- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A083450

May 2024 Insight Into High Insider Ownership Growth Stocks On KRX

Reviewed by Simply Wall St

Over the past week, South Korea's market has experienced a 1.4% decline, though it has gained 4.3% over the last year with earnings projected to grow by 28% annually. In this context, stocks with high insider ownership can be particularly compelling, as they often reflect a management team deeply invested in the company's success and growth potential.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| Modetour Network (KOSDAQ:A080160) | 12.4% | 45.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| UTI (KOSDAQ:A179900) | 34.2% | 122.7% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 74.2% |

| Devsisters (KOSDAQ:A194480) | 27.2% | 73.5% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 67.2% |

| Enchem (KOSDAQ:A348370) | 21.3% | 105.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 102.5% |

We'll examine a selection from our screener results.

Global Standard Technology (KOSDAQ:A083450)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Global Standard Technology, Limited operates in the environmental and energy sectors both in South Korea and internationally, with a market capitalization of approximately ₩415.03 billion.

Operations: The company's revenue is derived from its operations in the environmental and energy sectors across both domestic and international markets.

Insider Ownership: 23.5%

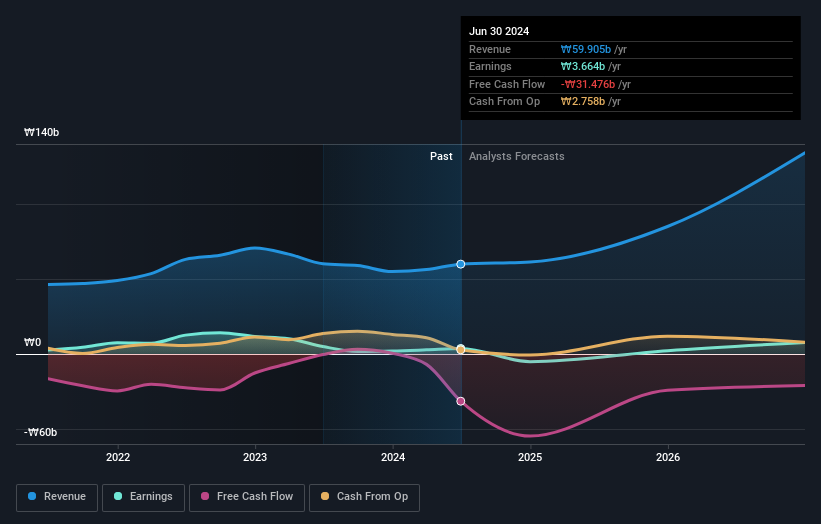

Global Standard Technology is trading 24% below its estimated fair value, making it an attractive pick in the South Korean market. Despite a volatile share price recently, the company's earnings are expected to grow by 29.7% annually, outpacing the broader market's growth. However, it has shown an unstable dividend track record and slower revenue growth at 17.5% per year compared to other high-growth benchmarks. No insider trading activity was reported in the past three months.

- Dive into the specifics of Global Standard Technology here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Global Standard Technology's share price might be too pessimistic.

VINA TECHLtd (KOSDAQ:A126340)

Simply Wall St Growth Rating: ★★★★★★

Overview: VINA TECH Co., Ltd., operating both domestically and internationally, specializes in the production and sale of energy storage devices under the Hy-Cap brand, with a market capitalization of approximately ₩352.10 billion.

Operations: The company generates ₩54.96 billion in revenue from the manufacturing and sales of energy storage devices under the Hy-Cap brand.

Insider Ownership: 31.5%

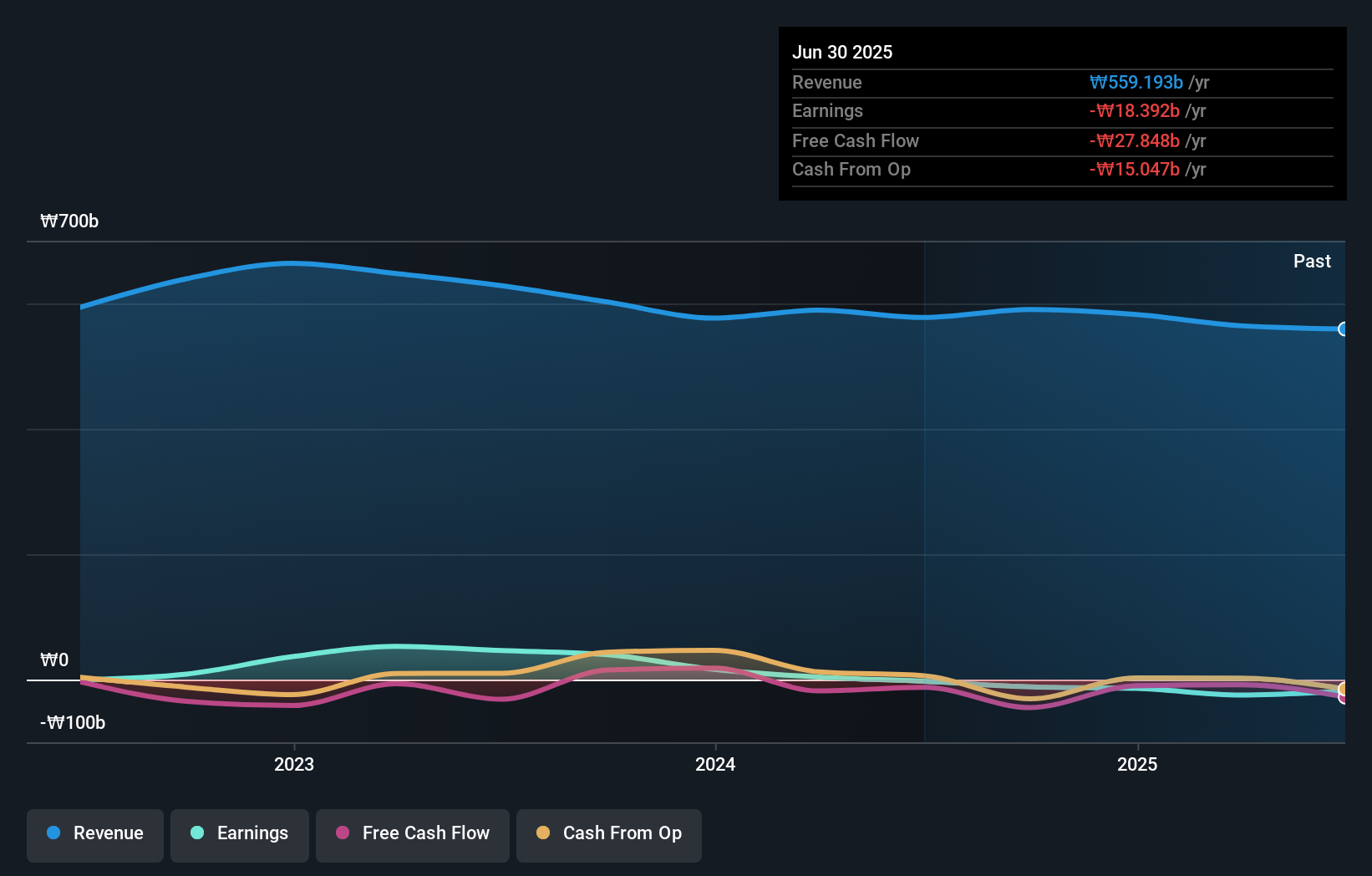

VINA TECH Ltd, a South Korean growth company with high insider ownership, is poised for substantial expansion. Despite a dip in profit margins from 16.5% to 3.6%, influenced by large one-off items, its earnings are expected to surge by 66.6% annually over the next three years, significantly outpacing the local market's forecast of 28.3%. Revenue growth projections are equally robust at 46.6% annually, dwarfing the market expectation of 10.2%. However, financial strain is evident as interest payments are poorly covered by earnings.

- Click to explore a detailed breakdown of our findings in VINA TECHLtd's earnings growth report.

- According our valuation report, there's an indication that VINA TECHLtd's share price might be on the expensive side.

Shinsung E&GLtd (KOSE:A011930)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shinsung E&G Ltd., operating both domestically and internationally, specializes in the manufacturing of solar modules and solar systems, with a market capitalization of approximately ₩472.27 billion.

Operations: The company specializes in the production and distribution of solar modules and systems across various global markets.

Insider Ownership: 19.2%

Shinsung E&G Ltd, a South Korean company with high insider ownership, is navigating a challenging landscape. While its earnings are projected to grow at 82.2% annually, outstripping the market's 28.3%, revenue growth is modest at 16.2% per year compared to the market's 10.2%. However, profit margins have declined sharply to 0.7% from last year’s 8.2%, and the company faces issues with large one-off items affecting its financial results, alongside a highly volatile share price recently.

- Click here to discover the nuances of Shinsung E&GLtd with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Shinsung E&GLtd shares in the market.

Make It Happen

- Embark on your investment journey to our 83 Fast Growing KRX Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A083450

Global Standard Technology

Engages in the environmental and energy industry in South Korea and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives