- South Korea

- /

- Entertainment

- /

- KOSE:A079160

High Growth Tech Stocks in South Korea to Watch October 2024

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has experienced a 2.8% decline, though it remains up by 4.7% over the past year, with earnings anticipated to grow by 30% annually in the coming years. In this context, identifying high growth tech stocks involves looking for companies that can capitalize on these projected earnings increases and demonstrate resilience amidst short-term market fluctuations.

Top 10 High Growth Tech Companies In South Korea

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| IMLtd | 21.80% | 111.43% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Bioneer | 23.53% | 97.58% | ★★★★★★ |

| ALTEOGEN | 64.22% | 99.46% | ★★★★★★ |

| NEXON Games | 29.64% | 66.98% | ★★★★★★ |

| FLITTO | 32.60% | 106.82% | ★★★★★★ |

| Devsisters | 29.08% | 63.02% | ★★★★★★ |

| Park Systems | 23.21% | 34.63% | ★★★★★★ |

| AmosenseLtd | 24.04% | 71.97% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 48 stocks from our KRX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of ₩18.91 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to ₩90.79 billion.

ALTEOGEN, a South Korean biotech firm, recently marked a significant stride in its growth trajectory with the MFDS approval of Tergase®, showcasing over 99% purity and lower immunogenicity compared to traditional animal-derived alternatives. This approval not only highlights ALTEOGEN's innovative edge but also its potential in expanding applications beyond traditional markets. Despite current unprofitability, the company is poised for rapid revenue escalation at 64.2% annually, significantly outpacing the broader KR market's 10.5%. Furthermore, with R&D expenses robustly fuelling these innovations—evident from their pivotal role in Tergase®'s development—the forecasted profit growth of 99.46% positions ALTEOGEN as a promising entity in biotech's competitive arena.

- Delve into the full analysis health report here for a deeper understanding of ALTEOGEN.

Understand ALTEOGEN's track record by examining our Past report.

ABL Bio (KOSDAQ:A298380)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ABL Bio Inc. is a biotech research company specializing in therapeutic drugs for immuno-oncology and neurodegenerative diseases, with a market cap of ₩1.56 trillion.

Operations: ABL Bio Inc. focuses on developing therapeutic drugs, primarily generating revenue from its biotechnology segment, which contributed approximately ₩32.95 billion.

ABL Bio's trajectory in South Korea's high-growth tech landscape is marked by its promising revenue forecast, projected to increase at 24.7% annually, significantly outstripping the broader market growth of 10.5%. Despite current unprofitability, the firm is anticipated to shift towards profitability with an impressive earnings growth rate of 48.2% per year. A notable focus on R&D has been pivotal; in fact, R&D expenses have been a critical investment area as they fuel innovation and future capabilities within the biotech sector. This strategic emphasis not only supports ABL Bio’s competitive edge but also aligns with industry trends towards advanced biomedical applications and therapies.

- Click here to discover the nuances of ABL Bio with our detailed analytical health report.

Gain insights into ABL Bio's historical performance by reviewing our past performance report.

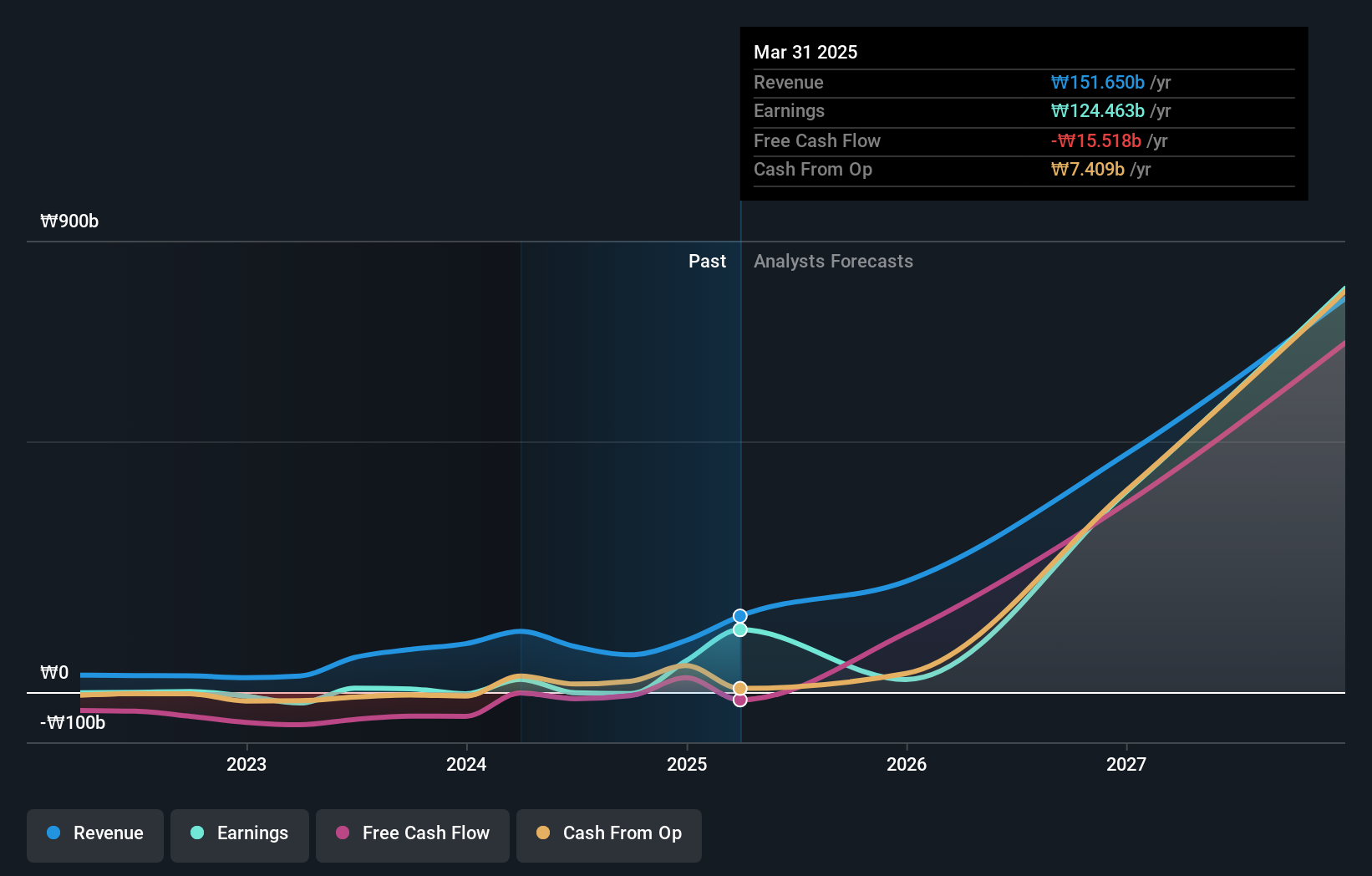

CJ CGV (KOSE:A079160)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CJ CGV Co., Ltd. operates theaters under the CJ CGV brand in South Korea, with a market capitalization of approximately ₩945.46 billion.

Operations: The company primarily generates revenue from its multiplex operations, contributing approximately ₩1.50 trillion. Additionally, it has a revenue stream from technology special format and equipment sales amounting to roughly ₩93.11 billion.

CJ CGV, a player in South Korea's tech scene, has shown resilience with its revenue growth forecast at 15.2% annually, outpacing the national average of 10.5%. Despite current unprofitability, the company is expected to pivot to profitability with earnings projected to surge by 117.1% per year over the next three years. This turnaround is underpinned by substantial investments in R&D which have not only fueled innovation but are critical for future competitiveness in the entertainment and technology sectors. Recent financials reflect a narrowing net loss from KRW 44 billion to KRW 3.7 billion year-over-year for Q2, underscoring effective cost management and operational improvements amidst challenging market conditions.

- Unlock comprehensive insights into our analysis of CJ CGV stock in this health report.

Evaluate CJ CGV's historical performance by accessing our past performance report.

Key Takeaways

- Embark on your investment journey to our 48 KRX High Growth Tech and AI Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A079160

CJ CGV

Engages in the operation of theaters under CJ CGV brand name in South Korea.

Undervalued with reasonable growth potential.