- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A240810

Wonik Ips Leads 3 KRX Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 5.7%, and it is down 3.9% over the past year, though earnings are forecast to grow by 29% annually. In this context, identifying undervalued stocks like Wonik Ips can present attractive opportunities for investors looking to capitalize on potential future growth at a discount.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| APR (KOSE:A278470) | ₩295000.00 | ₩523654.95 | 43.7% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩173500.00 | ₩305978.96 | 43.3% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Oscotec (KOSDAQ:A039200) | ₩35600.00 | ₩65583.14 | 45.7% |

| Intellian Technologies (KOSDAQ:A189300) | ₩50200.00 | ₩91374.48 | 45.1% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1629.00 | ₩2977.02 | 45.3% |

| Global Tax Free (KOSDAQ:A204620) | ₩3580.00 | ₩6420.28 | 44.2% |

| Hotel ShillaLtd (KOSE:A008770) | ₩44600.00 | ₩82523.19 | 46% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩97400.00 | ₩171464.92 | 43.2% |

| Kakao Games (KOSDAQ:A293490) | ₩16620.00 | ₩29539.21 | 43.7% |

Here's a peek at a few of the choices from the screener.

Wonik Ips (KOSDAQ:A240810)

Overview: Wonik IPS Co., Ltd researches, develops, manufactures, and sells semiconductor, display, and solar cell systems in South Korea with a market cap of ₩1.43 billion.

Operations: The company generates revenue from semiconductor, display, and solar cell systems in South Korea.

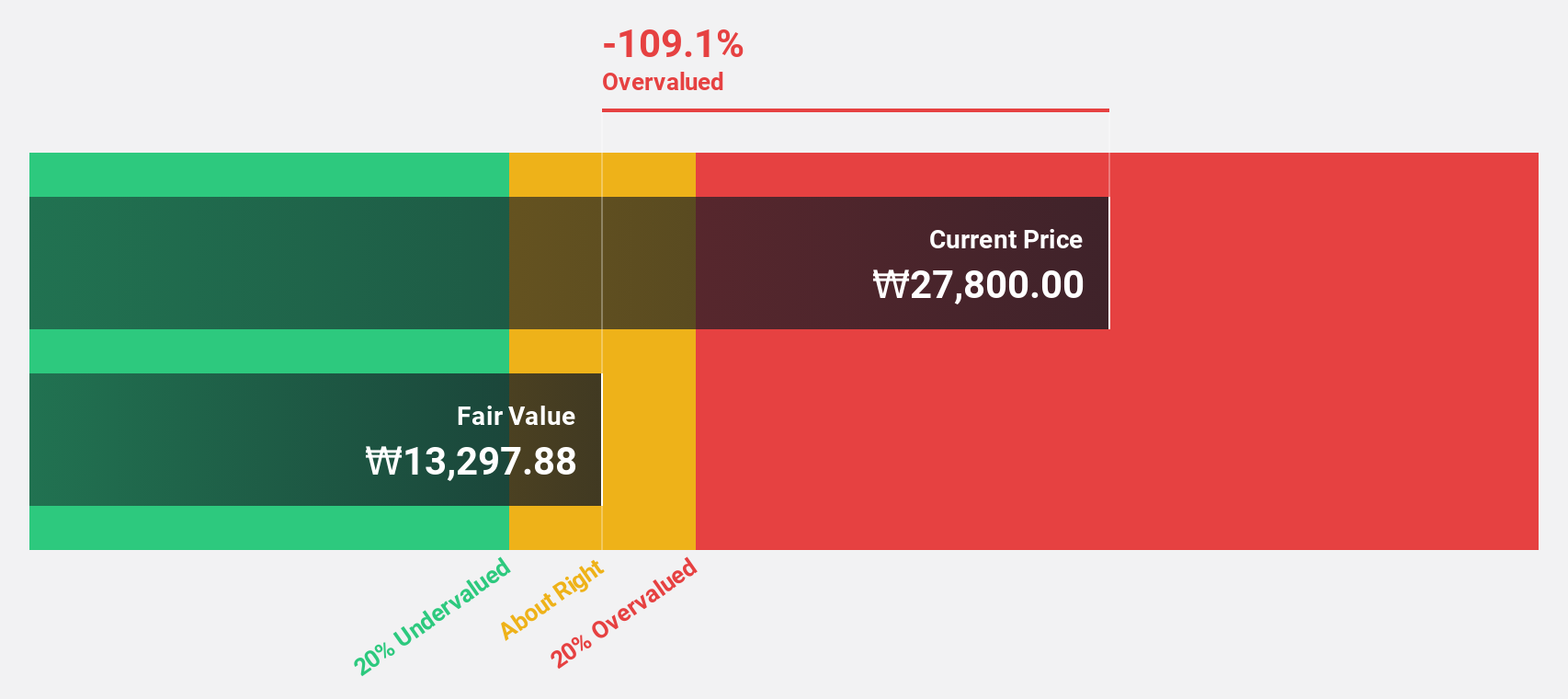

Estimated Discount To Fair Value: 33.8%

Wonik Ips, trading at ₩29,400, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of ₩44,396.17. Analysts forecast revenue growth at 23.2% per year, outpacing the South Korean market average of 10.3%. Despite a low return on equity forecast (11.5%), the stock is expected to become profitable within three years and has strong earnings growth potential at 90.24% annually. Recent earnings will be reported on August 8, 2024.

- The growth report we've compiled suggests that Wonik Ips' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Wonik Ips.

Hotel ShillaLtd (KOSE:A008770)

Overview: Hotel Shilla Co., Ltd operates as a hospitality company in South Korea and internationally, with a market cap of ₩1.69 trillion.

Operations: Hotel Shilla's revenue segments include Travel Retail (₩3.31 trillion) and Hotel & Leisure Sector (₩701.77 billion).

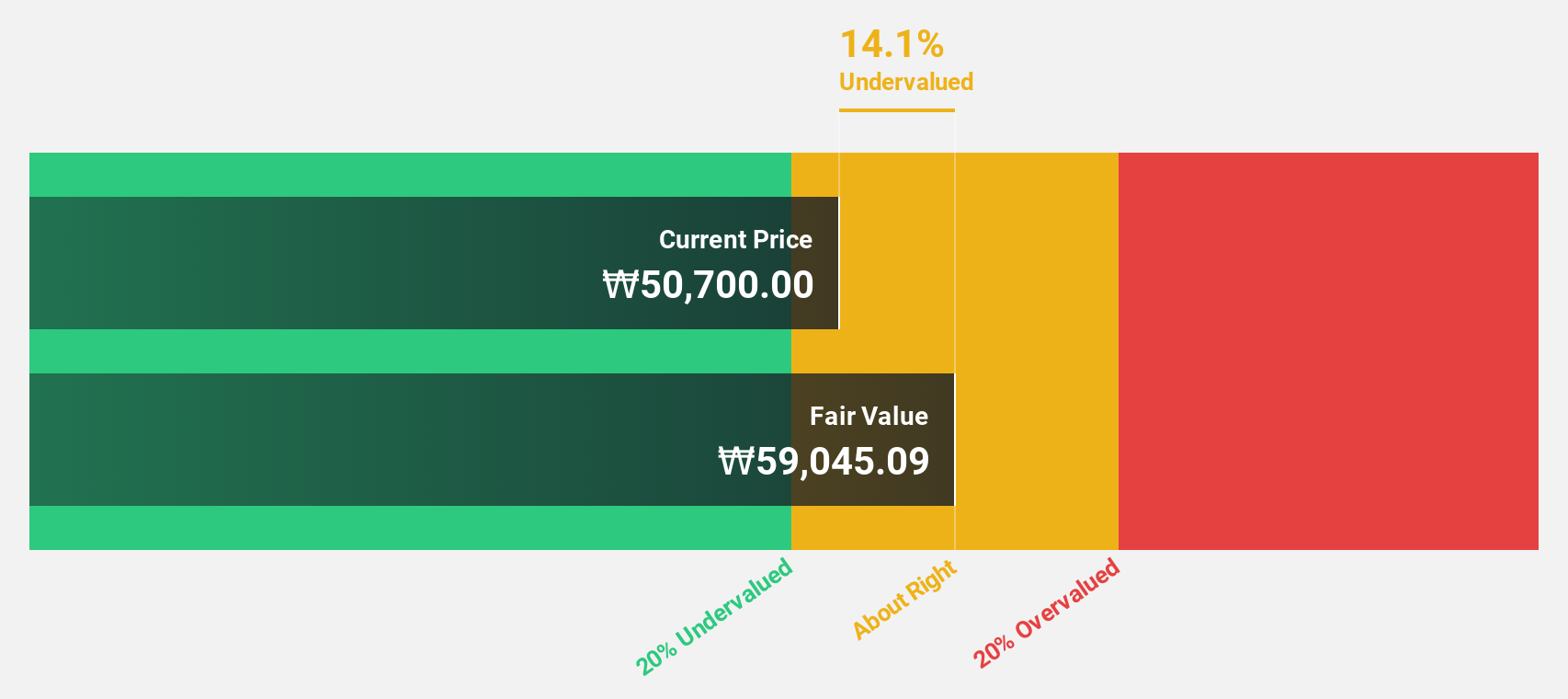

Estimated Discount To Fair Value: 46%

Hotel Shilla Ltd. is trading at ₩44,600, significantly below its estimated fair value of ₩82,523.19 based on discounted cash flow analysis. The company is expected to become profitable within the next three years and has a strong earnings growth forecast of 69.41% annually. Despite slower revenue growth (11.6% per year) compared to peers, it remains undervalued by 46%. Recent private placements raised KRW 132.80 billion through exchangeable bonds with a zero interest rate maturing in 2029.

- In light of our recent growth report, it seems possible that Hotel ShillaLtd's financial performance will exceed current levels.

- Navigate through the intricacies of Hotel ShillaLtd with our comprehensive financial health report here.

Hd Hyundai MipoLtd (KOSE:A010620)

Overview: Hd Hyundai Mipo Co., Ltd. is a South Korean company specializing in the manufacture, repair, and remodeling of ships with a market cap of ₩3.88 trillion.

Operations: The company's revenue segments include Shipbuilding, which generated ₩5.10 billion, and Connection Adjustment, which accounted for -₩0.87 billion.

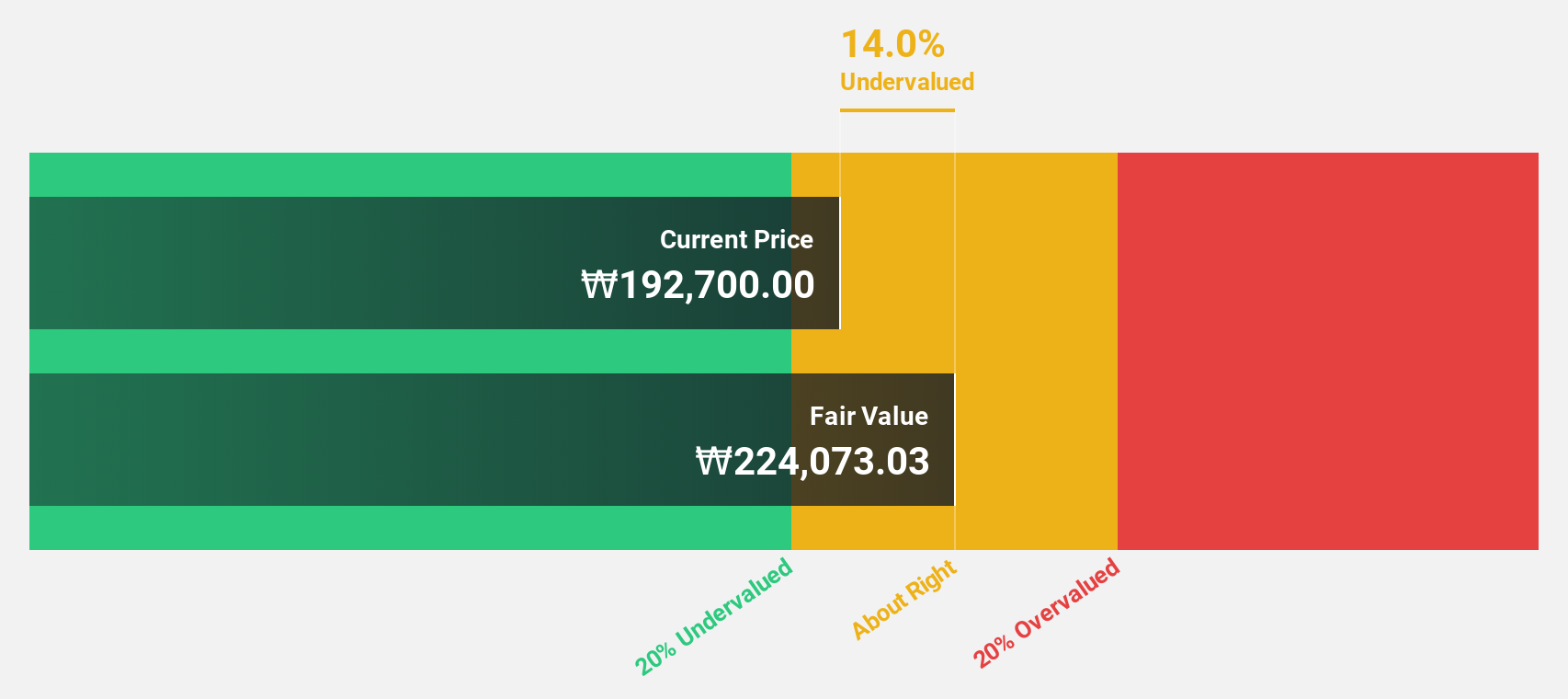

Estimated Discount To Fair Value: 43.2%

Hd Hyundai Mipo Ltd. is trading at ₩97,400, significantly below its estimated fair value of ₩171,464.92 based on discounted cash flow analysis. The company is forecast to become profitable within the next three years with earnings expected to grow 93.19% annually. Although revenue growth (11.4% per year) is slower than 20%, it surpasses the market average of 10.3%. Recent shareholder and analyst calls have provided positive insights into future profitability and valuation prospects.

- According our earnings growth report, there's an indication that Hd Hyundai MipoLtd might be ready to expand.

- Get an in-depth perspective on Hd Hyundai MipoLtd's balance sheet by reading our health report here.

Seize The Opportunity

- Unlock more gems! Our Undervalued KRX Stocks Based On Cash Flows screener has unearthed 30 more companies for you to explore.Click here to unveil our expertly curated list of 33 Undervalued KRX Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wonik IPS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A240810

Wonik IPS

Researches and develops, manufactures, and sells semiconductor, display, and solar cell systems in South Korea.

Flawless balance sheet with reasonable growth potential.