- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A232140

Undiscovered Gems With Strong Fundamentals For January 2025

Reviewed by Simply Wall St

As global markets grapple with inflation concerns and political uncertainties, small-cap stocks have notably underperformed their large-cap counterparts, with the Russell 2000 Index slipping into correction territory. Despite this challenging backdrop, discerning investors may find opportunities in lesser-known stocks that boast strong fundamentals and resilience to economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Arsan Tekstil Ticaret ve Sanayi Anonim Sirketi | 0.75% | 19.36% | 52.36% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

YC (KOSDAQ:A232140)

Simply Wall St Value Rating: ★★★★★★

Overview: YC Corporation develops, manufactures, and sells inspection equipment for semiconductor memories in South Korea and internationally, with a market cap of ₩956.27 billion.

Operations: The company's revenue primarily comes from the sale of inspection equipment for semiconductor memories. It operates with a focus on both domestic and international markets, contributing to its financial performance.

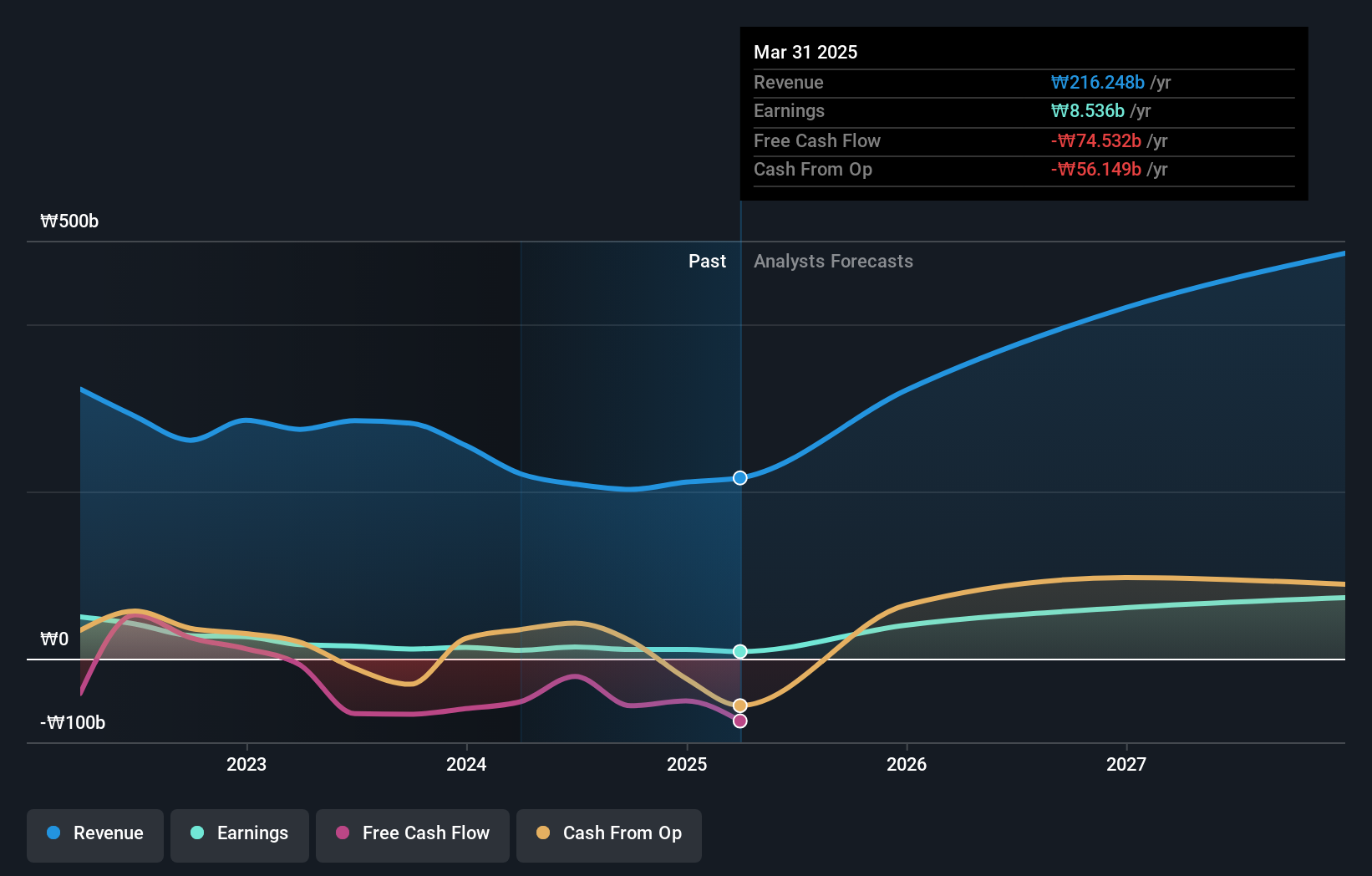

YC, a small-cap player in the semiconductor industry, has shown some intriguing financial dynamics. Over the past five years, its debt to equity ratio has impressively decreased from 46.3% to 20.6%, indicating better financial management. Despite this improvement, earnings growth was negative at -4.2% last year, contrasting with the industry's average of 7.4%. However, forecasts suggest a promising annual earnings growth of 55%. The company is profitable and can comfortably cover its interest payments with earnings exceeding interest expenses. While free cash flow remains negative, YC's high-quality earnings provide some reassurance for potential investors considering its future prospects.

Inspur Digital Enterprise Technology (SEHK:596)

Simply Wall St Value Rating: ★★★★★☆

Overview: Inspur Digital Enterprise Technology Limited is an investment holding company that offers software development, other software services, and cloud services in the People’s Republic of China with a market capitalization of approximately HK$4.45 billion.

Operations: Inspur Digital generates revenue primarily from three segments: IoT Solutions (CN¥3.53 billion), Management Software (CN¥2.55 billion), and Cloud Services (CN¥2.26 billion).

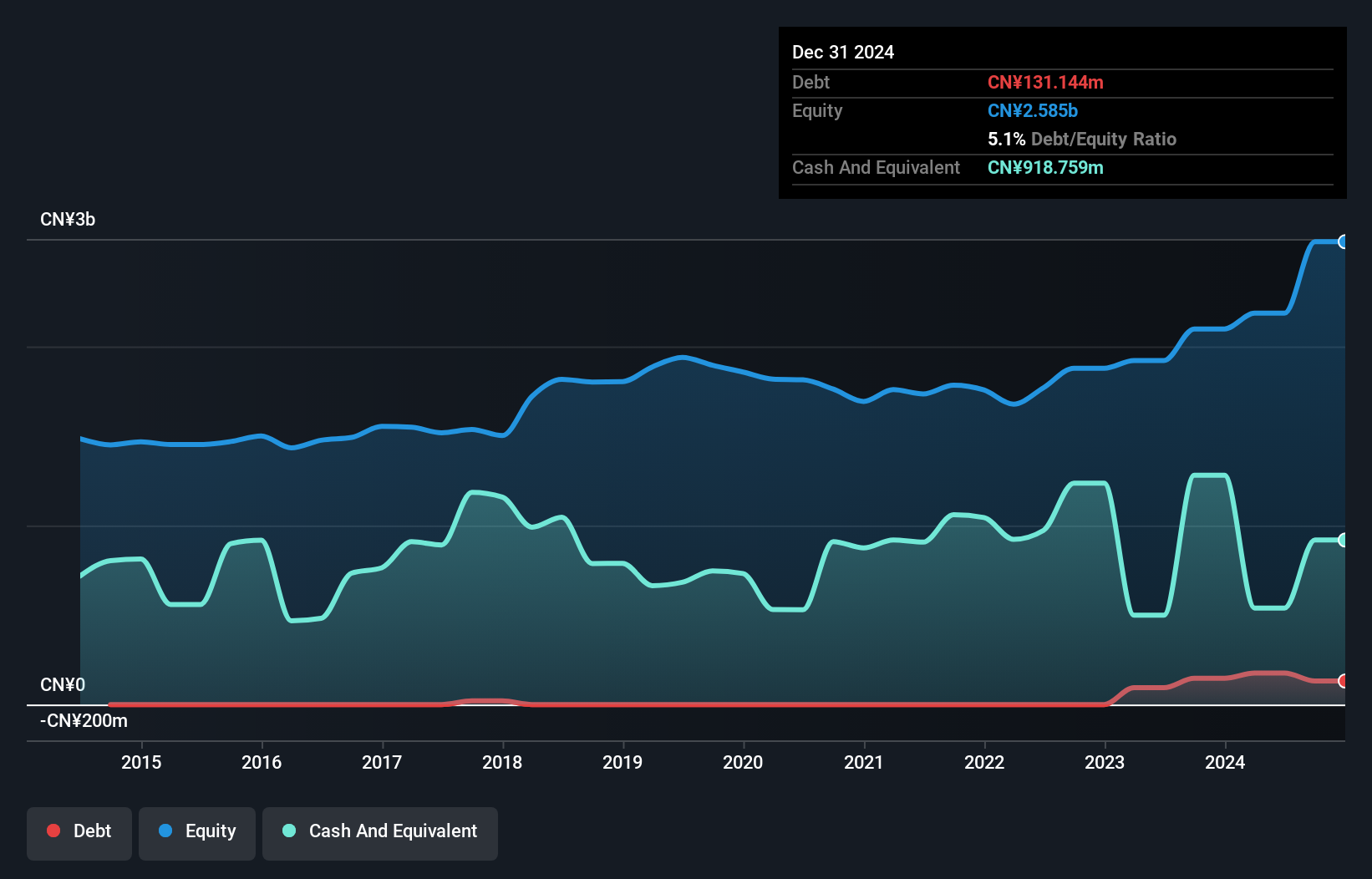

Inspur Digital Enterprise Technology stands out with its robust financial health, having more cash than total debt, which suggests a solid balance sheet. Earnings have surged by 84.5% over the past year, significantly outpacing the Software industry average of 6.1%, showcasing impressive growth potential. The company's net profit margin is noteworthy at 38%, reflecting operational efficiency and profitability. Trading at 79% below estimated fair value indicates potential undervaluation in the market, presenting an intriguing opportunity for investors looking for emerging players in the tech sector with high-quality earnings and strong future growth prospects.

