- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A330860

Revenues Not Telling The Story For Nepes Ark Corporation (KOSDAQ:330860) After Shares Rise 41%

Nepes Ark Corporation (KOSDAQ:330860) shareholders are no doubt pleased to see that the share price has bounced 41% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 58% share price decline over the last year.

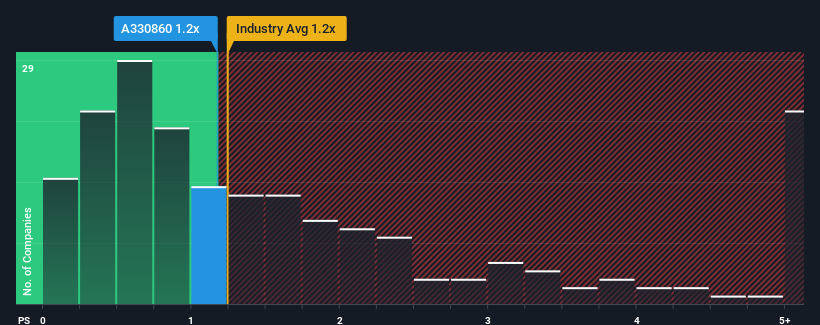

Although its price has surged higher, there still wouldn't be many who think Nepes Ark's price-to-sales (or "P/S") ratio of 1.2x is worth a mention when it essentially matches the median P/S in Korea's Semiconductor industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Nepes Ark

What Does Nepes Ark's P/S Mean For Shareholders?

For example, consider that Nepes Ark's financial performance has been pretty ordinary lately as revenue growth is non-existent. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Nepes Ark, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Nepes Ark's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow revenue by 30% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 44% shows it's noticeably less attractive.

In light of this, it's curious that Nepes Ark's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Its shares have lifted substantially and now Nepes Ark's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Nepes Ark's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Nepes Ark you should know about.

If these risks are making you reconsider your opinion on Nepes Ark, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nepes Ark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A330860

Nepes Ark

Engages in the semiconductor manufacturing-related testing and engineering service, semiconductor test production, and semiconductor product wholesale and retail businesses in South Korea.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives