- China

- /

- Auto Components

- /

- SHSE:603037

Undiscovered Gems With Potential To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic indicators, small-cap stocks have shown resilience, with indices like the S&P MidCap 400 and Russell 2000 maintaining positive year-to-date growth despite recent declines. In this environment, identifying potential undiscovered gems involves focusing on companies that demonstrate robust earnings growth and adaptability to shifting market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 37.70% | 9.99% | 13.08% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 20.75% | 18.12% | ★★★★★★ |

| C. Mer Industries | 131.82% | 12.24% | 75.61% | ★★★★★☆ |

| Conoil | 65.11% | 21.04% | 44.95% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

INNOX Advanced MaterialsLtd (KOSDAQ:A272290)

Simply Wall St Value Rating: ★★★★★★

Overview: INNOX Advanced Materials Co., Ltd operates in the semiconductor packaging materials and flexible circuit board materials sectors both domestically in South Korea and internationally, with a market capitalization of approximately ₩576.76 billion.

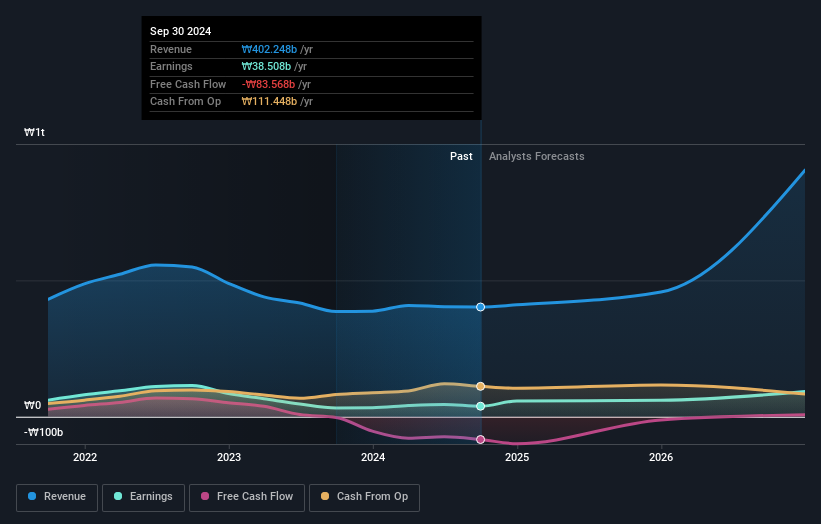

Operations: INNOX Advanced Materials generates revenue primarily from its manufacturing and sales segment, which amounted to approximately ₩402.25 billion. The company focuses on semiconductor packaging materials and flexible circuit board materials for both domestic and international markets.

INNOX Advanced Materials, a small player in the semiconductor sector, has shown impressive earnings growth of 20.1% over the past year, outpacing the industry average of 7.4%. The company's price-to-earnings ratio stands at 15x, which is below the industry norm of 16.7x, suggesting potential value for investors. Over five years, its debt-to-equity ratio decreased from 80.7% to 73.1%, reflecting improved financial health. Recently, INNOX repurchased a total of 816,267 shares between August and December for KRW19 billion (approximately US$15 million), indicating confidence in its own stock's value amidst ongoing market dynamics.

Shanghai CarthaneLtd (SHSE:603037)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Carthane Co., Ltd. operates in the auto parts manufacturing industry in China with a market cap of CN¥3.05 billion.

Operations: Shanghai Carthane Co., Ltd. generates revenue primarily from its activities in the auto parts manufacturing sector. The company has a market capitalization of CN¥3.05 billion, indicating its valuation within the industry.

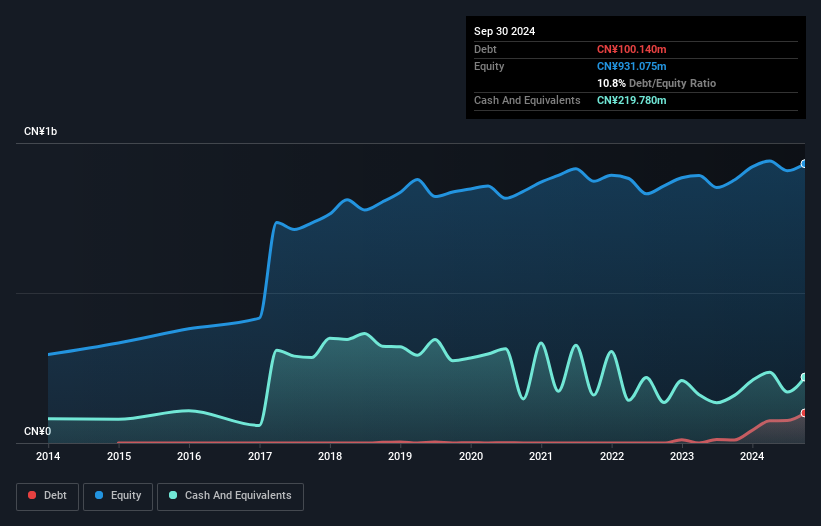

Shanghai Carthane Ltd., a notable player in the auto components sector, has shown impressive earnings growth of 23.4% over the past year, surpassing the industry's 10.5%. The company seems to be maintaining a strong financial footing with more cash than its total debt, indicating an appropriate debt level. Its price-to-earnings ratio of 30.7x is attractively below the CN market average of 35.8x, suggesting potential value for investors. Despite an increase in its debt-to-equity ratio from 0% to 10.8% over five years, Carthane's high-quality earnings and positive free cash flow reinforce its stable position in the market.

- Get an in-depth perspective on Shanghai CarthaneLtd's performance by reading our health report here.

Shenglan Technology (SZSE:300843)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenglan Technology Co., Ltd. is engaged in the research, development, manufacturing, and sale of electronic connectors, wire harness components, and precision components globally with a market cap of CN¥5.61 billion.

Operations: Shenglan Technology generates revenue primarily from the sale of electronic connectors, wire harness components, and precision parts. The company's net profit margin is notable at 15.2%, reflecting its efficiency in managing costs relative to its revenue streams.

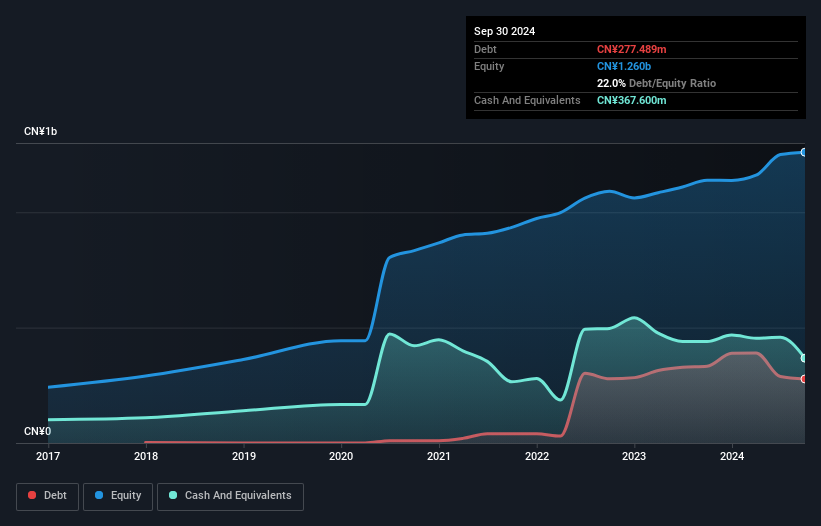

Shenglan Technology, a nimble player in its field, has seen its debt to equity ratio rise from 0% to 22% over five years, indicating increased leverage. Despite this, the company remains profitable and not burdened by its debt level. Earnings surged by 31% last year, outpacing the broader electronics industry growth of just 3%, although they have decreased annually by about 5% over the past five years. Recent shareholder meetings focused on strategic financial maneuvers like convertible bond issuance and capital adjustments to bolster working capital and future projects.

- Unlock comprehensive insights into our analysis of Shenglan Technology stock in this health report.

Gain insights into Shenglan Technology's past trends and performance with our Past report.

Taking Advantage

- Reveal the 4725 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603037

Shanghai CarthaneLtd

Operates in the auto parts manufacturing industry in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives