- South Korea

- /

- Chemicals

- /

- KOSE:A268280

Exploring TaesungLtd And 2 Other Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As the South Korean stock market experiences slight fluctuations, with the KOSPI hovering just below the 2,610-point mark amid mixed performances from various sectors, investors are keenly observing potential opportunities that may arise from these shifts. In this environment of cautious optimism driven by decent earnings and global economic news, identifying stocks with strong fundamentals and growth potential becomes crucial. This article explores Taesung Ltd and two other lesser-known companies that stand out as promising candidates in this landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. is engaged in the development, manufacturing, and sale of PCB automation equipment both domestically in South Korea and internationally, with a market capitalization of ₩1.10 billion.

Operations: Taesung generates revenue primarily from the manufacturing and sale of PCB automation equipment, amounting to ₩45.68 billion. The company's market capitalization stands at approximately ₩1.10 billion.

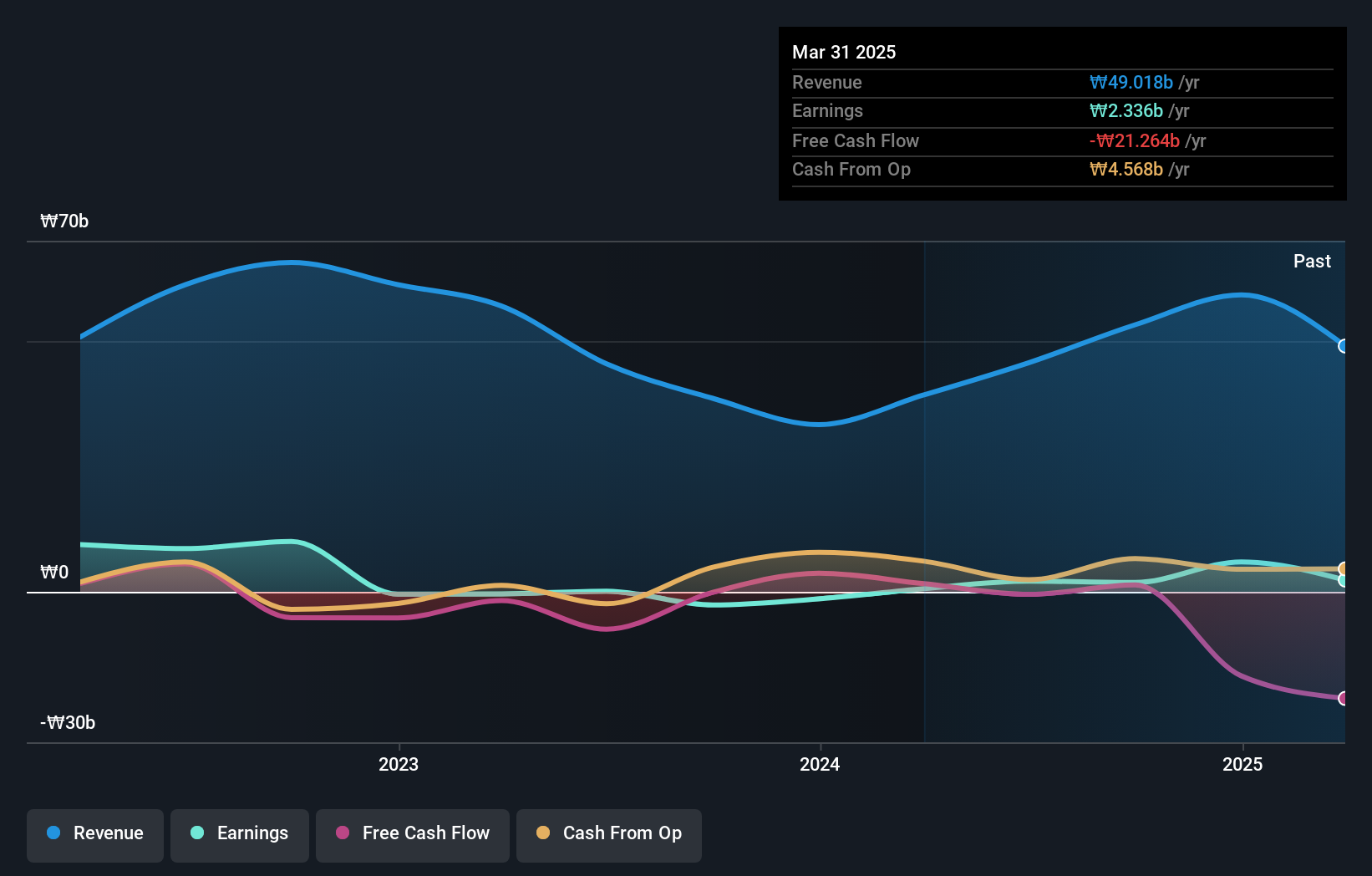

Taesung, a smaller player in South Korea's semiconductor scene, recently joined the S&P Global BMI Index, highlighting its growing prominence. The company boasts high-quality earnings with an impressive 1482% growth over the past year, far outpacing the industry's -10%. Despite this success, share price volatility remains a concern. Its debt situation appears manageable with a net debt to equity ratio of 4.2%, and interest payments are well-covered by EBIT at 17.5 times. However, free cash flow is not positive currently, which might affect future financial flexibility if not addressed effectively.

Kyung Dong Navien (KOSE:A009450)

Simply Wall St Value Rating: ★★★★★★

Overview: Kyung Dong Navien Co., Ltd. is a South Korean company specializing in the manufacturing and sale of machinery and heat combustion equipment, with a market cap of ₩1.28 trillion.

Operations: Kyung Dong Navien's primary revenue stream is from the air conditioning manufacturing and sale segment, contributing approximately ₩1.29 billion.

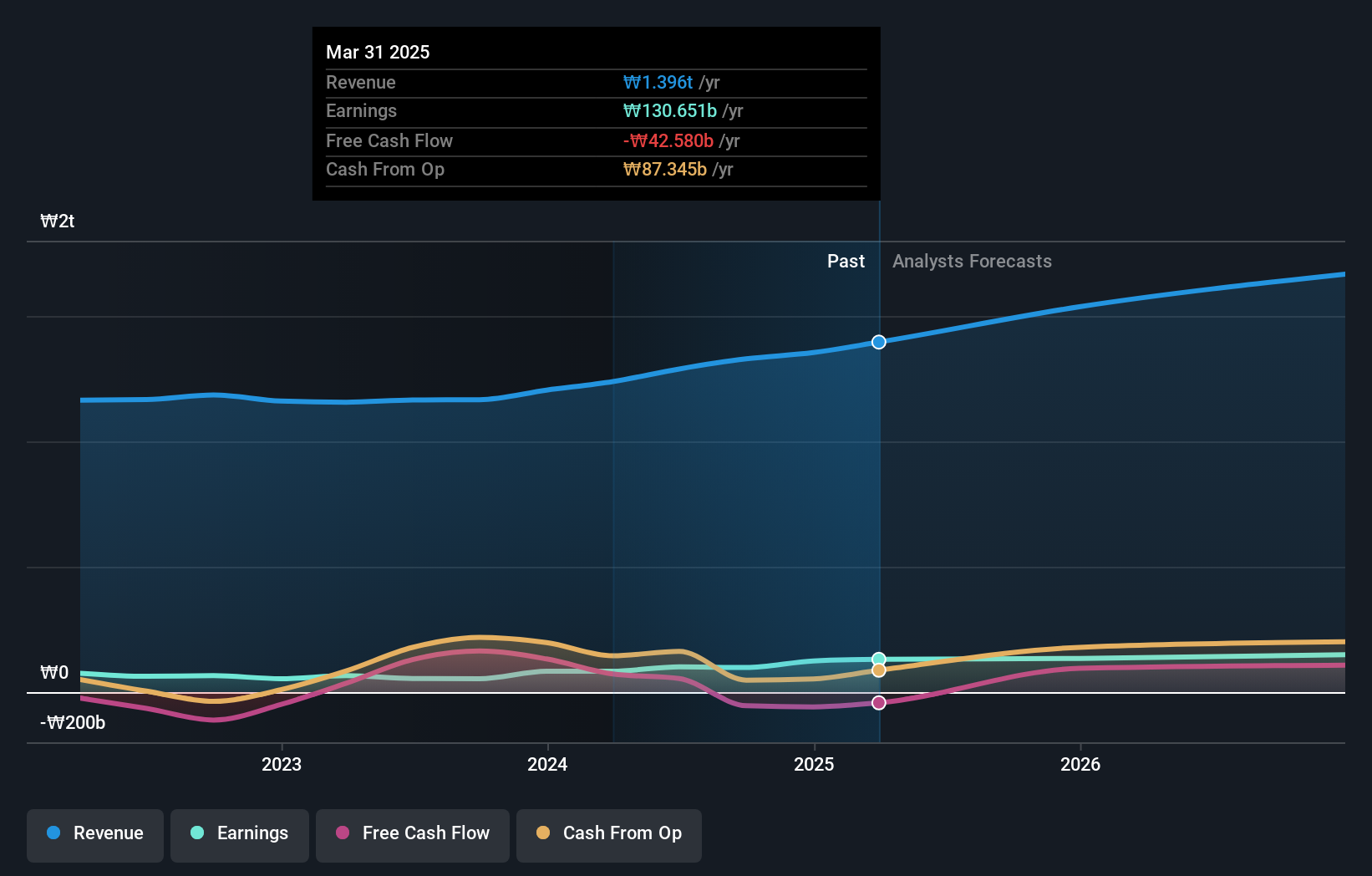

Kyung Dong Navien, a notable player in South Korea's heating solutions market, has shown promising financial health with its interest payments well covered by EBIT at 27.4 times. The company's net debt to equity ratio stands at a satisfactory 6.5%, reflecting prudent financial management over the years as it decreased from 46.4% five years ago to 22.4%. Earnings have surged by an impressive 85% in the past year, outpacing industry growth of 28%. With high-quality earnings and positive free cash flow, Kyung Dong Navien seems positioned for continued stability and potential growth within its sector.

- Click here and access our complete health analysis report to understand the dynamics of Kyung Dong Navien.

Understand Kyung Dong Navien's track record by examining our Past report.

Miwon Specialty Chemical (KOSE:A268280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Miwon Specialty Chemical Co., Ltd. specializes in producing and supplying basic raw materials for UV/EB curing systems both in Korea and internationally, with a market capitalization of approximately ₩730.02 billion.

Operations: Miwon Specialty Chemical generates revenue primarily from the manufacture and sale of energy curable resins, amounting to ₩468.28 billion.

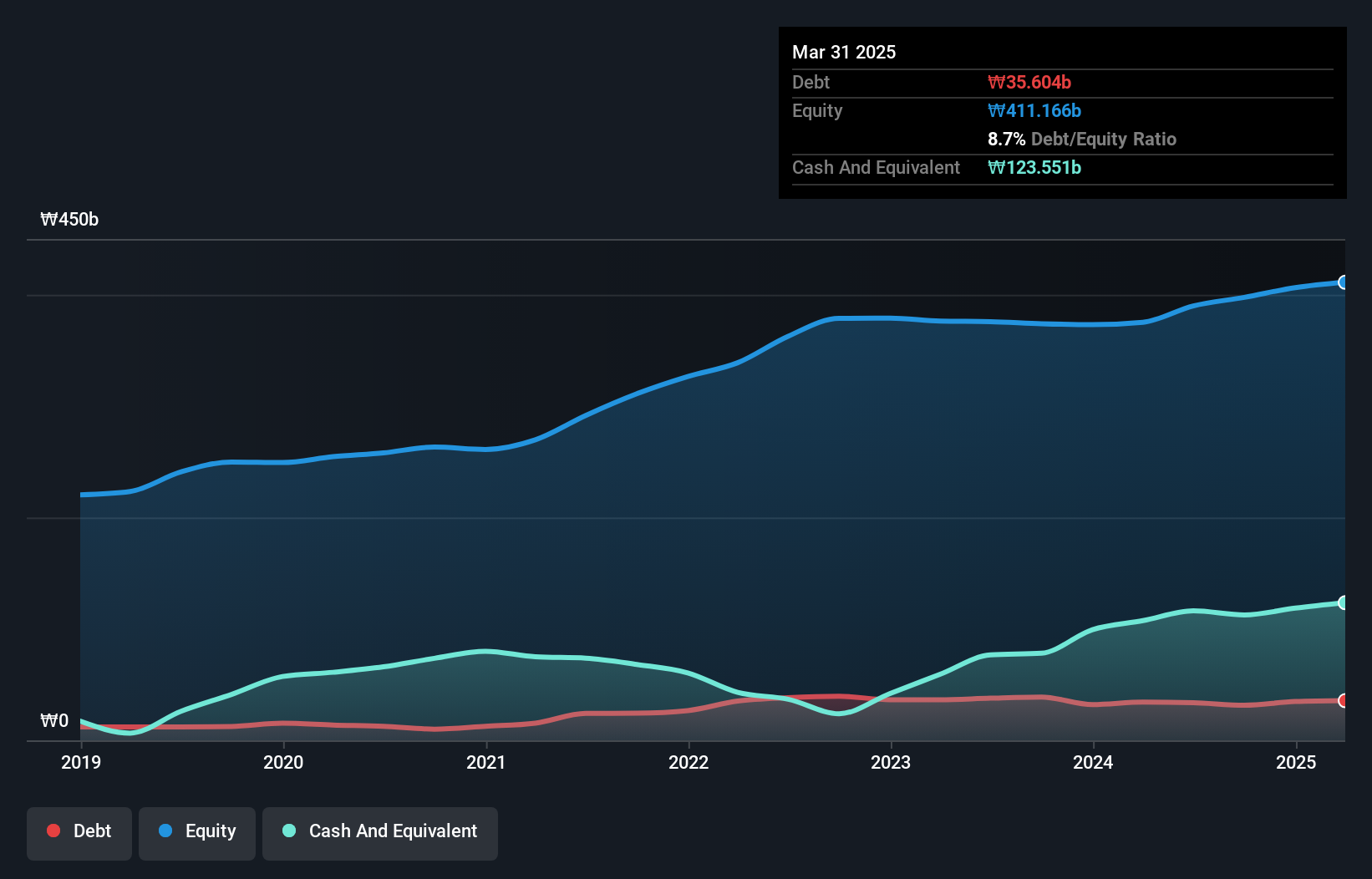

Miwon Specialty Chemical, a South Korean player in the chemicals sector, is trading at 62.3% below its estimated fair value, suggesting potential upside. The company has demonstrated high-quality earnings and has more cash than total debt, reflecting financial stability. Over the past year, earnings surged by 25.8%, outpacing the broader industry's -4.5%. However, over five years, earnings have seen a modest annual decline of 1.3%, with debt to equity rising from 5% to 8.6%. Recently announced plans to repurchase up to 20,000 shares aim to enhance shareholder value and stabilize stock prices by January 2025.

Where To Now?

- Discover the full array of 182 KRX Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A268280

Miwon Specialty Chemical

Engages in the production and supply of basic raw materials for UV/EB curing systems in Korea and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives