- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A394280

Openedges Technology, Inc. (KOSDAQ:394280) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

Despite an already strong run, Openedges Technology, Inc. (KOSDAQ:394280) shares have been powering on, with a gain of 26% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

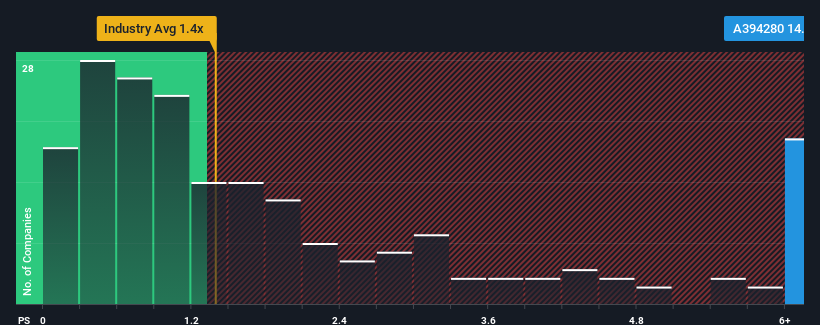

Following the firm bounce in price, you could be forgiven for thinking Openedges Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 14.3x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 1.4x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Openedges Technology

What Does Openedges Technology's Recent Performance Look Like?

Recent times have been advantageous for Openedges Technology as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Openedges Technology.What Are Revenue Growth Metrics Telling Us About The High P/S?

Openedges Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 62% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 40% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Openedges Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Openedges Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Openedges Technology maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Openedges Technology has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A394280

Openedges Technology

Develops AI computing IP solutions and memory systems in South Korea.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives