- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A323280

South Korea's Hidden Gems Including Three Promising Small Caps

Reviewed by Simply Wall St

The South Korean stock market has seen modest gains recently, with the KOSPI index hovering near the 2,600-point mark amid mixed performances across sectors and global uncertainties about interest rates. In this fluctuating environment, identifying promising small-cap stocks can be crucial for investors looking to uncover hidden opportunities that may offer growth potential despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

| THINKWARE | 36.75% | 21.25% | 22.92% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. is a company that specializes in the production and export of laminating machines and films globally, with a market cap of ₩1.28 trillion.

Operations: VT Co., Ltd. generates revenue primarily from its Cosmetic segment, contributing ₩256.27 billion, followed by Entertainment at ₩93.74 billion, and Laminating at ₩33.86 billion.

VT has shown impressive earnings growth, surging 563.7% over the past year, far outpacing the Personal Products industry's 30.2%. The company reported a net income of KRW 15.4 billion for Q2 2024, up from KRW 5.1 billion a year earlier, with basic earnings per share rising to KRW 481 from KRW 154. Despite recent shareholder dilution and a volatile share price, VT's debt-to-equity ratio improved significantly from 71.2% to 22.4% over five years, suggesting prudent financial management amidst its robust performance trajectory.

- Delve into the full analysis health report here for a deeper understanding of VT.

Review our historical performance report to gain insights into VT's's past performance.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. is engaged in the development, manufacturing, and sale of PCB automation equipment both domestically in South Korea and internationally, with a market capitalization of ₩1.01 billion.

Operations: Taesung generates revenue primarily from manufacturing and selling PCB automation equipment, amounting to ₩45.68 billion. The company's market capitalization stands at approximately ₩1.01 trillion.

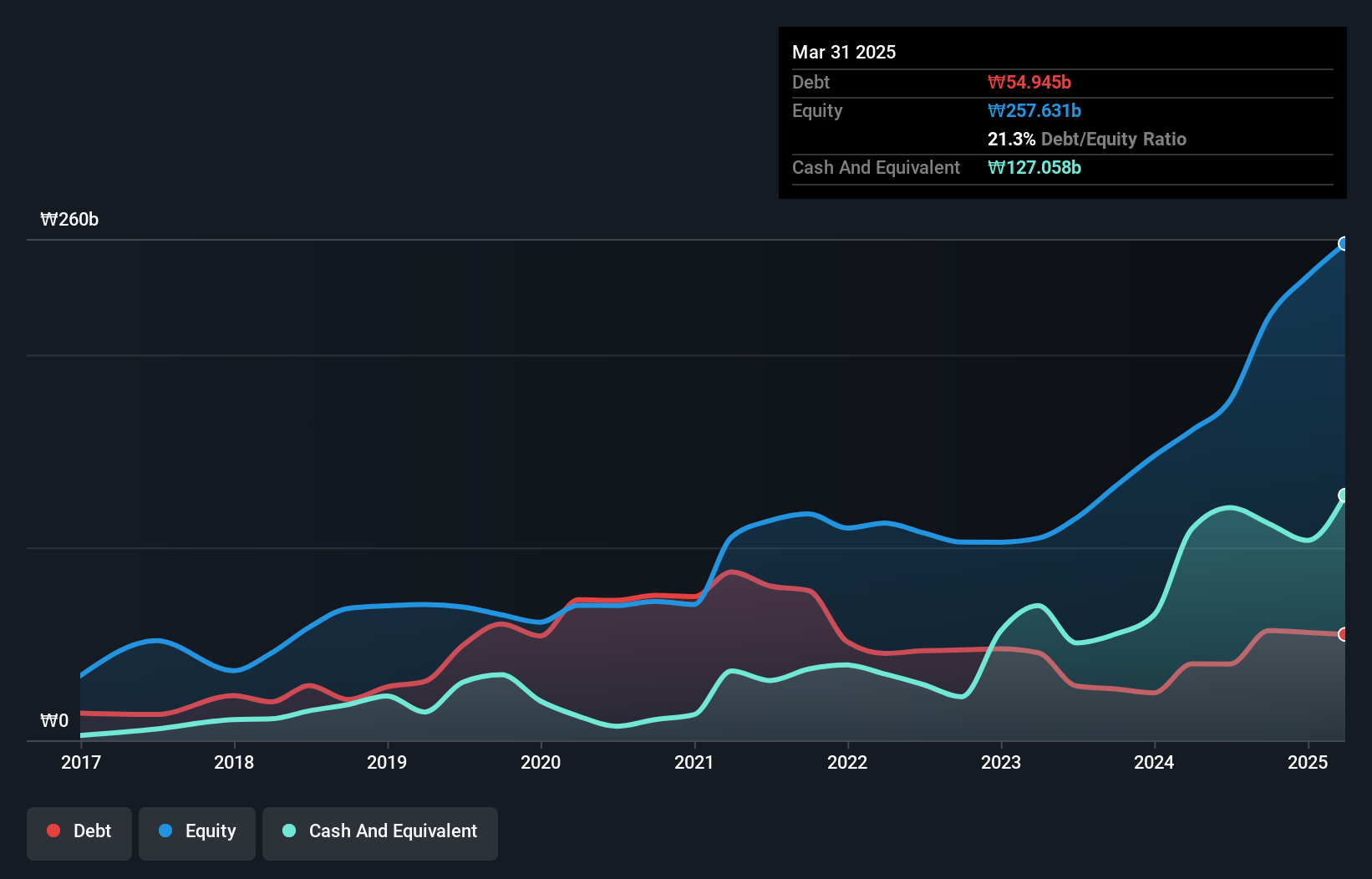

Taesung Ltd., a notable player in the semiconductor sector, has seen its earnings skyrocket by 1482% over the past year, far outpacing the industry's -10% trend. The company's net debt to equity ratio stands at a satisfactory 4.2%, reflecting prudent financial management. Despite recent shareholder dilution, Taesung's interest payments are well-covered with an EBIT coverage of 17.5x. Recently added to the S&P Global BMI Index, this inclusion highlights its growing recognition in global markets.

- Dive into the specifics of TaesungLtd here with our thorough health report.

Explore historical data to track TaesungLtd's performance over time in our Past section.

Dongwon Systems (KOSE:A014820)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dongwon Systems Corporation is a South Korean packaging company that manufactures and markets packaging materials, with a market cap of ₩1.56 trillion.

Operations: The company generates revenue primarily from its packaging business, amounting to ₩1.27 trillion.

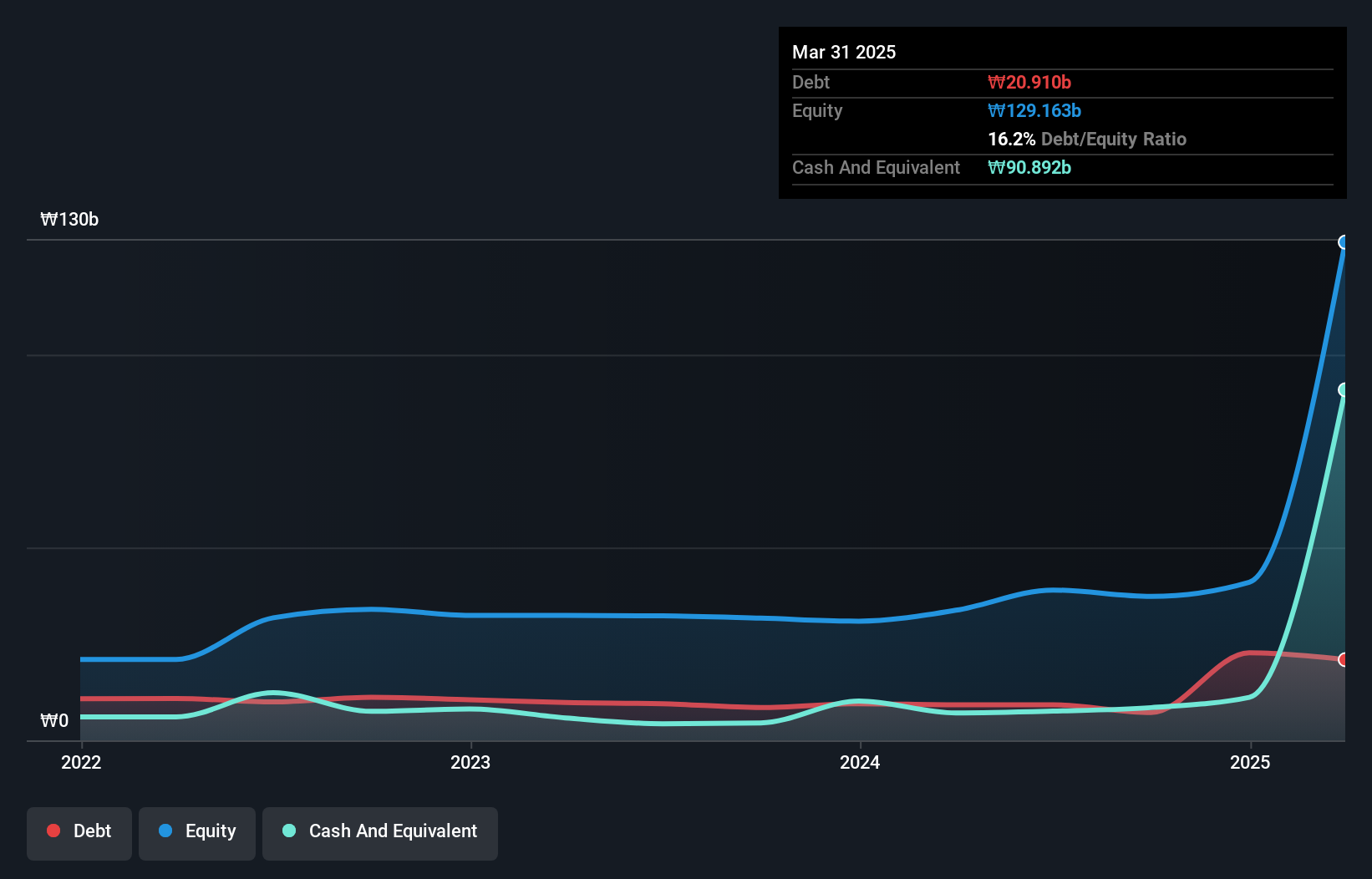

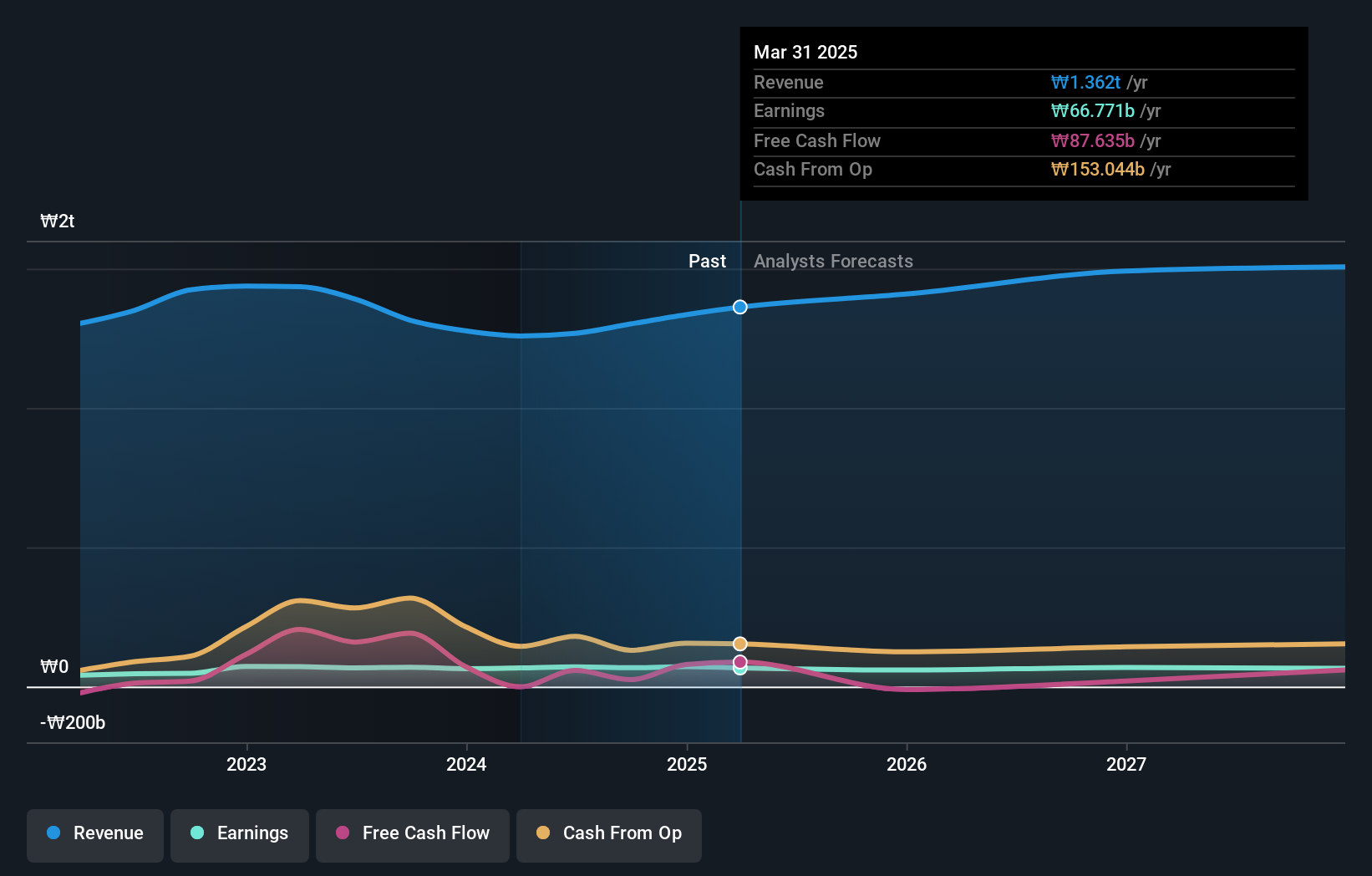

Dongwon Systems, a promising player in South Korea's packaging sector, has shown solid financial performance despite its small size. Recent earnings reports reveal net income of KRW 22.26 million for Q2 2024, up from KRW 17.89 million the previous year, with basic earnings per share rising to KRW 761 from KRW 612. The company boasts high-quality earnings and a net debt to equity ratio that has decreased to 61.9% over five years, although it remains relatively high at 48.4%. With interest payments well covered by EBIT at a factor of 5.2x and positive free cash flow trends, Dongwon appears financially sound and poised for growth within its industry context.

- Take a closer look at Dongwon Systems' potential here in our health report.

Evaluate Dongwon Systems' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Reveal the 185 hidden gems among our KRX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TaesungLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A323280

TaesungLtd

Develops, manufactures, and sells PCB automation equipment in South Korea and internationally.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026