Mega Union Technology (TPEX:6944)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mega Union Technology Inc. specializes in planning and designing water and wastewater recovery systems for industrial applications, with a market cap of NT$27.08 billion.

Operations: Mega Union Technology generates revenue primarily from planning and designing water and wastewater recovery systems for industrial applications. The company's market capitalization stands at NT$27.08 billion.

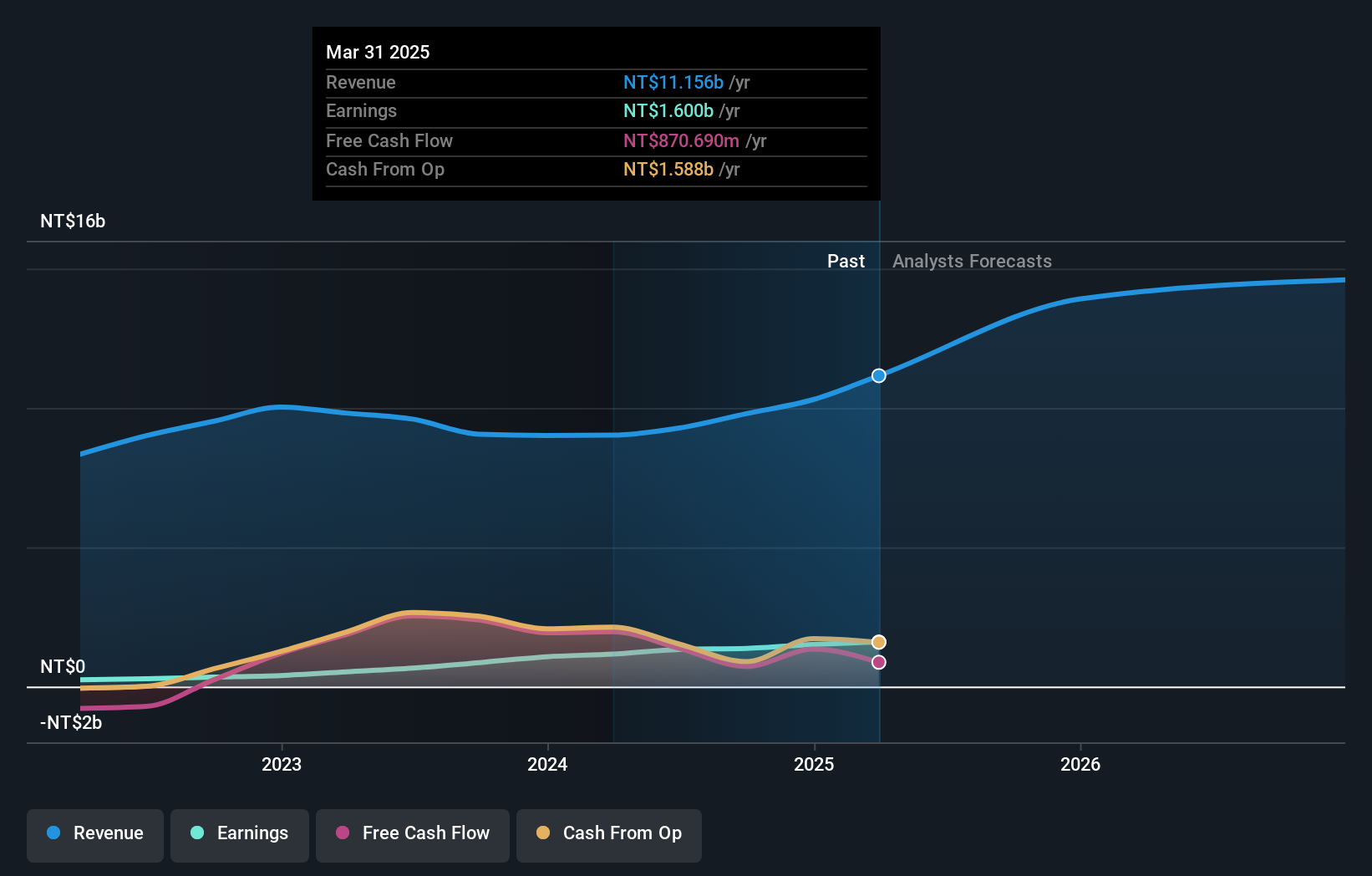

Mega Union Technology, a smaller player in the tech industry, has shown robust performance with a 58.8% earnings growth over the past year, outpacing the Machinery industry's 14.6%. The company's financials reveal more cash than total debt, indicating strong liquidity. Recent results for Q3 show sales of TWD 2,597.88 million and net income at TWD 331.05 million, both up from last year’s figures of TWD 2,082 million and TWD 296.64 million respectively. With a price-to-earnings ratio of 19.8x below the TW market average of 20.4x and positive free cash flow trends, Mega Union seems well-positioned financially within its sector.

Make It Happen

- Navigate through the entire inventory of 4562 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A232140

YC

Engages in the development, manufacture, and sale of inspection equipment for semiconductor memories in South Korea and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives