that many expect the mediocre earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for HANMI Semiconductor

Is There Enough Growth For HANMI Semiconductor?

In order to justify its P/E ratio, HANMI Semiconductor would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 124% overall rise in EPS, in spite of its uninspiring short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 80% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 33%, which is noticeably less attractive.

With this information, we can see why HANMI Semiconductor is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in HANMI Semiconductor have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of HANMI Semiconductor's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware HANMI Semiconductor is showing 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

Of course, you might also be able to find a better stock than HANMI Semiconductor. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if HANMI Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A042700

HANMI Semiconductor

Manufactures and sells semiconductor equipment in South Korea and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives