- South Korea

- /

- Semiconductors

- /

- KOSE:A003160

High Insider Ownership Growth Companies On KRX In September 2024

Reviewed by Simply Wall St

The South Korea stock market has moved higher in six straight sessions, improving almost 120 points or 4.6 percent along the way. The KOSPI now sits just above the 2,630-point plateau and has another positive lead for Wednesday's trade, buoyed by optimism over interest rates and gains across various sectors. In this favorable market environment, growth companies with high insider ownership can be particularly attractive as they often signal strong management confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 122% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 96.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

We're going to check out a few of the best picks from our screener tool.

ITM Semiconductor (KOSDAQ:A084850)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ITM Semiconductor Co., Ltd. manufactures and sells components for secondary batteries worldwide, with a market cap of ₩435.50 billion.

Operations: The company's revenue segments include the SET Division at ₩142.96 billion and the Parts Division at ₩501.96 billion.

Insider Ownership: 15%

ITM Semiconductor, with significant insider ownership, is trading at 41.1% below its estimated fair value and is expected to become profitable within the next three years. Revenue growth is forecasted at 13.5% per year, outpacing the South Korean market average of 10.4%. Recent earnings reports show a strong turnaround with KRW 702.28 million net income for Q2 2024 compared to a substantial loss last year, indicating robust financial recovery and potential for future growth.

- Navigate through the intricacies of ITM Semiconductor with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility ITM Semiconductor's shares may be trading at a discount.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩18.75 trillion.

Operations: Revenue from biotechnology amounts to ₩90.79 billion.

Insider Ownership: 26.6%

ALTEOGEN, with high insider ownership, is trading at 72.6% below its estimated fair value and is expected to see revenue growth of 64.2% per year, significantly outpacing the South Korean market average. The company recently received MFDS approval for Tergase®, a recombinant hyaluronidase with over 99% purity, marking a pivotal transition to commercial-stage operations. Despite past shareholder dilution, ALTEOGEN's earnings are forecasted to grow by 99.46% annually and achieve profitability within three years.

- Dive into the specifics of ALTEOGEN here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that ALTEOGEN is priced higher than what may be justified by its financials.

D.I (KOSE:A003160)

Simply Wall St Growth Rating: ★★★★★★

Overview: D.I Corporation manufactures and supplies semiconductor inspection equipment in South Korea and internationally, with a market cap of ₩382.75 billion.

Operations: The company's revenue segments include Semiconductor Equipment (₩137.77 billion), Audio and Video Equipment (₩14.35 billion), Secondary Battery Equipment (₩29.55 billion), Electronic Components Division (₩12.90 billion), and Environmental Facilities Sector (₩6.85 billion).

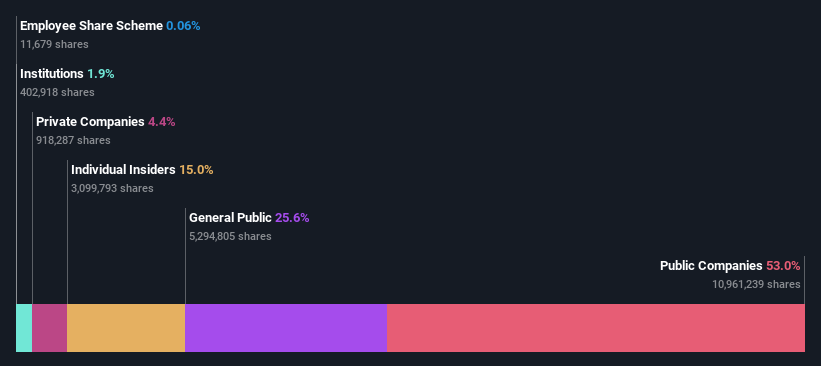

Insider Ownership: 32%

D.I. shows strong growth potential with high insider ownership, trading at 12.2% below its estimated fair value. The company is forecasted to grow earnings by 102.27% annually and revenue by 47.5% per year, outpacing the South Korean market average of 10.4%. Despite a highly volatile share price over the past three months, D.I.'s return on equity is expected to be high at 29.6%, and it aims to achieve profitability within three years.

- Click here and access our complete growth analysis report to understand the dynamics of D.I.

- Our comprehensive valuation report raises the possibility that D.I is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Investigate our full lineup of 89 Fast Growing KRX Companies With High Insider Ownership right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003160

D.I

Manufactures and supplies semiconductor inspection equipment in South Korea and internationally.

Exceptional growth potential and fair value.