- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A031980

Exploring 3 Undiscovered Gems in South Korea's Stock Market

Reviewed by Simply Wall St

Over the last 7 days, South Korea's stock market has experienced a 1.4% decline, maintaining a flat performance over the past year despite forecasts of a 30% annual growth in earnings. In such conditions, identifying promising stocks often involves seeking out lesser-known companies with strong fundamentals and potential for growth amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| NOROO PAINT & COATINGS | 13.99% | 5.04% | 7.74% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Sammok S-FormLtd (KOSDAQ:A018310)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sammok S-Form Co., Ltd specializes in manufacturing, selling, and leasing formwork for construction and civil engineering projects both in South Korea and internationally, with a market cap of ₩398.10 billion.

Operations: Sammok S-Form generates revenue primarily from the structural metal products manufacturing segment, amounting to ₩457.90 billion.

Sammok S-FormLtd, a smaller player in its field, has shown impressive financial strength with earnings growing by 75% over the past year. It holds more cash than its total debt, indicating a solid balance sheet. The company is trading at 10.1% below the estimated fair value, suggesting potential undervaluation. With free cash flow turning positive and high-quality past earnings reported, Sammok seems poised for continued stability in the competitive building industry landscape.

- Get an in-depth perspective on Sammok S-FormLtd's performance by reading our health report here.

Examine Sammok S-FormLtd's past performance report to understand how it has performed in the past.

PSK HOLDINGS (KOSDAQ:A031980)

Simply Wall St Value Rating: ★★★★★☆

Overview: PSK HOLDINGS Inc. is engaged in the global production and sale of semiconductor manufacturing and flat panel display equipment, with a market cap of approximately ₩972.46 billion.

Operations: PSK HOLDINGS generates its revenue primarily from the sale of semiconductor manufacturing equipment, totaling approximately ₩132.98 billion.

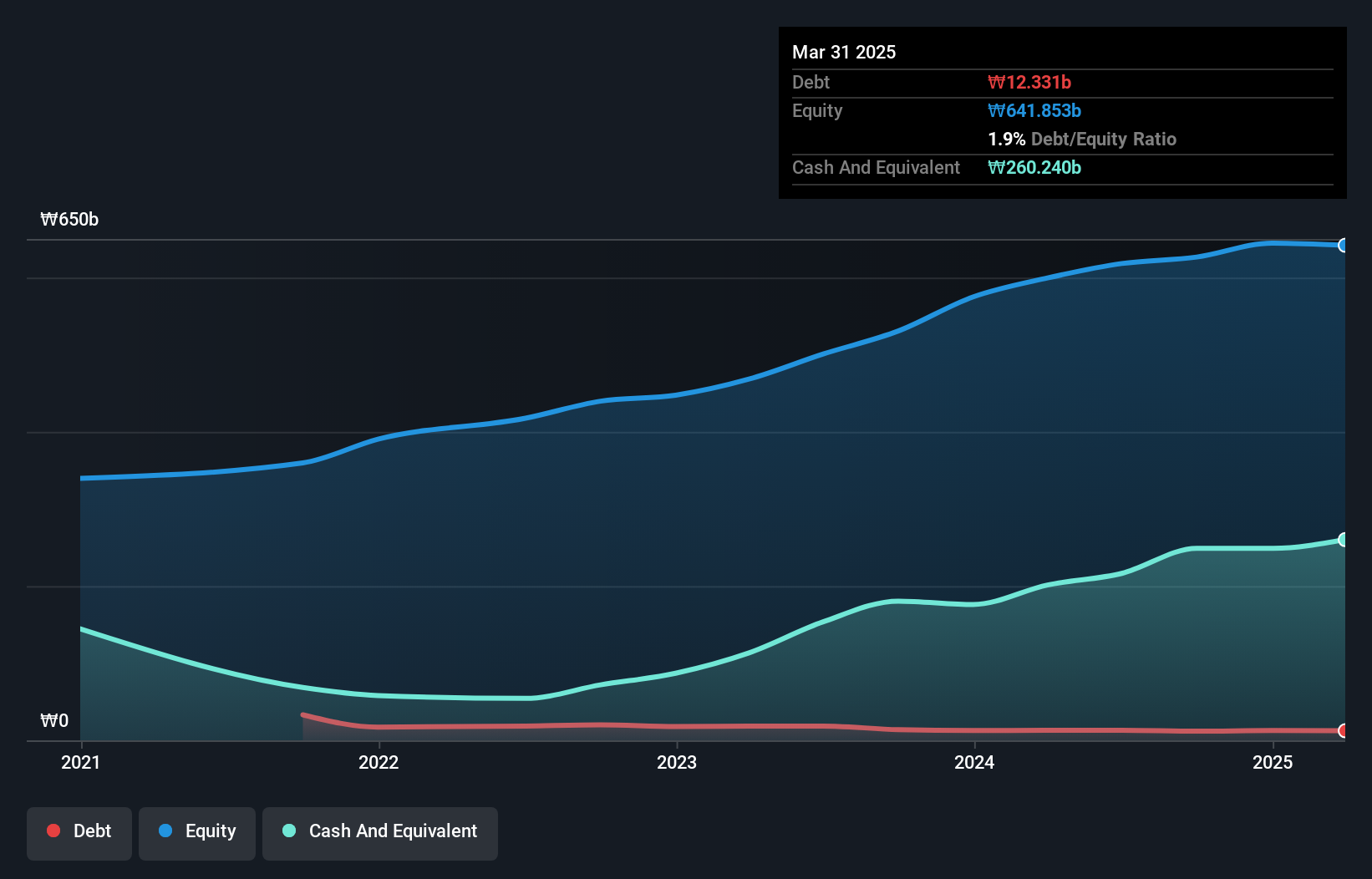

PSK Holdings, a nimble player in the semiconductor sector, has shown impressive earnings growth of 40.8% over the past year, outpacing the industry which saw a -10% change. Despite recent shareholder dilution and a volatile share price, its financial health seems robust with interest payments well-covered and more cash than total debt. A notable one-off gain of ₩26.4 billion impacted recent results, yet free cash flow remains positive at ₩21.74 billion as of June 2024.

- Delve into the full analysis health report here for a deeper understanding of PSK HOLDINGS.

Gain insights into PSK HOLDINGS' historical performance by reviewing our past performance report.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. is engaged in the development, manufacturing, and sale of PCB automation equipment both domestically in South Korea and internationally, with a market capitalization of approximately ₩743.64 billion.

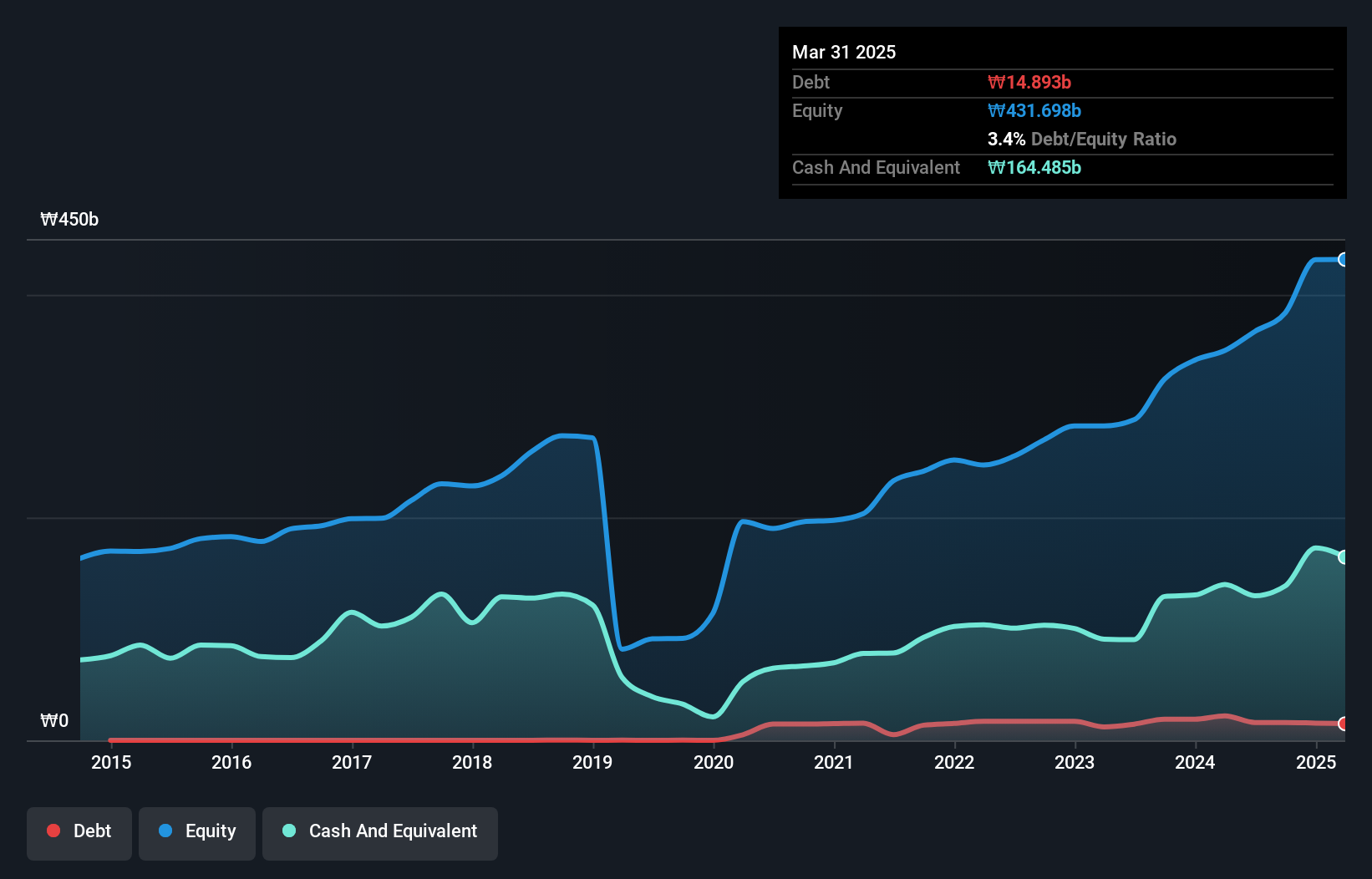

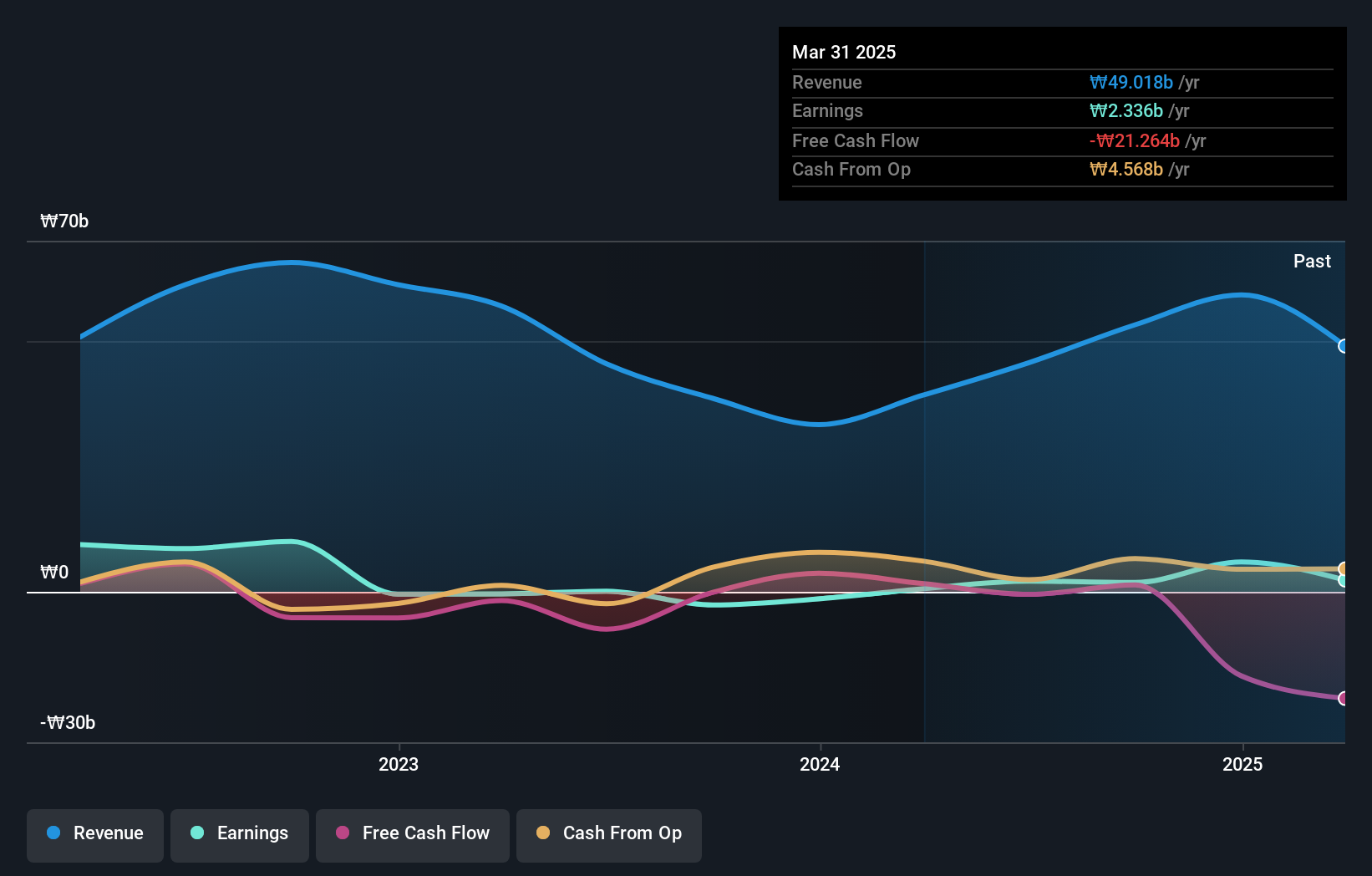

Operations: Taesung's primary revenue stream is from the manufacturing and sale of equipment, generating approximately ₩45.68 billion. The company's financial performance can be analyzed through its net profit margin, which provides insight into profitability levels.

Taesung Ltd., a small-cap player in South Korea's semiconductor industry, has shown remarkable earnings growth of 1482% over the past year, outpacing the sector's -10%. The company's debt situation appears stable with a net debt to equity ratio of 4.2%, deemed satisfactory. Despite recent volatility in its share price, Taesung's inclusion in the S&P Global BMI Index suggests increased recognition. However, free cash flow remains negative at -US$520 million as of October 2024.

- Navigate through the intricacies of TaesungLtd with our comprehensive health report here.

Gain insights into TaesungLtd's past trends and performance with our Past report.

Summing It All Up

- Navigate through the entire inventory of 186 KRX Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A031980

PSK HOLDINGS

Manufactures and sells semiconductor manufacturing and flat panel display equipment worldwide.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives