- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A256940

Market Participants Recognise Keeps Biopharma Inc.'s (KOSDAQ:256940) Revenues Pushing Shares 43% Higher

Keeps Biopharma Inc. (KOSDAQ:256940) shares have continued their recent momentum with a 43% gain in the last month alone. The annual gain comes to 230% following the latest surge, making investors sit up and take notice.

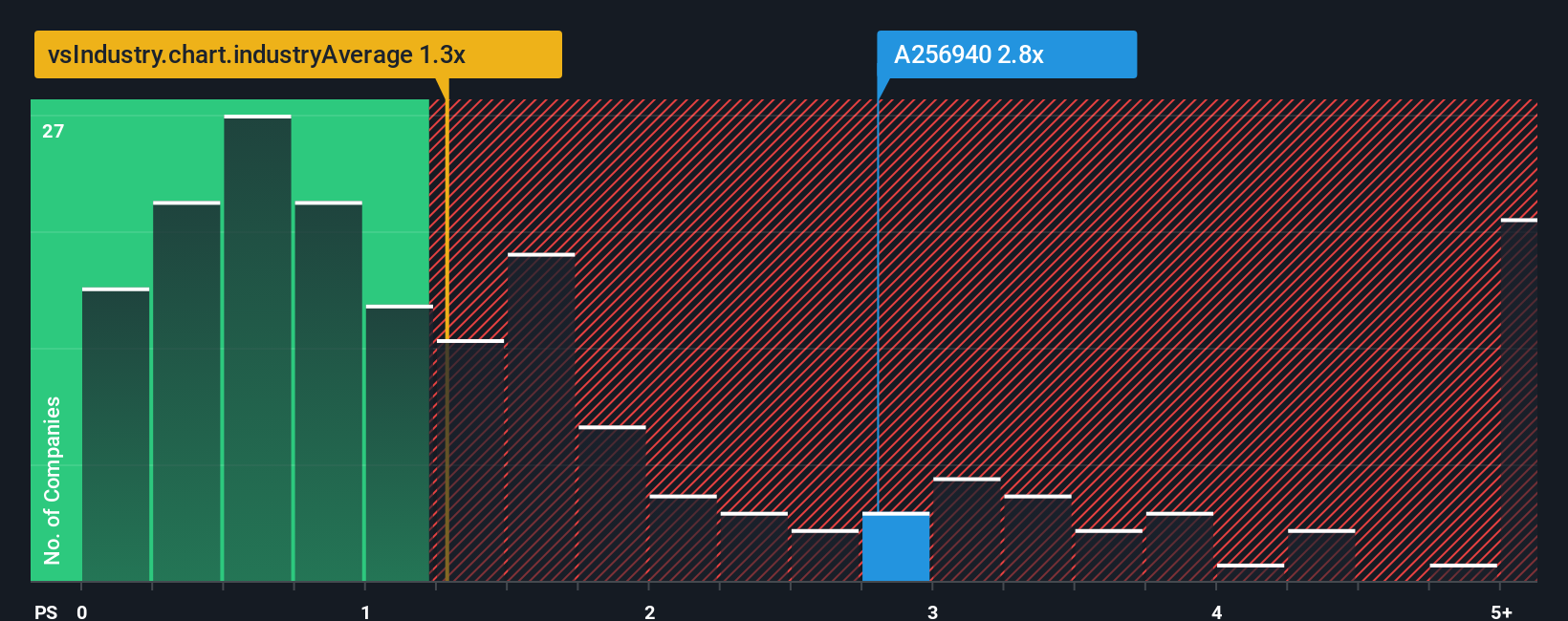

After such a large jump in price, when almost half of the companies in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Keeps Biopharma as a stock probably not worth researching with its 2.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Keeps Biopharma

How Keeps Biopharma Has Been Performing

Revenue has risen firmly for Keeps Biopharma recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Keeps Biopharma's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Keeps Biopharma would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 27% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Keeps Biopharma's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

Keeps Biopharma's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Keeps Biopharma can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Keeps Biopharma is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Keeps Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A256940

Keeps Biopharma

Engages in the research, development, production, and sale of mechanical equipment for manufacturing flat panel displays in South Korea, China, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.