- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A323280

Young Poong Precision And 2 Other Undiscovered Gems In South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has remained flat, yet it boasts an impressive 6.4% rise over the past year with earnings forecasted to grow by 31% annually. In this dynamic environment, identifying stocks with strong growth potential and unique market positions can uncover hidden opportunities like Young Poong Precision and two other undiscovered gems in South Korea.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

| THINKWARE | 36.75% | 21.25% | 22.92% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Young Poong Precision (KOSDAQ:A036560)

Simply Wall St Value Rating: ★★★★★★

Overview: Young Poong Precision Corporation develops, manufactures, and sells chemical process pumps in South Korea and internationally, with a market cap of ₩532.35 billion.

Operations: Young Poong Precision generates revenue primarily from the sale of chemical process pumps. The company's net profit margin is noted at 12.5%, reflecting its profitability after accounting for all expenses.

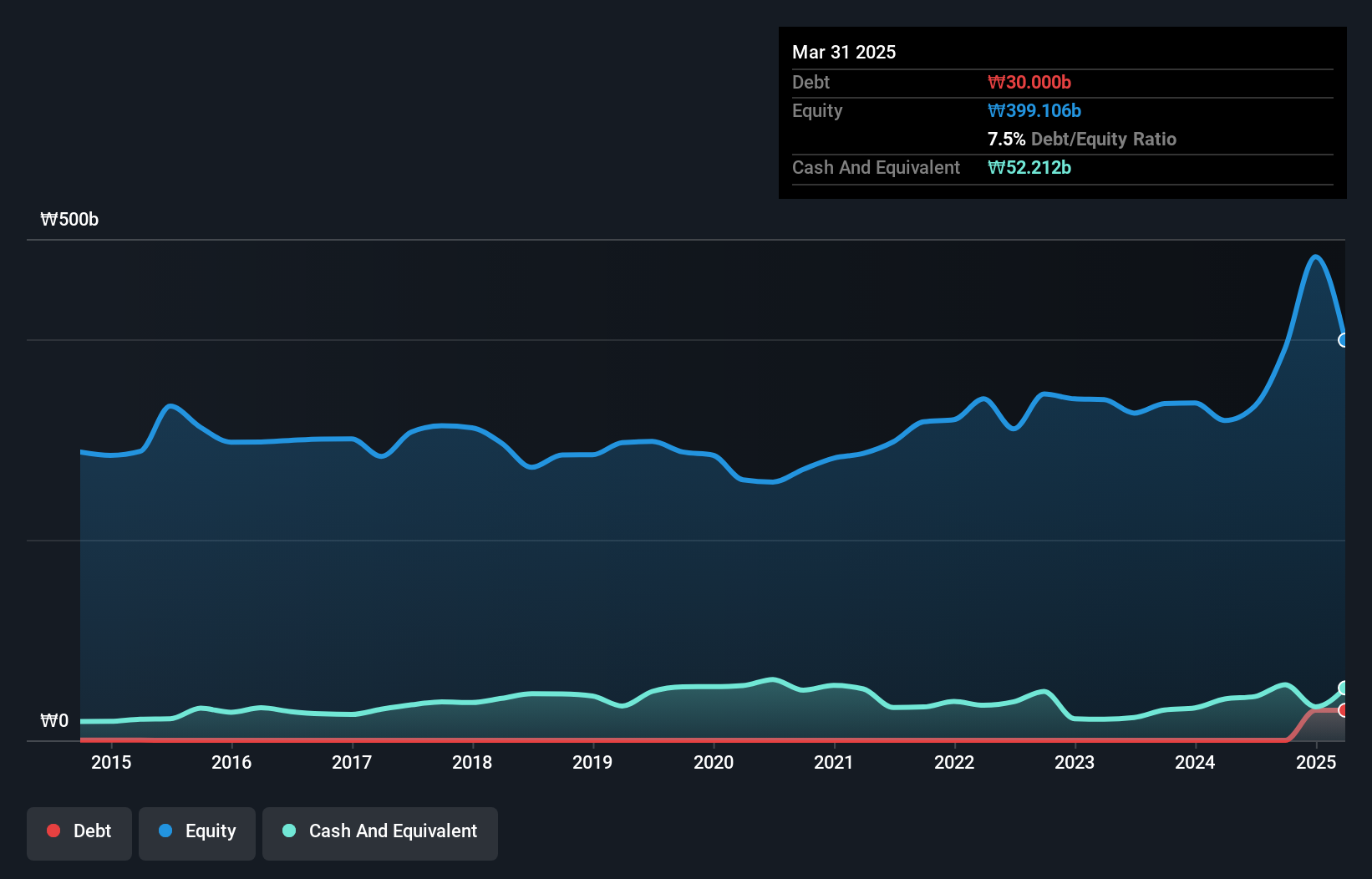

Young Poong Precision, a smaller player in South Korea's market, showcases high-quality earnings with a notable 10.1% growth over the past year, outpacing the Machinery industry average of 5.4%. The company is trading at 67.9% below its estimated fair value and remains debt-free, which likely contributes to its stable financial health despite recent share price volatility. Recent M&A activities include offers from Jerico Partners and Korea Corporate Investment Holdings to acquire significant stakes, potentially altering ownership dynamics significantly by October 2024.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

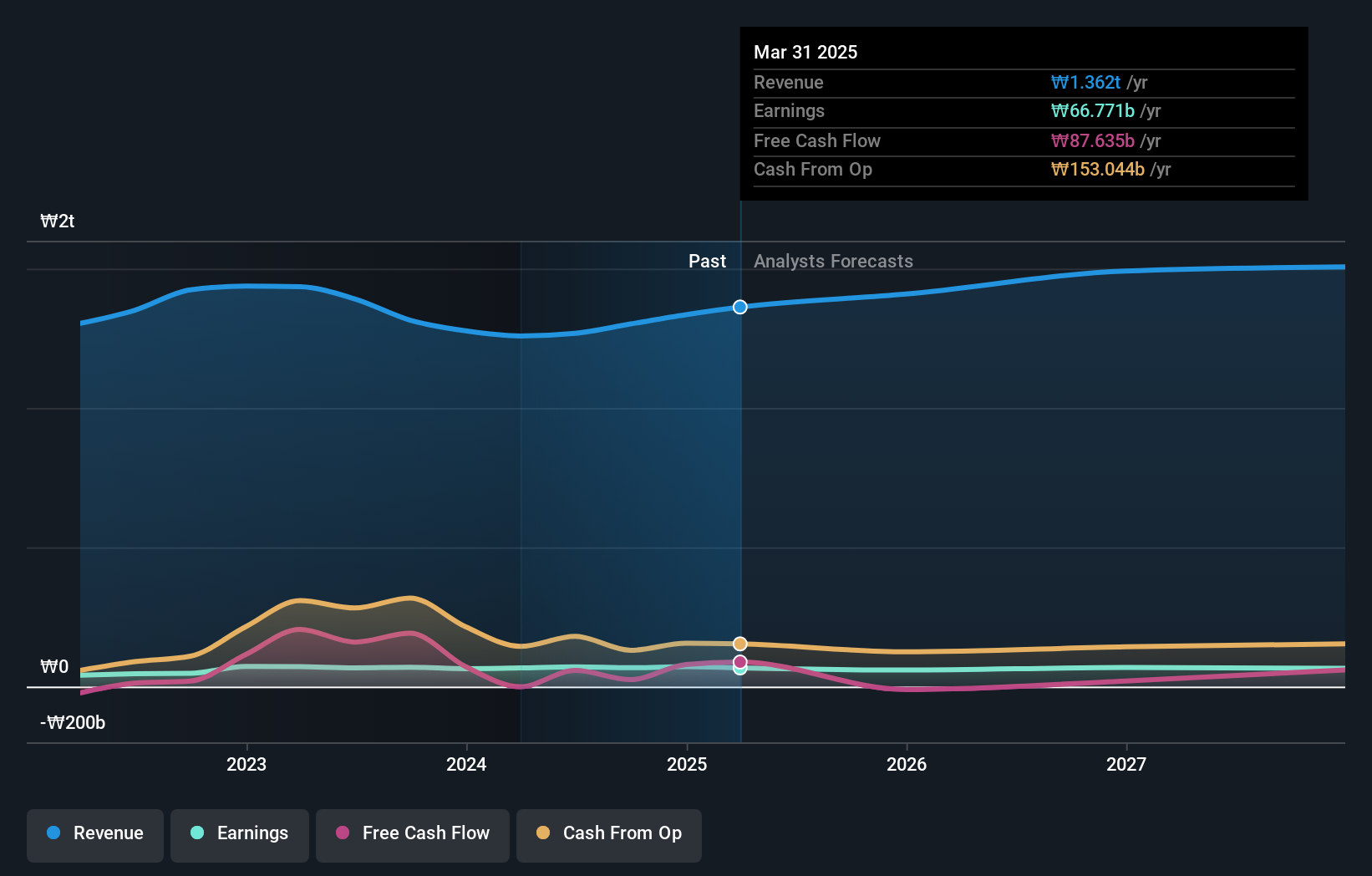

Overview: Taesung Co., Ltd. specializes in the development, manufacturing, and sale of PCB automation equipment both domestically and internationally, with a market cap of approximately ₩970.86 billion.

Operations: Taesung generates revenue primarily from manufacturing and selling PCB automation equipment, amounting to approximately ₩45.68 billion.

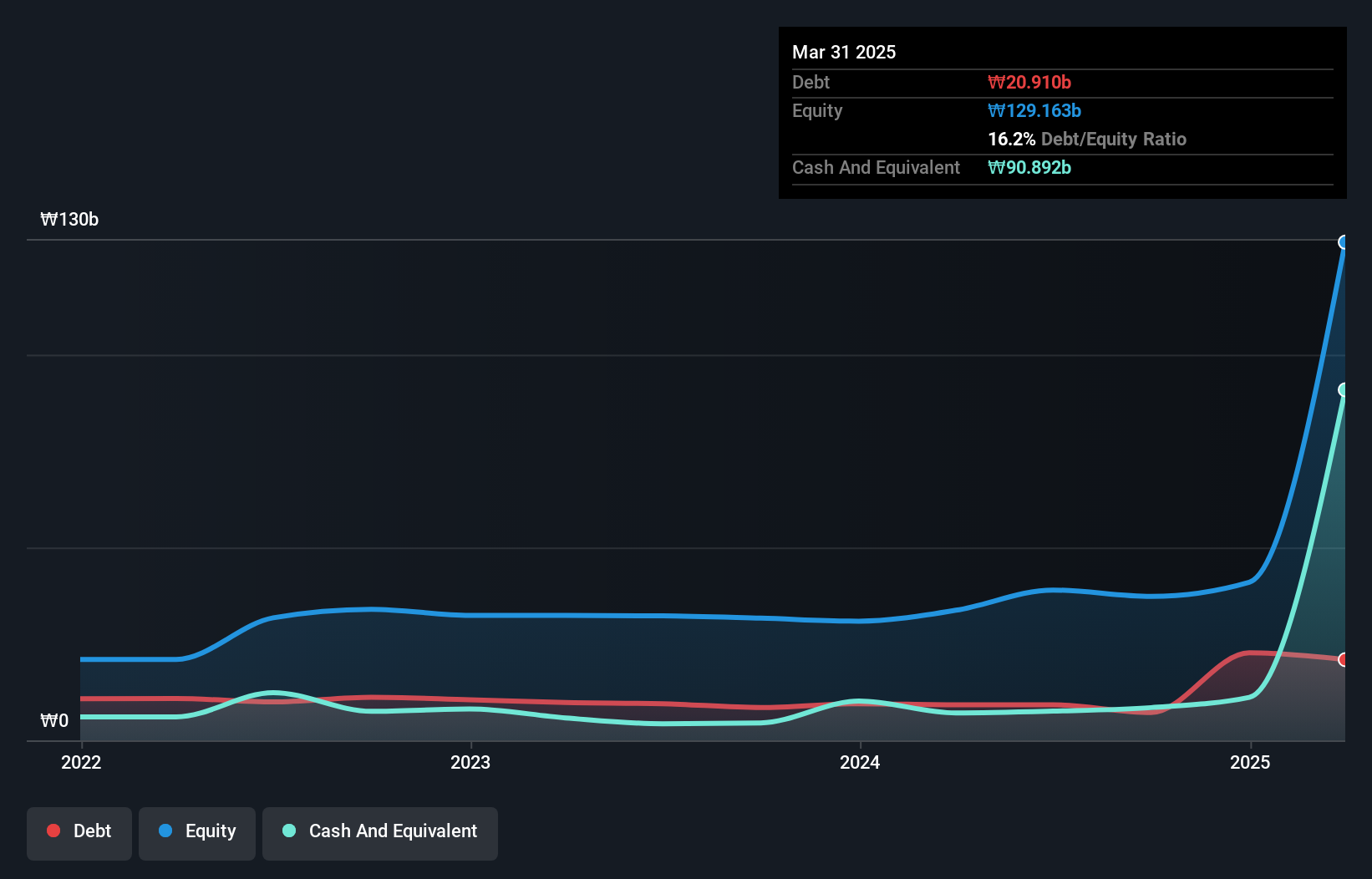

Taesung Ltd. has been making waves with its remarkable earnings growth of 1482% over the past year, significantly outpacing the semiconductor industry's -10%. The company’s net debt to equity ratio stands at a satisfactory 4.2%, and its interest payments are well covered by EBIT at 17.5 times, reflecting solid financial health. Despite recent volatility in share price and shareholder dilution, Taesung's addition to the S&P Global BMI Index highlights its growing recognition in the market.

- Delve into the full analysis health report here for a deeper understanding of TaesungLtd.

Explore historical data to track TaesungLtd's performance over time in our Past section.

Dongwon Systems (KOSE:A014820)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dongwon Systems Corporation is a South Korean packaging company that specializes in the manufacturing and marketing of packaging materials, with a market capitalization of ₩1.47 trillion.

Operations: Dongwon Systems generates revenue primarily from its packaging business, amounting to ₩1.27 trillion. The company's market capitalization stands at ₩1.47 trillion.

Dongwon Systems, a player in the packaging industry, has shown promising financial performance despite its small size. Over the past year, earnings grew by 4.8%, outpacing the industry's growth rate. The company's debt to equity ratio improved from 69% to 62% over five years, although it remains relatively high at 48%. Recent results highlight a net income of KRW 22.26 million for Q2 and basic EPS rising to KRW 761 from KRW 612 last year, indicating robust profitability and potential for future growth.

Turning Ideas Into Actions

- Unlock our comprehensive list of 184 KRX Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TaesungLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A323280

TaesungLtd

Develops, manufactures, and sells PCB automation equipment in South Korea and internationally.

Excellent balance sheet with questionable track record.