- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A297890

HB SOLUTION Co., Ltd.'s (KOSDAQ:297890) last week's 10% decline must have disappointed individual investors who have a significant stake

Key Insights

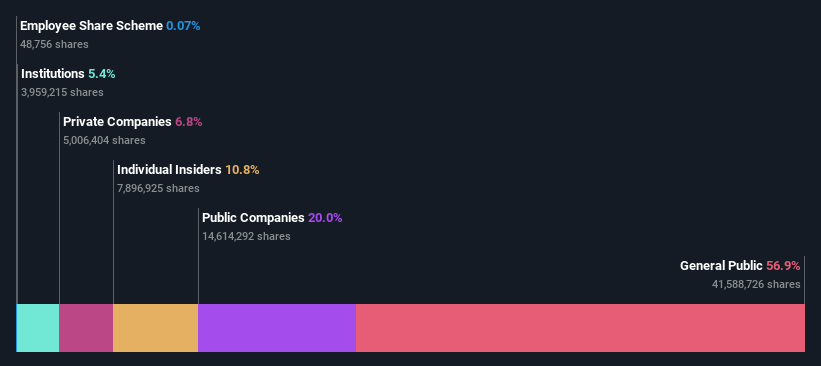

- HB SOLUTION's significant individual investors ownership suggests that the key decisions are influenced by shareholders from the larger public

- A total of 11 investors have a majority stake in the company with 43% ownership

- 11% of HB SOLUTION is held by insiders

To get a sense of who is truly in control of HB SOLUTION Co., Ltd. (KOSDAQ:297890), it is important to understand the ownership structure of the business. With 57% stake, individual investors possess the maximum shares in the company. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

And last week, individual investors endured the biggest losses as the stock fell by 10%.

Let's take a closer look to see what the different types of shareholders can tell us about HB SOLUTION.

Check out our latest analysis for HB SOLUTION

What Does The Institutional Ownership Tell Us About HB SOLUTION?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

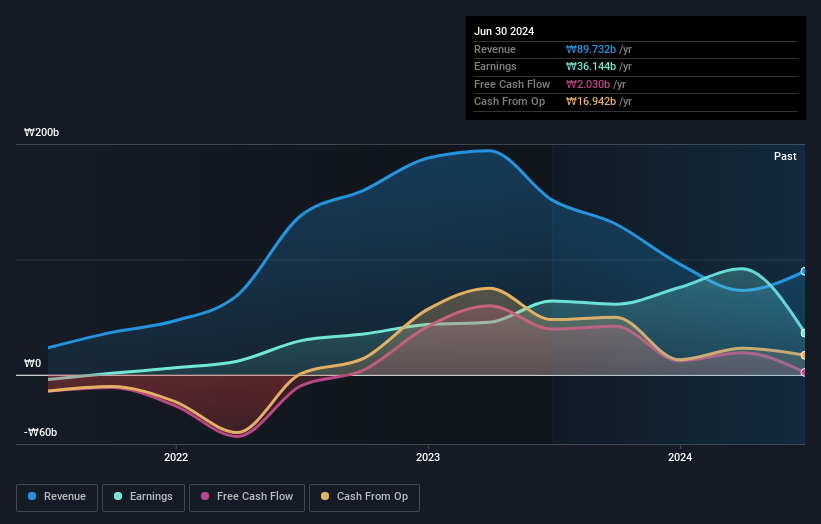

HB SOLUTION already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of HB SOLUTION, (below). Of course, keep in mind that there are other factors to consider, too.

Hedge funds don't have many shares in HB SOLUTION. HB Technology CO.,LTD. is currently the company's largest shareholder with 20% of shares outstanding. In comparison, the second and third largest shareholders hold about 9.7% and 6.8% of the stock.

A deeper look at our ownership data shows that the top 11 shareholders collectively hold less than half of the register, suggesting a large group of small holders where no single shareholder has a majority.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of HB SOLUTION

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

It seems insiders own a significant proportion of HB SOLUTION Co., Ltd.. Insiders have a ₩33b stake in this ₩305b business. We would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, hold a substantial 57% stake in HB SOLUTION, suggesting it is a fairly popular stock. This level of ownership gives investors from the wider public some power to sway key policy decisions such as board composition, executive compensation, and the dividend payout ratio.

Private Company Ownership

We can see that Private Companies own 6.8%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Public Company Ownership

We can see that public companies hold 20% of the HB SOLUTION shares on issue. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Be aware that HB SOLUTION is showing 3 warning signs in our investment analysis , you should know about...

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if HB SOLUTION might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A297890

HB SOLUTION

Manufactures and sells module process display manufacturing equipment and automation system for display industry in South Korea and internationally.

Excellent balance sheet low.