- South Korea

- /

- Semiconductors

- /

- KOSE:A003160

December 2024's Leading Growth Companies With Strong Insider Confidence

Reviewed by Simply Wall St

As 2024 draws to a close, global markets have experienced a mixed bag of economic indicators, with U.S. consumer confidence taking a hit while major stock indexes like the Nasdaq Composite and S&P 500 showed moderate gains during the holiday-shortened week. In this fluctuating environment, growth companies with high insider ownership often stand out as they suggest strong internal confidence in their potential for long-term success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 25.6% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

D.I (KOSE:A003160)

Simply Wall St Growth Rating: ★★★★★★

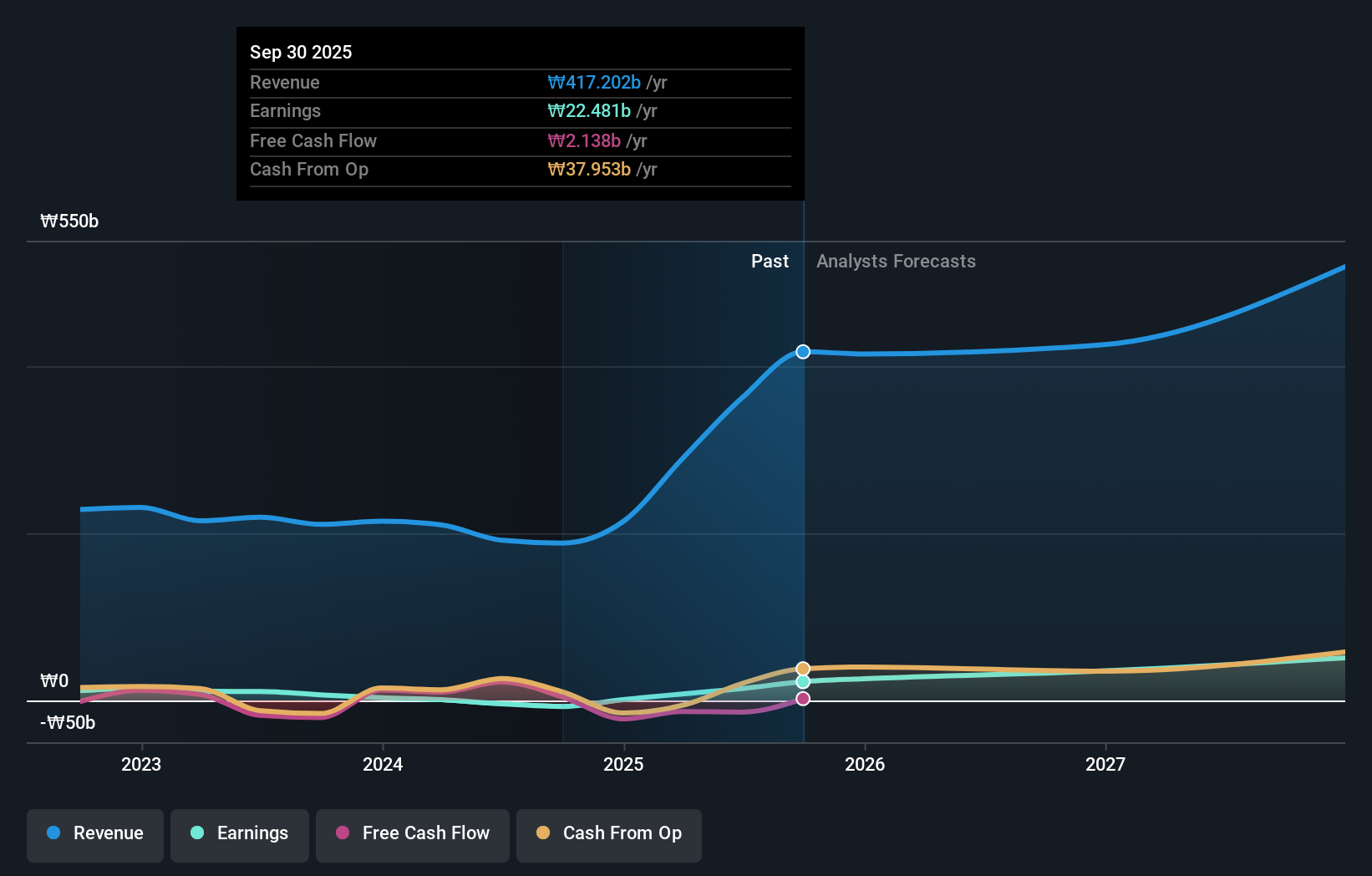

Overview: D.I Corporation manufactures and supplies semiconductor inspection equipment in South Korea and internationally, with a market cap of approximately ₩376.72 billion.

Operations: The company's revenue segments include Semiconductor Equipment at ₩130.74 billion, Secondary Battery Equipment at ₩30.34 billion, Audio/Visual Equipment at ₩14.83 billion, Electronic Components Division at ₩12.96 billion, and Environmental Facilities Sector at ₩6.79 billion.

Insider Ownership: 31.8%

Earnings Growth Forecast: 112.3% p.a.

D.I Corporation is projected to achieve profitability within three years, with earnings expected to grow at 112.33% annually. Its revenue growth forecast of 52.9% per year significantly surpasses the market average of 8.9%. The stock trades at a substantial discount, 78.3% below its estimated fair value, although it has experienced high volatility recently. Despite no significant insider trading activity in the past three months, its strong growth prospects remain compelling for investors focused on insider ownership dynamics.

- Get an in-depth perspective on D.I's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that D.I's current price could be quite moderate.

Jiangsu Canlon Building Materials (SZSE:300715)

Simply Wall St Growth Rating: ★★★★☆☆

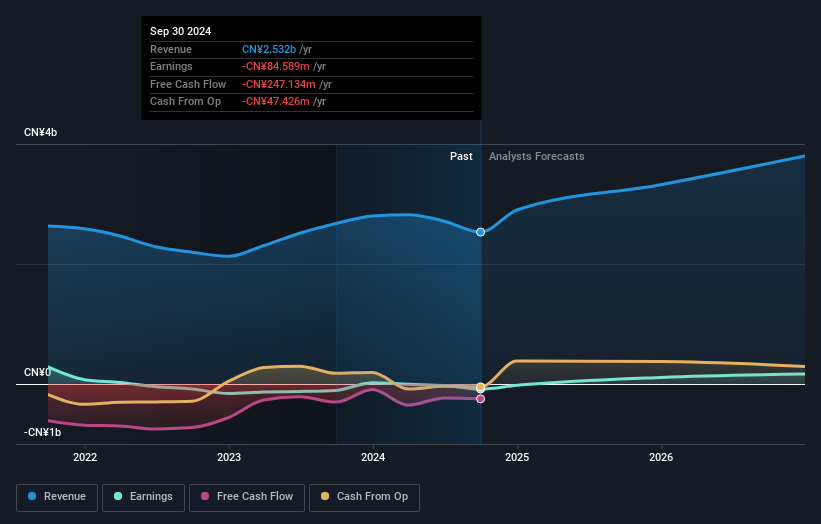

Overview: Jiangsu Canlon Building Materials Co., Ltd. (SZSE:300715) operates in the building materials sector and has a market capitalization of approximately CN¥2.64 billion.

Operations: Unfortunately, the provided text does not contain specific revenue segment information for Jiangsu Canlon Building Materials Co., Ltd.

Insider Ownership: 26.1%

Earnings Growth Forecast: 115.7% p.a.

Jiangsu Canlon Building Materials is forecast to become profitable within three years, with earnings expected to grow at 115.74% annually, outpacing the Chinese market's revenue growth of 13.7%. Despite a recent net loss of CNY 32.15 million and declining sales, the company trades at good value compared to peers. Its low return on equity forecast and inadequate debt coverage by operating cash flow are concerns, but no substantial insider trading activity has been reported recently.

- Navigate through the intricacies of Jiangsu Canlon Building Materials with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Jiangsu Canlon Building Materials' share price might be on the cheaper side.

Guangzhou Frontop Digital Creative Technology (SZSE:301313)

Simply Wall St Growth Rating: ★★★★★☆

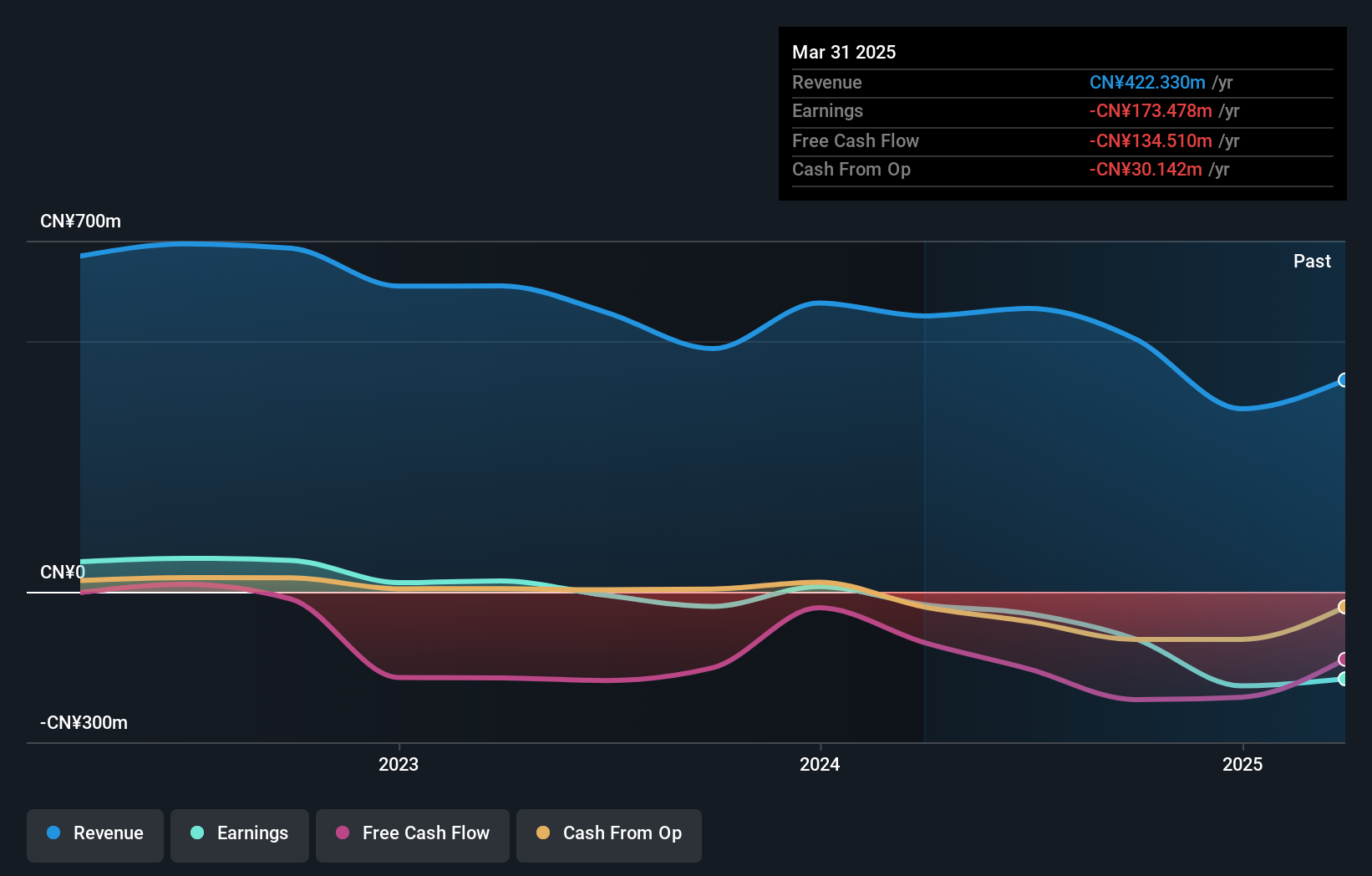

Overview: Guangzhou Frontop Digital Creative Technology Corporation specializes in digital multimedia display services and technology, operating both in China and internationally, with a market cap of CN¥2.50 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 36.7%

Earnings Growth Forecast: 74% p.a.

Guangzhou Frontop Digital Creative Technology faces challenges with declining sales, reporting a net loss of CNY 127.15 million for the first nine months of 2024. Despite this, the company is forecasted to achieve revenue growth of 23.9% annually, surpassing the market average and expected to become profitable in three years. However, its return on equity is projected to remain low at 6.4%, and its dividend yield of 0.58% lacks coverage by earnings or cash flow.

- Dive into the specifics of Guangzhou Frontop Digital Creative Technology here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Guangzhou Frontop Digital Creative Technology shares in the market.

Where To Now?

- Discover the full array of 1512 Fast Growing Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003160

D.I

Manufactures and supplies semiconductor inspection equipment in South Korea and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives