- South Korea

- /

- Electrical

- /

- KOSE:A001440

Young Poong Precision And 2 Other Undiscovered Gems In South Korea

Reviewed by Simply Wall St

Amidst a challenging period for the South Korean stock market, with the KOSPI experiencing a notable decline over three consecutive sessions, investors are keenly observing how global economic factors and regional tensions might influence future movements. In this environment of uncertainty, identifying promising small-cap stocks like Young Poong Precision becomes crucial as these companies often present unique opportunities for growth and resilience despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

| THINKWARE | 36.75% | 21.25% | 22.92% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Young Poong Precision (KOSDAQ:A036560)

Simply Wall St Value Rating: ★★★★★★

Overview: Young Poong Precision Corporation is engaged in the development, manufacturing, and sale of chemical process pumps both domestically in South Korea and internationally, with a market capitalization of ₩501.64 billion.

Operations: Young Poong Precision generates revenue primarily from the sale of chemical process pumps. The company's financial data indicates a focus on maintaining profitability, with a notable net profit margin trend.

Young Poong Precision, a dynamic player in South Korea's machinery sector, is capturing attention with its robust earnings growth of 10.1% over the past year, outpacing the industry's 5.4%. Despite a highly volatile share price recently, it trades at nearly 70% below its estimated fair value and remains debt-free. Recent M&A activity could reshape ownership significantly as Jerico Partners aims to acquire an additional stake for KRW 120 billion (US$102 million), potentially increasing Chairman Choi's influence to over 60%.

- Delve into the full analysis health report here for a deeper understanding of Young Poong Precision.

Understand Young Poong Precision's track record by examining our Past report.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. specializes in the development, manufacturing, and sale of PCB automation equipment both domestically and internationally, with a market capitalization of approximately ₩870.16 billion.

Operations: Taesung generates revenue primarily from the manufacturing and sale of PCB automation equipment, amounting to approximately ₩45.68 billion.

Earnings for Taesung Ltd. surged by 1482% over the past year, outpacing the struggling semiconductor sector's -10%. Despite recent shareholder dilution, its net debt to equity ratio stands at a satisfactory 4.2%, and interest payments are well covered with EBIT at 17.5x coverage. The company was recently added to the S&P Global BMI Index, indicating growing recognition in financial markets despite its volatile share price in recent months.

- Take a closer look at TaesungLtd's potential here in our health report.

Examine TaesungLtd's past performance report to understand how it has performed in the past.

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taihan Cable & Solution Co., Ltd. is a global manufacturer and seller of electric wires, cables, and related products with a market cap of ₩2.47 trillion.

Operations: The primary revenue stream for Taihan Cable & Solution comes from its wire segment, which generated approximately ₩3.42 billion. The company reported sales between divisions amounting to -₩380.13 million, impacting overall financial performance.

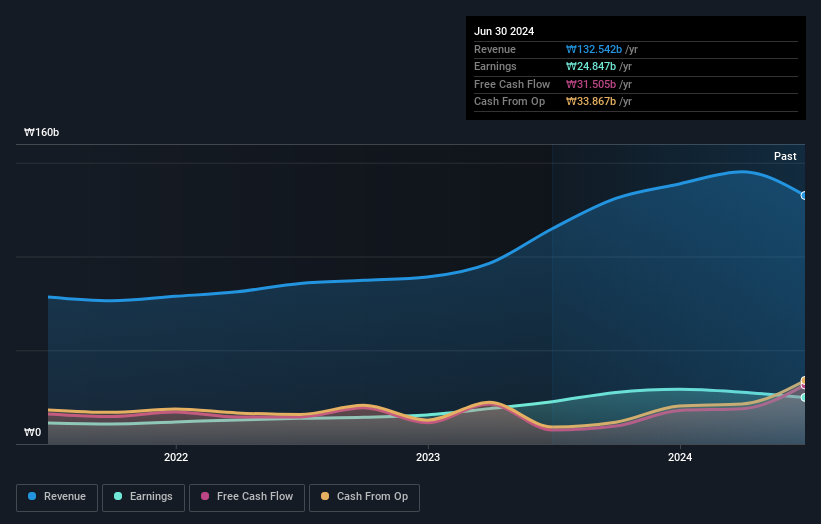

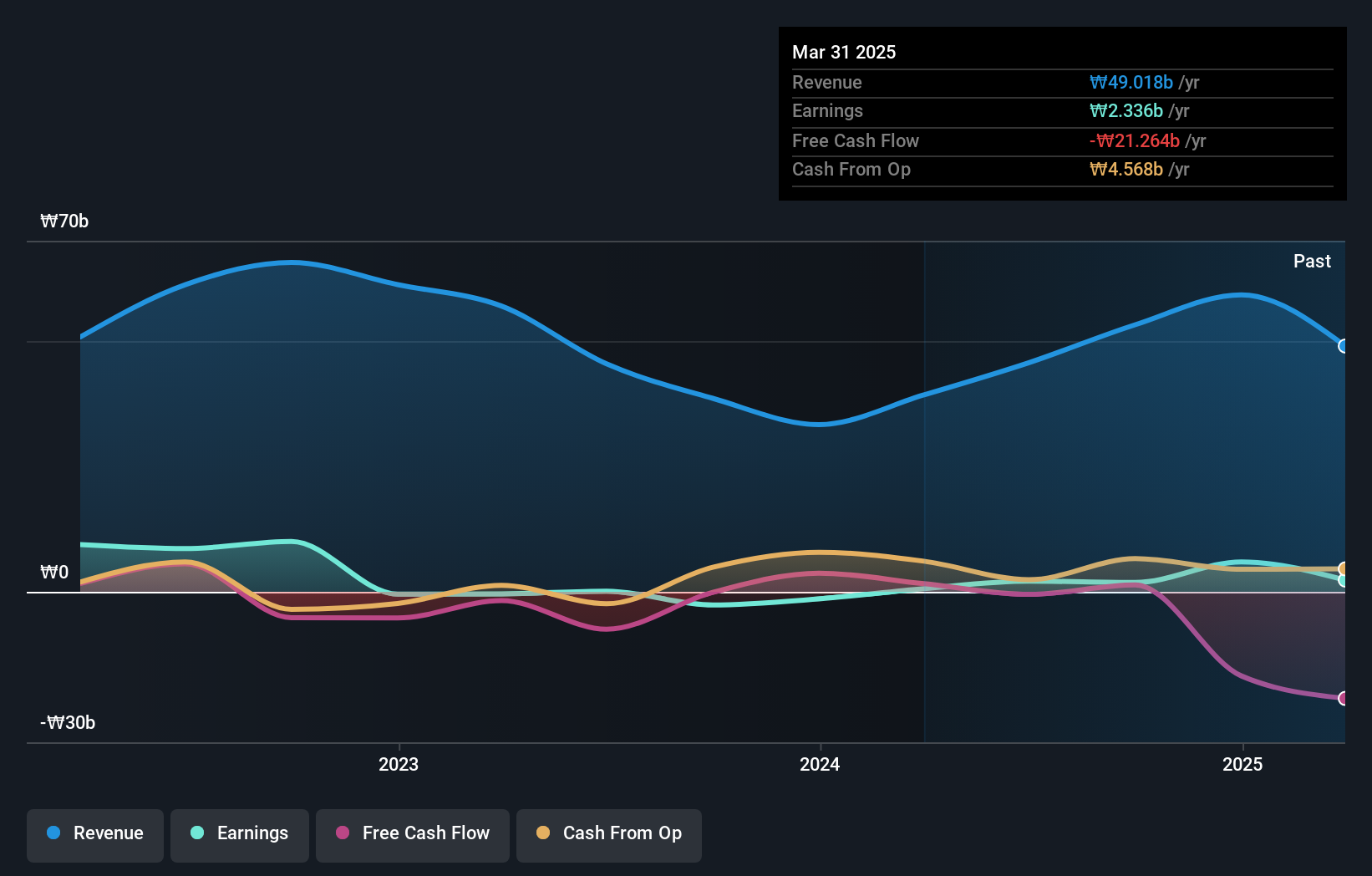

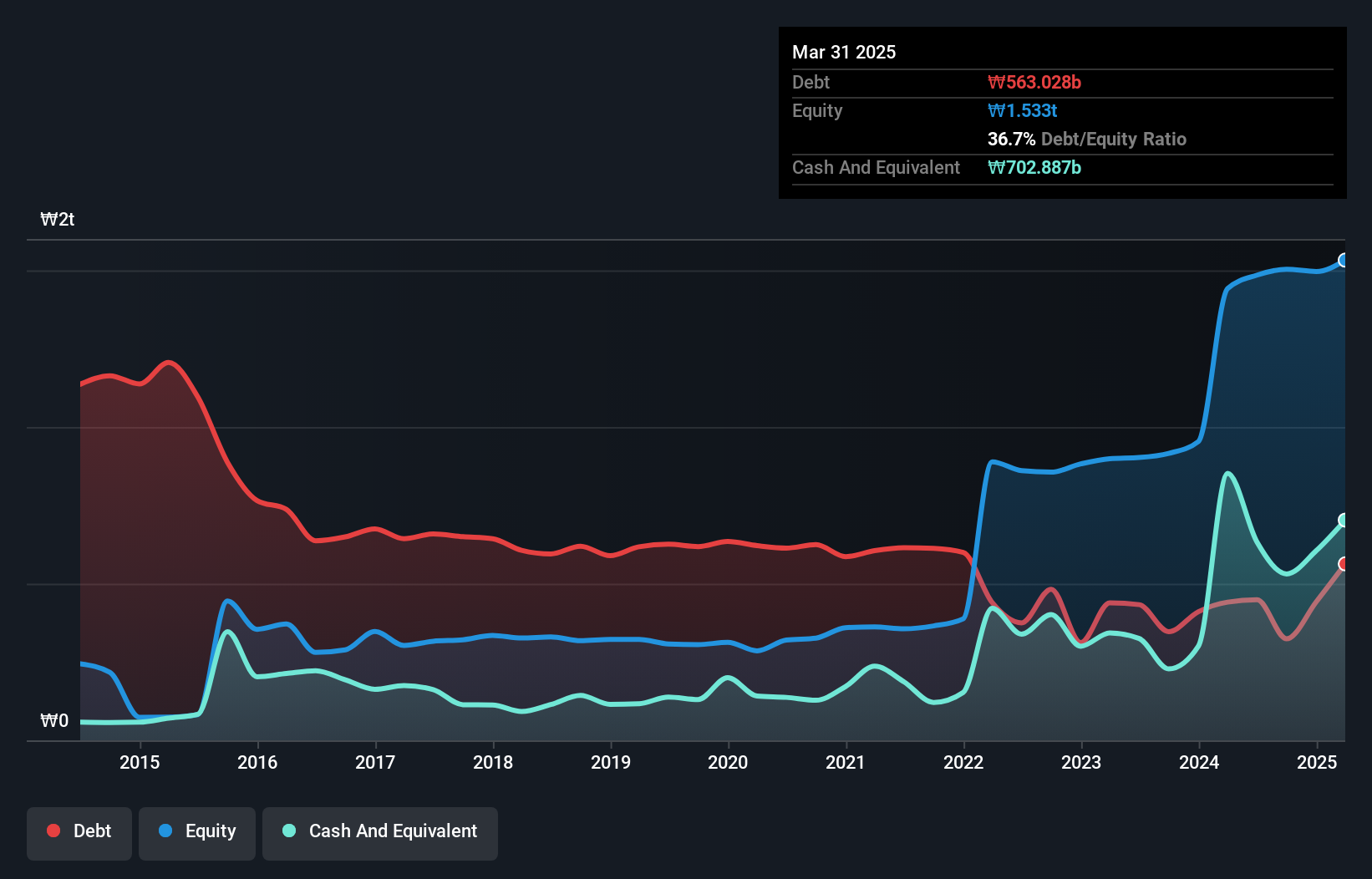

Taihan Cable & Solution has demonstrated impressive earnings growth of 127% over the past year, significantly outpacing the Electrical industry's average of 18.5%. Despite a dip in sales to ₩8.82 billion for Q2 2024 from ₩9.75 billion a year prior, net income surged to ₩24.88 billion from ₩12.82 billion, reflecting enhanced profitability with basic EPS rising to ₩134 from ₩104. The company’s debt-to-equity ratio improved dramatically over five years, dropping from 203.6% to 30.2%, indicating stronger financial health despite recent shareholder dilution concerns and negative free cash flow trends.

- Get an in-depth perspective on Taihan Cable & Solution's performance by reading our health report here.

Gain insights into Taihan Cable & Solution's past trends and performance with our Past report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 181 KRX Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taihan Cable & Solution might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A001440

Taihan Cable & Solution

Manufactures, processes, and sells electric wires, cables, and related products worldwide.

Excellent balance sheet with proven track record.