Asian Stocks Likely Trading Below Intrinsic Value With Discounts From 27.5% To 39.9%

Reviewed by Simply Wall St

As global markets experience shifts in economic dynamics, with inflation concerns and trade tensions making headlines, the Asian stock market presents intriguing opportunities for investors seeking value. Identifying stocks trading below their intrinsic value can be a prudent strategy in such an environment, where careful analysis may uncover potential discounts that range from 27.5% to 39.9%.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PropNex (SGX:OYY) | SGD1.34 | SGD2.66 | 49.7% |

| Medy-Tox (KOSDAQ:A086900) | ₩163000.00 | ₩322233.66 | 49.4% |

| Mandom (TSE:4917) | ¥1427.00 | ¥2828.12 | 49.5% |

| Lucky Harvest (SZSE:002965) | CN¥35.75 | CN¥70.35 | 49.2% |

| Japan Eyewear Holdings (TSE:5889) | ¥2151.00 | ¥4222.53 | 49.1% |

| HL Holdings (KOSE:A060980) | ₩41300.00 | ₩81736.71 | 49.5% |

| Cosmax (KOSE:A192820) | ₩243000.00 | ₩483155.97 | 49.7% |

| Astroscale Holdings (TSE:186A) | ¥673.00 | ¥1324.01 | 49.2% |

| ALUX (KOSDAQ:A475580) | ₩11490.00 | ₩22618.10 | 49.2% |

| Accton Technology (TWSE:2345) | NT$798.00 | NT$1590.11 | 49.8% |

Let's dive into some prime choices out of the screener.

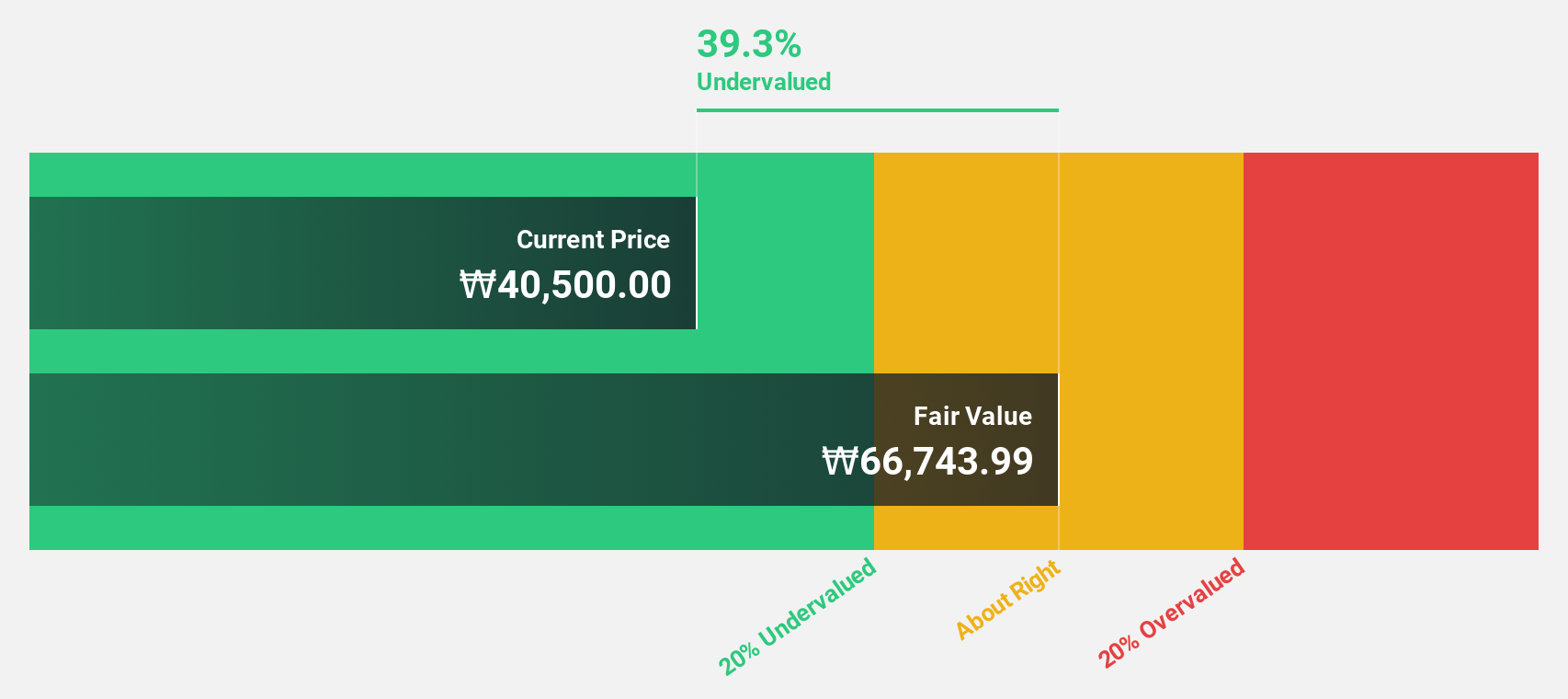

Duk San NeoluxLtd (KOSDAQ:A213420)

Overview: Duk San Neolux Co., Ltd is a South Korean company that develops and manufactures OLED materials for the display industry, with a market cap of ₩986.20 billion.

Operations: Duk San Neolux Co., Ltd generates revenue from its semiconductors segment, amounting to ₩197.71 billion.

Estimated Discount To Fair Value: 39.9%

Duk San Neolux Ltd. is trading at ₩40,150, significantly undervalued compared to its estimated fair value of ₩66,854.33. With earnings projected to grow 30.43% annually over the next three years and revenue expected to increase by 27.1% per year—surpassing the Korean market's growth rate—this stock presents a compelling case for investors focused on cash flow potential despite recent share price volatility and a forecasted low Return on Equity of 17%.

- Our earnings growth report unveils the potential for significant increases in Duk San NeoluxLtd's future results.

- Take a closer look at Duk San NeoluxLtd's balance sheet health here in our report.

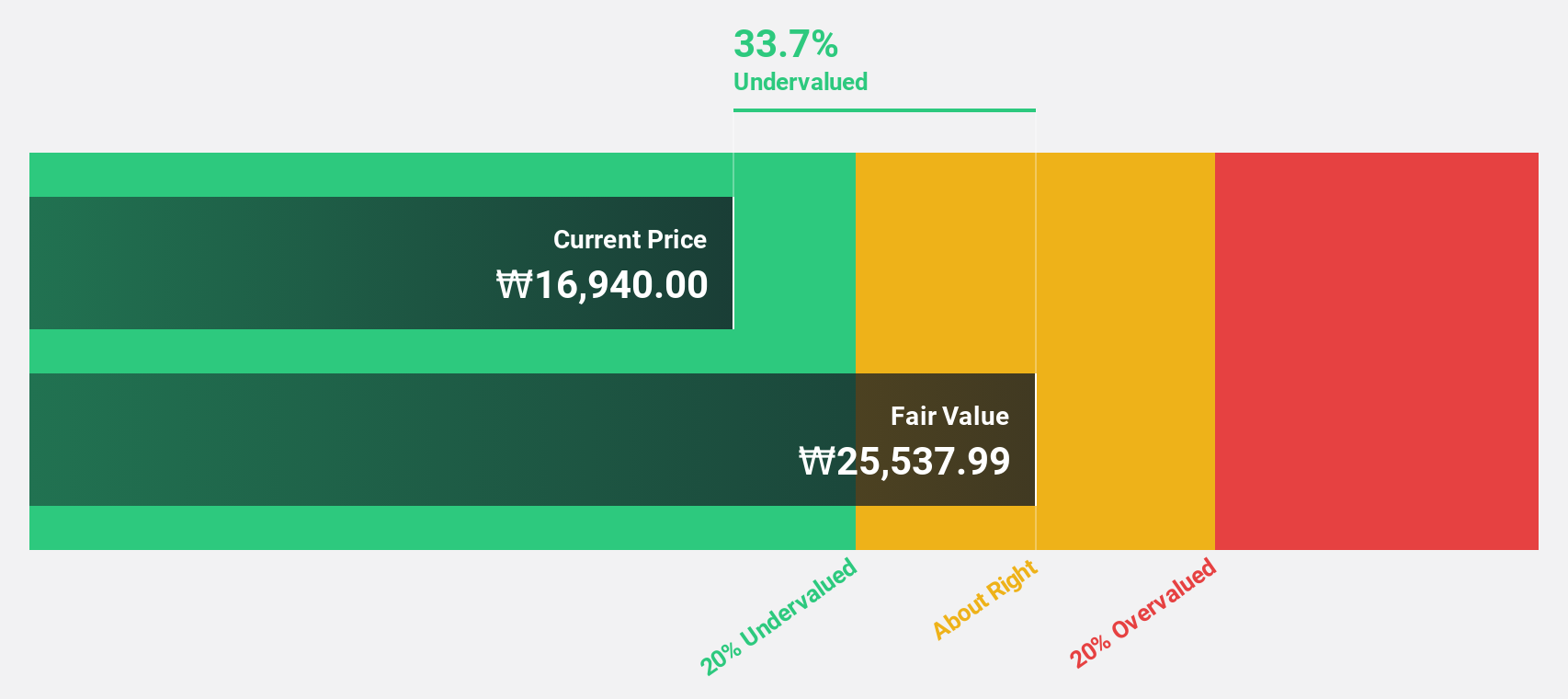

DAEDUCK ELECTRONICS (KOSE:A353200)

Overview: Daeduck Electronics Co., Ltd. specializes in manufacturing printed circuit boards for both domestic and international markets, with a market capitalization of approximately ₩1.02 trillion.

Operations: The company generates revenue primarily from the manufacture and sale of printed circuit boards, amounting to approximately ₩892.75 billion.

Estimated Discount To Fair Value: 27.5%

Daeduck Electronics is trading at ₩20,300, undervalued by over 27% compared to its estimated fair value of ₩28,001.93. Despite a recent net loss of KRW 5,700.6 million in Q1 2025 and unstable dividends, its earnings are forecast to grow significantly at 58.69% annually over the next three years, outpacing the Korean market's growth rate and highlighting potential for investors focused on cash flow opportunities.

- Our expertly prepared growth report on DAEDUCK ELECTRONICS implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of DAEDUCK ELECTRONICS stock in this financial health report.

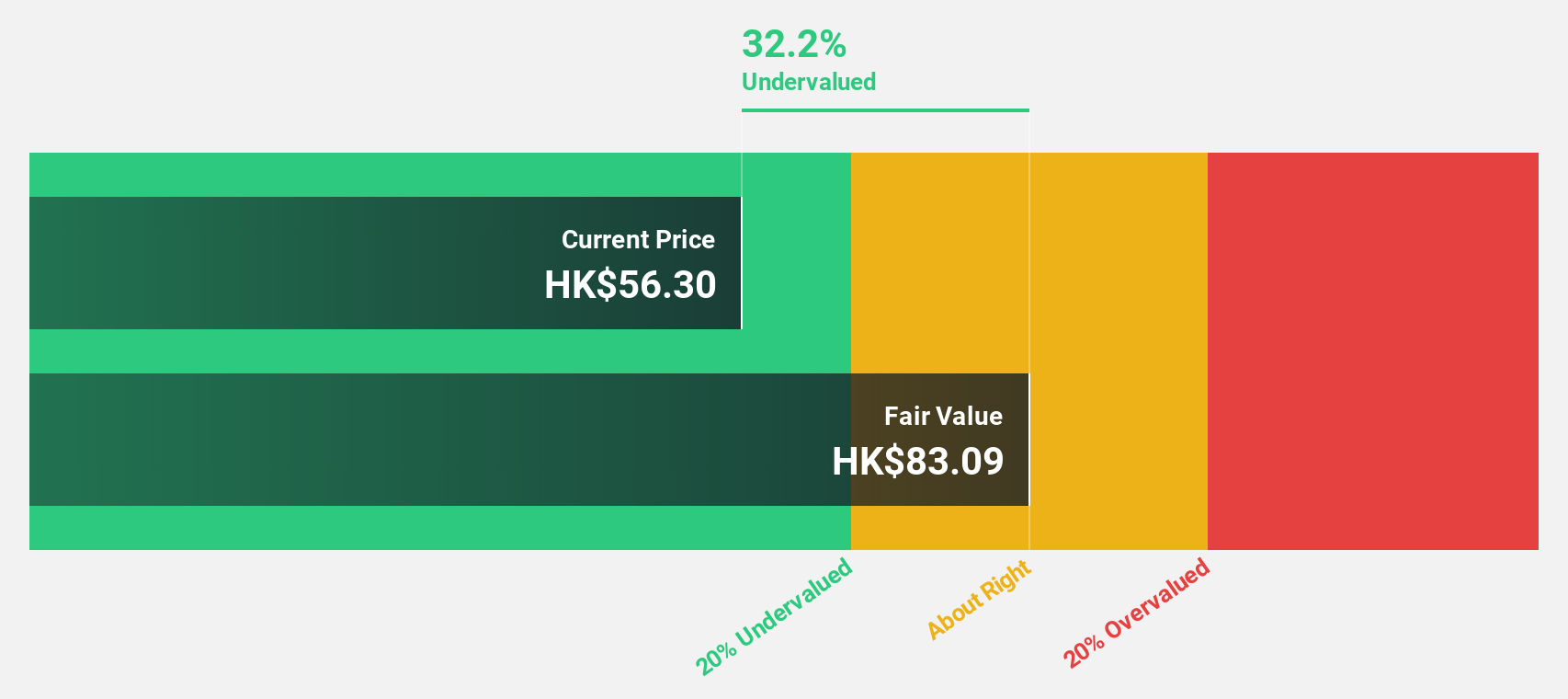

Beijing Fourth Paradigm Technology (SEHK:6682)

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in China, with a market capitalization of HK$27.82 billion.

Operations: The company's revenue is derived from several segments, including CN¥3.68 billion from the Sage AI Platform, CN¥562.50 million from Sagegpt AIGS Services, and CN¥1.02 billion from Shift Intelligent Solutions.

Estimated Discount To Fair Value: 31.9%

Beijing Fourth Paradigm Technology, trading at HK$56.4, is undervalued by over 31.9% against its fair value of HK$82.87. Its earnings have grown 23% annually over the past five years and are forecast to grow significantly at 96.93% per year, surpassing market averages. The company recently filed a follow-on equity offering for HK$1.31 billion, which could impact cash flow dynamics but offers potential for growth-focused investors in Asia's tech sector.

- In light of our recent growth report, it seems possible that Beijing Fourth Paradigm Technology's financial performance will exceed current levels.

- Click here to discover the nuances of Beijing Fourth Paradigm Technology with our detailed financial health report.

Turning Ideas Into Actions

- Click this link to deep-dive into the 254 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Fourth Paradigm Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6682

Beijing Fourth Paradigm Technology

An investment holding company, provides platform-centric artificial intelligence (AI) solutions in the People's Republic of China.

High growth potential and good value.

Market Insights

Community Narratives