- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A323280

Exploring 3 Undiscovered Gems in South Korea with Promising Potential

Reviewed by Simply Wall St

The South Korean stock market has recently faced a downturn, with the KOSPI index experiencing a decline over three consecutive sessions, reflecting broader global market uncertainties and fluctuating oil prices due to geopolitical tensions. In such volatile conditions, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities amidst the turbulence.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Daewon Cable | 30.50% | 8.72% | 60.28% | ★★★★★☆ |

| Itcen | 64.57% | 14.33% | -24.39% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

| THINKWARE | 36.75% | 21.25% | 22.92% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Sammok S-FormLtd (KOSDAQ:A018310)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sammok S-Form Co., Ltd is involved in the manufacturing, selling, and leasing of formwork for construction and civil engineering projects both in South Korea and internationally, with a market cap of approximately ₩398.10 billion.

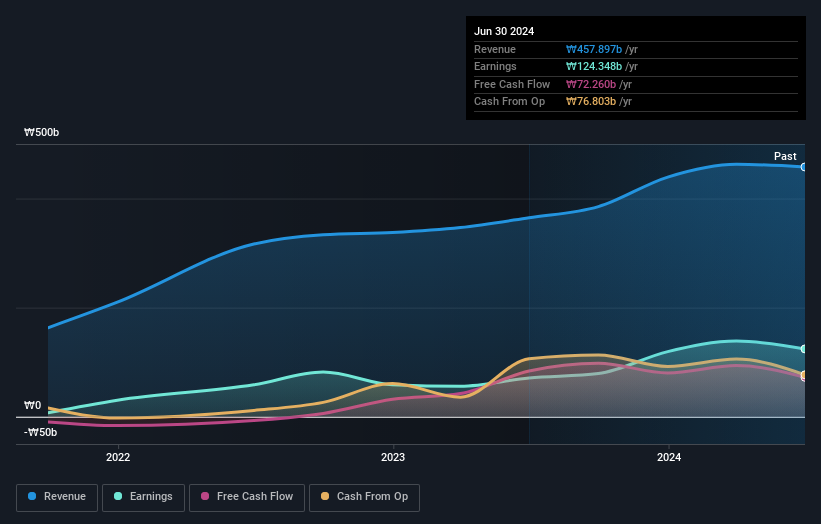

Operations: Sammok S-Form Co., Ltd generates revenue primarily from the manufacturing, selling, and leasing of formwork for construction and civil engineering projects, with a significant contribution of ₩457.90 billion from structural metal products manufacture.

Sammok S-FormLtd, a small player in the South Korean market, showcases impressive earnings growth of 75% over the past year, outpacing its industry. The company is trading at 10.1% below its estimated fair value, suggesting potential undervaluation. With high-quality earnings and positive free cash flow reported at US$93.73 million as of March 2024, Sammok S-FormLtd appears financially robust with more cash than total debt on hand, indicating sound financial management.

TaesungLtd (KOSDAQ:A323280)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taesung Co., Ltd. is engaged in the development, manufacturing, and sale of PCB automation equipment both domestically and internationally, with a market capitalization of approximately ₩743.64 billion.

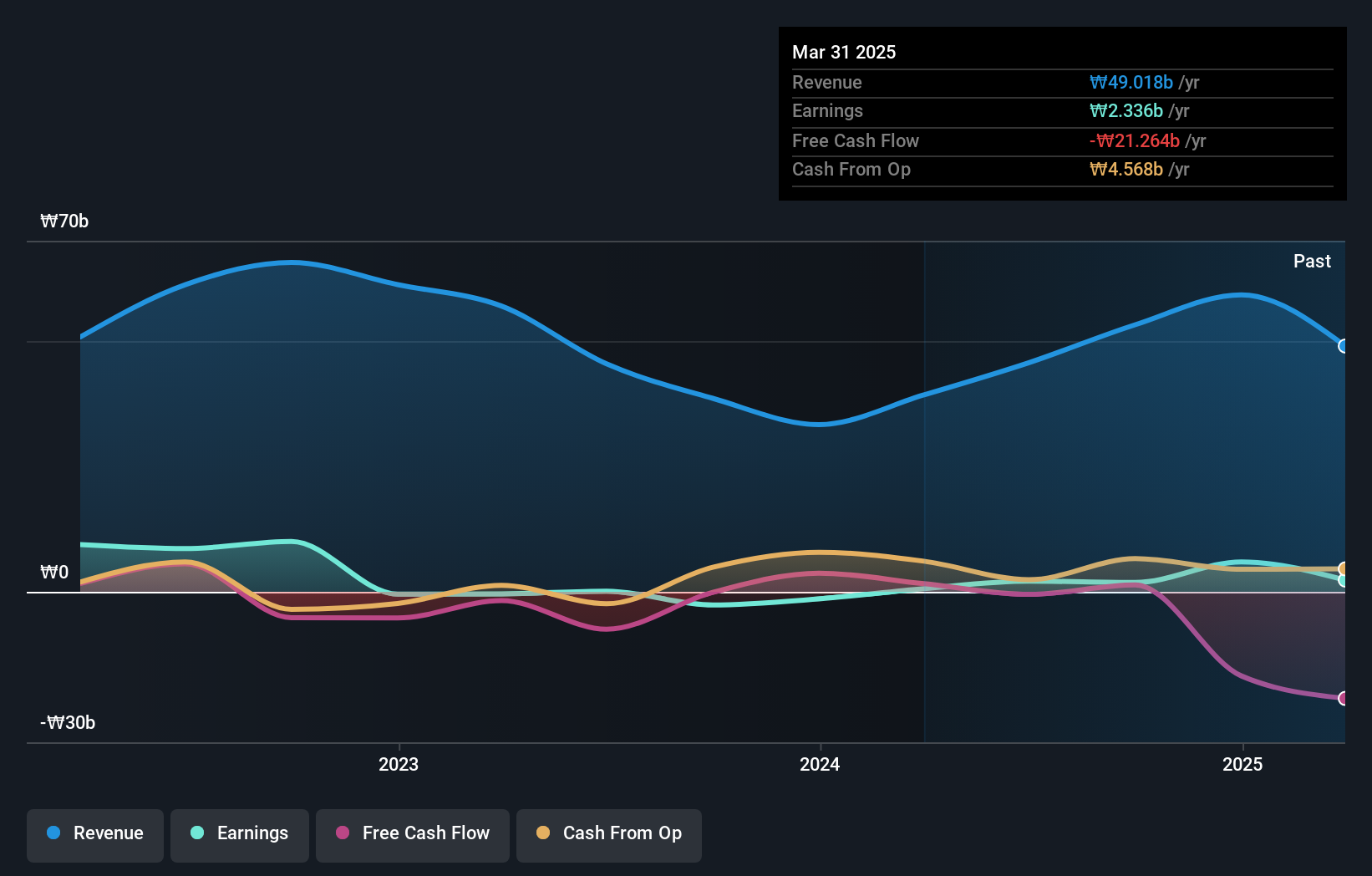

Operations: Taesung generates revenue primarily from the manufacturing and sale of PCB automation equipment, amounting to approximately ₩45.68 billion.

Taesung Ltd., a small player in the semiconductor space, has been making waves with a staggering earnings growth of 1482% over the past year, outpacing its industry peers. The company's interest payments are well covered by EBIT at 17.5 times, indicating solid financial health despite shareholder dilution recently. While its net debt to equity ratio stands at a satisfactory 4.2%, Taesung's share price has shown high volatility recently; however, being added to the S&P Global BMI Index could signal increased investor interest moving forward.

- Unlock comprehensive insights into our analysis of TaesungLtd stock in this health report.

Examine TaesungLtd's past performance report to understand how it has performed in the past.

Dongwon Systems (KOSE:A014820)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dongwon Systems Corporation is a South Korean packaging company that specializes in manufacturing and marketing packaging materials, with a market cap of ₩1.31 trillion.

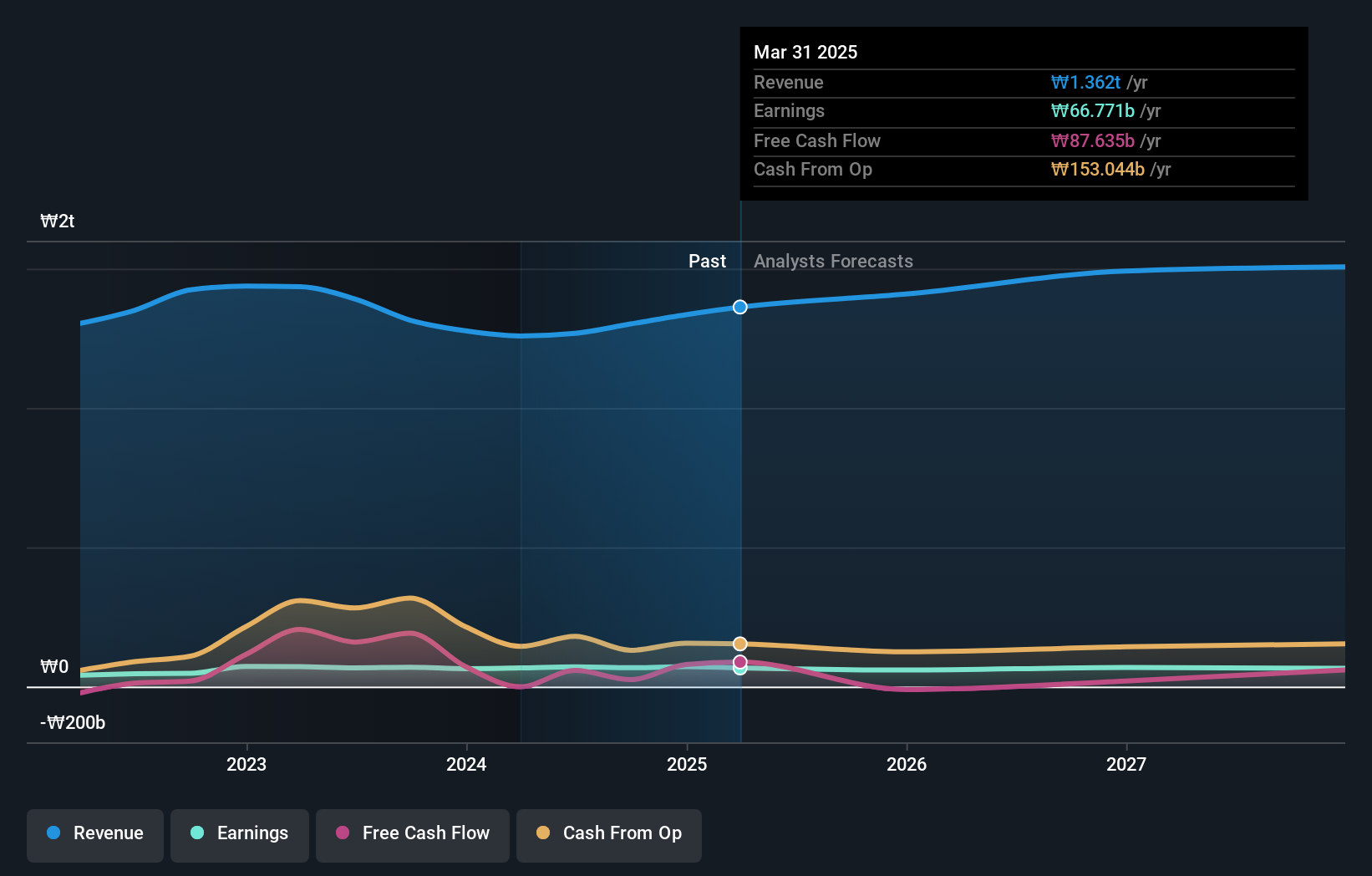

Operations: Dongwon Systems generates revenue primarily from its packaging business, which reported ₩1.27 trillion. The company's financial performance can be evaluated in part by examining its gross profit margin trends over recent periods.

Dongwon Systems, a notable player in the packaging industry, reported impressive net income growth to KRW 22.26 million for Q2 2024 from KRW 17.89 million last year, with earnings per share rising to KRW 761. Despite facing a high net debt to equity ratio of 48.4%, the company has reduced this figure from 69.4% over five years while maintaining positive free cash flow at KRW 191,192.73 as of September 2023. Earnings have outpaced industry averages by growing at a rate of 4.8%.

- Click here to discover the nuances of Dongwon Systems with our detailed analytical health report.

Assess Dongwon Systems' past performance with our detailed historical performance reports.

Where To Now?

- Explore the 185 names from our KRX Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TaesungLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A323280

TaesungLtd

Develops, manufactures, and sells PCB automation equipment in South Korea and internationally.

Excellent balance sheet with questionable track record.