- South Korea

- /

- Electrical

- /

- KOSE:A103590

Discovering VT And 2 Other Hidden Gems In South Korea

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 1.4%, although it has experienced a decline of 3.9% over the past year. With earnings expected to grow by 29% per annum over the next few years, identifying strong stocks that are currently underappreciated can be a key strategy for investors looking to capitalize on future growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Korea Cast Iron Pipe Ind | NA | 1.97% | 8.84% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| Namuga | 14.47% | 0.88% | 38.25% | ★★★★★★ |

| Synergy Innovation | 12.39% | 12.87% | 28.82% | ★★★★★★ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. produces and exports laminating machines and films worldwide with a market cap of ₩1.27 billion.

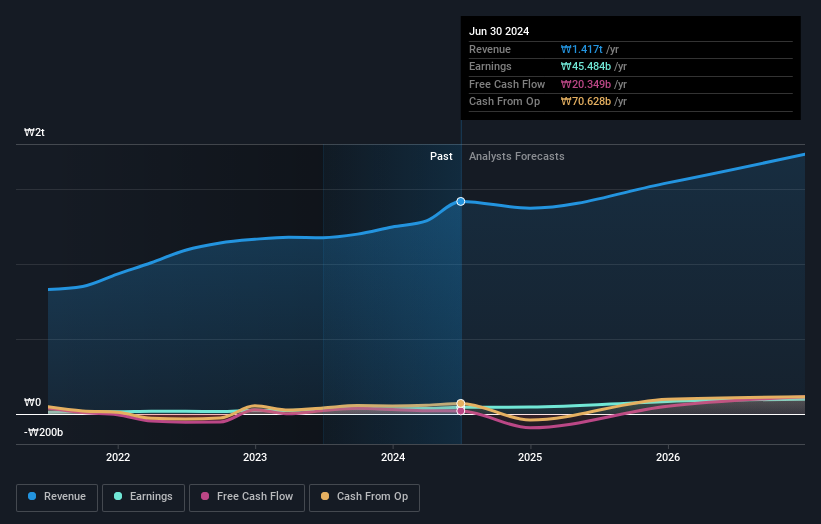

Operations: VT Co., Ltd. generates revenue from three main segments: Cosmetics (₩256.27 billion), Laminating (₩33.86 billion), and Entertainment (₩93.74 billion). The Cosmetic segment is the largest contributor to its revenue stream, followed by Entertainment and Laminating respectively.

VT Co., Ltd. has shown impressive growth, with earnings surging 563.7% over the past year, outpacing the Personal Products industry’s 30.2%. The company reported second-quarter sales of KRW 113.35 million and net income of KRW 15.40 million, significantly higher than last year's figures. Additionally, VT's debt-to-equity ratio improved from 71.2% to 22.4% over five years, indicating strong financial health while trading at an attractive valuation below fair value by around 8%.

- Dive into the specifics of VT here with our thorough health report.

Gain insights into VT's past trends and performance with our Past report.

YC (KOSDAQ:A232140)

Simply Wall St Value Rating: ★★★★★★

Overview: YC Corporation develops, manufactures, and sells inspection equipment for semiconductor memories in South Korea and internationally, with a market cap of ₩1.07 billion.

Operations: YC Corporation generates revenue primarily from its Semiconductor Division (₩161.99 billion), followed by Electrical and Electronic Accessories (₩42.12 billion) and Wholesale/Retail operations (₩4.71 billion).

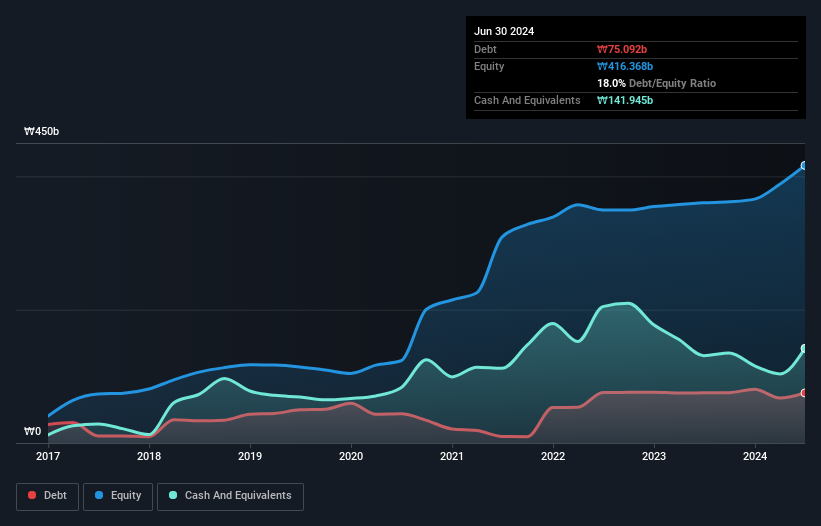

YC, a small cap player in South Korea's semiconductor industry, has seen its debt to equity ratio improve from 43.6% to 18% over the past five years. Despite a negative earnings growth of -7.1% last year, it outperformed the industry average of -10%. The company repurchased shares in 2024 and forecasts suggest earnings could grow by nearly 50% annually. However, the share price has been highly volatile over the past three months.

Iljin ElectricLtd (KOSE:A103590)

Simply Wall St Value Rating: ★★★★★★

Overview: Iljin Electric Co., Ltd operates as a heavy electric machinery company in South Korea and internationally, with a market cap of ₩945.92 billion.

Operations: Iljin Electric Co., Ltd generates revenue primarily from its Wire segment (₩1.17 trillion) and Power System segment (₩329.01 billion).

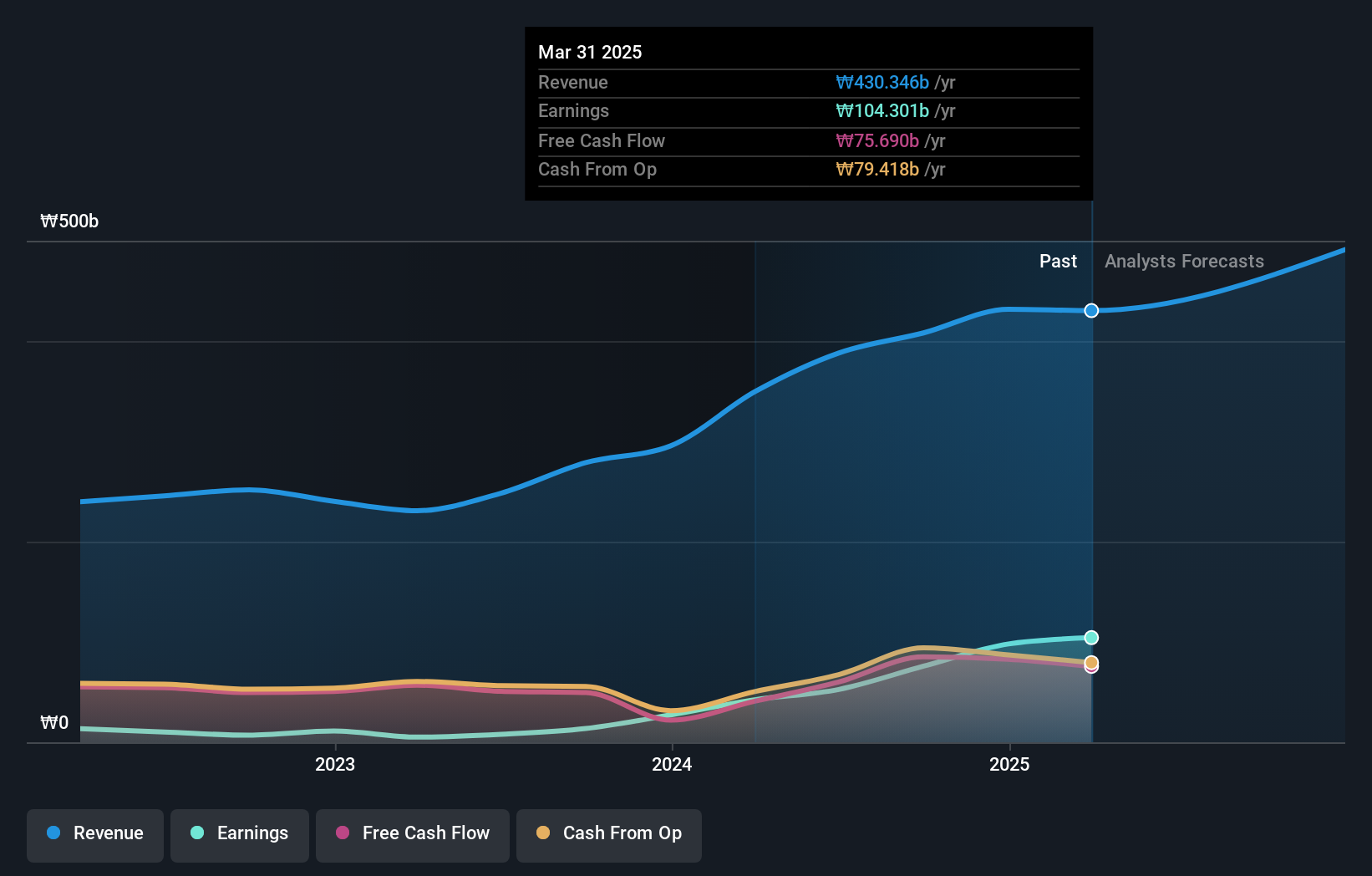

Iljin Electric Ltd., a small cap player in South Korea's electrical industry, has shown robust earnings growth of 55.6% over the past year, outpacing the sector's 18.5%. The company’s debt to equity ratio improved from 86.4% to 29.1% over five years, highlighting better financial health. Trading at 84.7% below its estimated fair value, Iljin offers significant upside potential, with future earnings projected to grow by 34.63% annually and high-quality past earnings supporting this outlook.

- Click here and access our complete health analysis report to understand the dynamics of Iljin ElectricLtd.

Assess Iljin ElectricLtd's past performance with our detailed historical performance reports.

Summing It All Up

- Embark on your investment journey to our 187 KRX Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A103590

Iljin ElectricLtd

Operates as a heavy electric machinery company in South Korea and internationally.

Flawless balance sheet with solid track record.