- South Korea

- /

- Semiconductors

- /

- KOSE:A003160

There's Reason For Concern Over D.I Corporation's (KRX:003160) Massive 51% Price Jump

Despite an already strong run, D.I Corporation (KRX:003160) shares have been powering on, with a gain of 51% in the last thirty days. The last month tops off a massive increase of 104% in the last year.

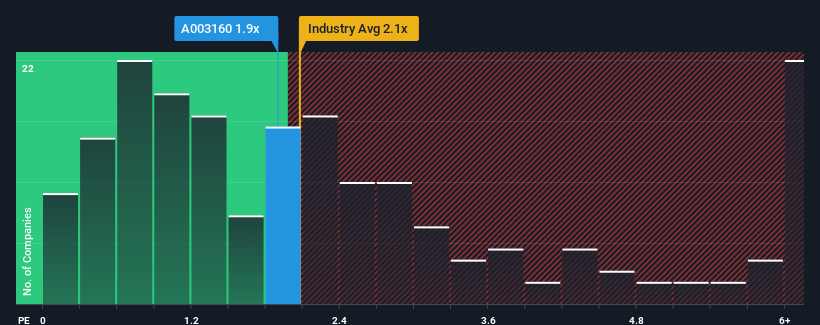

Even after such a large jump in price, you could still be forgiven for feeling indifferent about D.I's P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in Korea is also close to 2.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for D.I

What Does D.I's P/S Mean For Shareholders?

Recent times have been more advantageous for D.I as its revenue hasn't fallen as much as the rest of the industry. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. You'd much rather the company continue improving its revenue if you still believe in the business. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on D.I.How Is D.I's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like D.I's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.1%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 32% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 100% as estimated by the lone analyst watching the company. Meanwhile, the broader industry is forecast to expand by 80%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that D.I's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From D.I's P/S?

Its shares have lifted substantially and now D.I's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears that D.I currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Before you settle on your opinion, we've discovered 3 warning signs for D.I (1 makes us a bit uncomfortable!) that you should be aware of.

If these risks are making you reconsider your opinion on D.I, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A003160

D.I

Manufactures and supplies semiconductor inspection equipment in South Korea and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success