- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A218410

What RFHIC Corporation's (KOSDAQ:218410) 27% Share Price Gain Is Not Telling You

RFHIC Corporation (KOSDAQ:218410) shareholders have had their patience rewarded with a 27% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

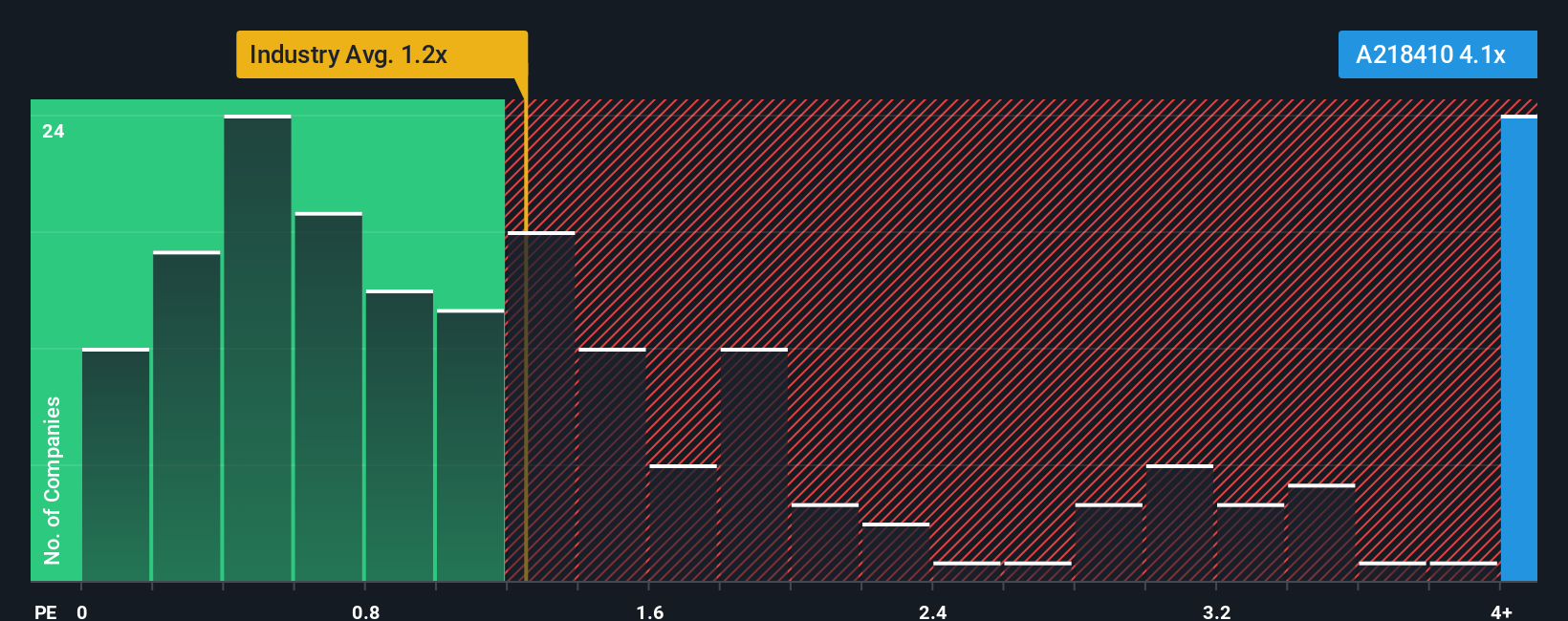

After such a large jump in price, you could be forgiven for thinking RFHIC is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.1x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 1.2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for RFHIC

How RFHIC Has Been Performing

Recent times haven't been great for RFHIC as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on RFHIC.Is There Enough Revenue Growth Forecasted For RFHIC?

The only time you'd be truly comfortable seeing a P/S as steep as RFHIC's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. Revenue has also lifted 17% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 27% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that RFHIC's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does RFHIC's P/S Mean For Investors?

Shares in RFHIC have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that RFHIC currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - RFHIC has 2 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A218410

RFHIC

Designs and manufactures radio frequency (RF) and microwave components for wireless infrastructure, commercial and military radar, and RF energy applications in South Korea and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026