- South Korea

- /

- Electrical

- /

- KOSE:A001440

Discovering 3 Hidden Gems in South Korea with Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has risen 2.5%, driven by gains in every sector, although it has remained flat over the past 12 months. In light of forecasted annual earnings growth of 29%, identifying stocks with strong potential and solid fundamentals becomes crucial for investors looking to capitalize on these promising conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 49.49% | 6.68% | 23.96% | ★★★★★★ |

| Korea Airport ServiceLtd | NA | 3.97% | 42.22% | ★★★★★★ |

| Korea Ratings | NA | 1.13% | 0.54% | ★★★★★★ |

| Woori Technology Investment | NA | 25.66% | -1.45% | ★★★★★★ |

| Kyung Dong Navien | 22.40% | 11.19% | 18.84% | ★★★★★★ |

| ONEJOON | 10.13% | 35.30% | -5.78% | ★★★★★☆ |

| iMarketKorea | 28.53% | 5.35% | 1.30% | ★★★★★☆ |

| ASIA Holdings | 34.98% | 8.43% | 16.17% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 54.53% | 3.14% | 0.80% | ★★★★★☆ |

| FnGuide | 36.10% | 8.92% | 10.27% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

YC (KOSDAQ:A232140)

Simply Wall St Value Rating: ★★★★★★

Overview: YC Corporation develops, manufactures, and sells inspection equipment for semiconductor memories in South Korea and internationally, with a market cap of ₩1.07 trillion.

Operations: YC Corporation generates revenue primarily from its Semiconductor Division (₩161.99 billion), followed by Electrical and Electronic Accessories (₩42.12 billion) and Wholesale/Retail (₩4.71 billion).

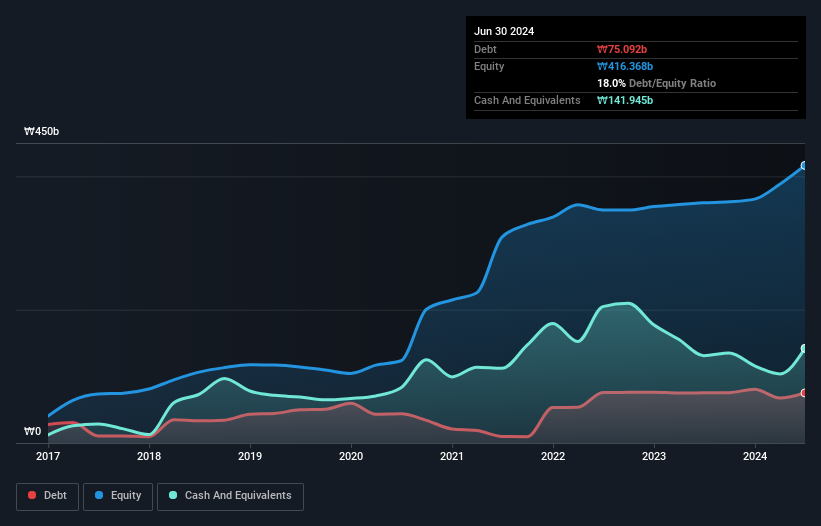

YC, a notable player in South Korea's semiconductor industry, has seen its debt to equity ratio improve from 43.6% to 18% over the past five years. Despite a -7.1% earnings growth last year, which is still better than the industry average of -11.2%, it shows resilience. The company’s interest coverage remains strong as it earns more interest than it pays out. With high-quality past earnings and forecasted annual growth of 49.59%, YC presents an intriguing investment case despite recent volatility in its share price.

- Take a closer look at YC's potential here in our health report.

Gain insights into YC's historical performance by reviewing our past performance report.

Taihan Cable & Solution (KOSE:A001440)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taihan Cable & Solution Co., Ltd. manufactures, processes, and sells electric wires, cables, and related products worldwide with a market cap of ₩2.09 trillion.

Operations: Taihan Cable & Solution Co., Ltd. generates revenue primarily from its wire segment, amounting to ₩3.42 billion, with inter-division sales adjustments of -₩0.38 billion.

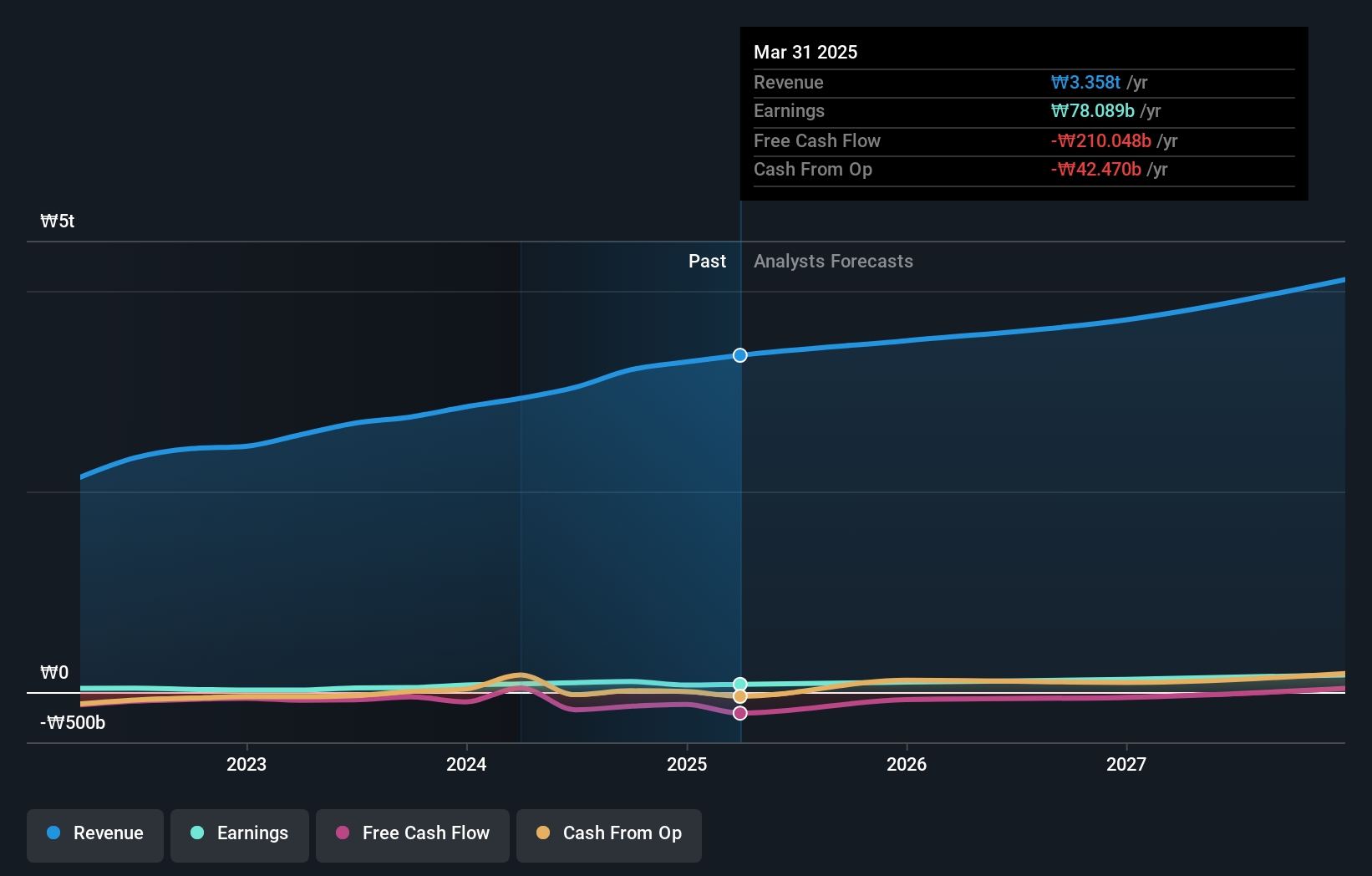

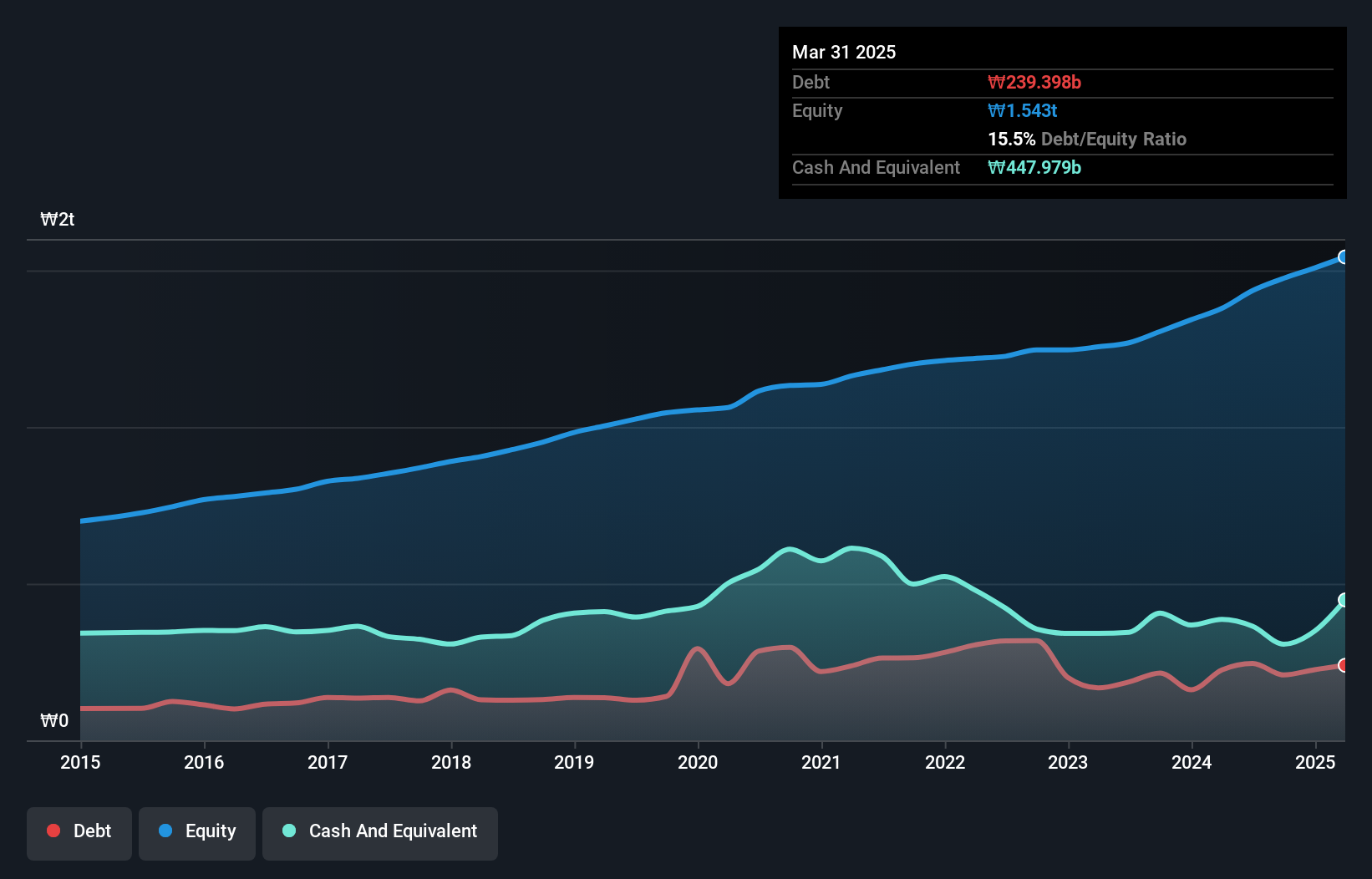

Taihan Cable & Solution has shown impressive earnings growth, with net income surging to ₩24.88 billion in Q2 2024 from ₩12.82 billion a year earlier. Despite sales dropping to ₩8.82 million from ₩9.75 million, the company’s basic earnings per share rose to ₩134 from ₩104 over the same period. Over six months, net income reached ₩45.22 billion against last year's ₩21.49 billion, indicating robust profitability despite lower sales figures of ₩16.61 million compared to previous year's KRW 24 million

Sebang Global Battery (KOSE:A004490)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sebang Global Battery Co., Ltd. manufactures and sells lead acid batteries in South Korea and internationally, with a market cap of ₩1.17 trillion.

Operations: Sebang Global Battery generates revenue primarily from the sale of lead acid batteries both domestically and internationally. The company has a market cap of ₩1.17 trillion.

Sebang Global Battery, a small cap player in the battery industry, has shown impressive earnings growth of 190.8% over the past year, outpacing the Auto Components industry's 20.8%. Trading at 40.2% below its estimated fair value, it offers significant potential for investors seeking undervalued stocks. The company also boasts high-quality earnings and sufficient interest coverage, indicating financial stability and robust operational performance in a competitive market.

- Delve into the full analysis health report here for a deeper understanding of Sebang Global Battery.

Taking Advantage

- Unlock our comprehensive list of 151 KRX Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taihan Cable & Solution might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A001440

Taihan Cable & Solution

Manufactures, processes, and sells electric wires, cables, and related products worldwide.

Excellent balance sheet with proven track record.