- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A238490

We Think HIMSLtd (KOSDAQ:238490) Can Stay On Top Of Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies HIMS Co.,Ltd. (KOSDAQ:238490) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for HIMSLtd

What Is HIMSLtd's Debt?

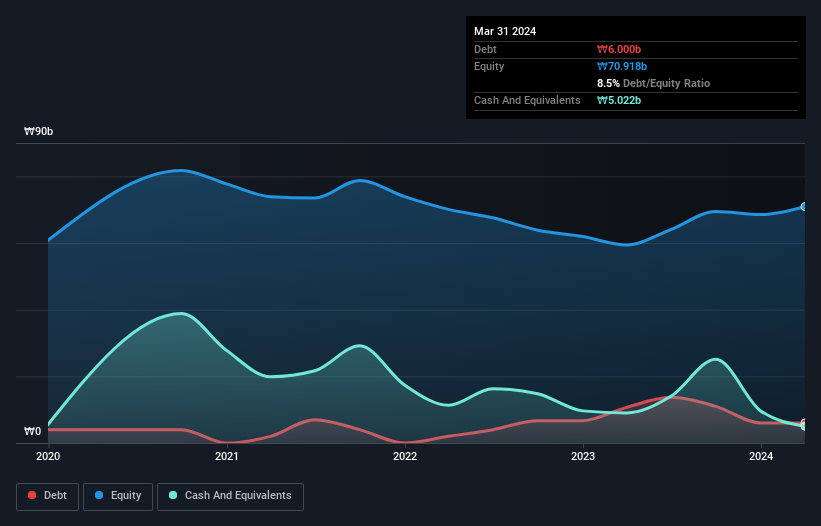

You can click the graphic below for the historical numbers, but it shows that HIMSLtd had ₩6.00b of debt in March 2024, down from ₩10.7b, one year before. However, it does have ₩5.02b in cash offsetting this, leading to net debt of about ₩978.0m.

How Strong Is HIMSLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that HIMSLtd had liabilities of ₩24.1b due within 12 months and liabilities of ₩1.86b due beyond that. Offsetting these obligations, it had cash of ₩5.02b as well as receivables valued at ₩9.87b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩11.1b.

While this might seem like a lot, it is not so bad since HIMSLtd has a market capitalization of ₩55.3b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

HIMSLtd has very modest net debt levels, with net debt at just 0.072 times EBITDA. Humorously, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like an Olympic ice-skater handles a pirouette. Although HIMSLtd made a loss at the EBIT level, last year, it was also good to see that it generated ₩13b in EBIT over the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since HIMSLtd will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. In the last year, HIMSLtd created free cash flow amounting to 5.9% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

HIMSLtd's interest cover was a real positive on this analysis, as was its net debt to EBITDA. In contrast, our confidence was undermined by its apparent struggle to convert EBIT to free cash flow. When we consider all the elements mentioned above, it seems to us that HIMSLtd is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with HIMSLtd (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if HIMSLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A238490

HIMSLtd

Manufactures and sells machine vision module equipment related to displays, semiconductors, and general industrial automation in South Korea.

Medium-low risk with excellent balance sheet.

Market Insights

Community Narratives