- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A036930

3 KRX Stocks That Could Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

The South Korea stock market has been on an upward trajectory, gaining over 2.6 percent in three consecutive sessions, with the KOSPI index now sitting above the 2,580-point mark. This positive momentum is fueled by optimism around interest rates and economic outlooks globally, making it a favorable environment to identify stocks that may be trading below their estimated value. In such conditions, finding undervalued stocks involves looking for companies with solid fundamentals that have not yet caught up with the broader market's gains.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| APR (KOSE:A278470) | ₩284500.00 | ₩520639.76 | 45.4% |

| VIOL (KOSDAQ:A335890) | ₩9100.00 | ₩17714.64 | 48.6% |

| T'Way Air (KOSE:A091810) | ₩3295.00 | ₩5818.78 | 43.4% |

| ABCO Electronics (KOSDAQ:A036010) | ₩5890.00 | ₩11507.53 | 48.8% |

| Oscotec (KOSDAQ:A039200) | ₩37600.00 | ₩65583.14 | 42.7% |

| Intellian Technologies (KOSDAQ:A189300) | ₩52900.00 | ₩91246.80 | 42% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1641.00 | ₩2981.40 | 45% |

| Global Tax Free (KOSDAQ:A204620) | ₩3570.00 | ₩6397.85 | 44.2% |

| Hotel ShillaLtd (KOSE:A008770) | ₩44900.00 | ₩81108.96 | 44.6% |

| Kakao Games (KOSDAQ:A293490) | ₩16620.00 | ₩29296.48 | 43.3% |

Let's review some notable picks from our screened stocks.

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Overview: JUSUNG ENGINEERING Co., Ltd. manufactures and sells semiconductor, display, solar, and lighting equipment in South Korea and internationally with a market cap of approximately ₩1.17 trillion.

Operations: Revenue from semiconductor equipment and services for JUSUNG ENGINEERING Co., Ltd. is ₩338.28 billion.

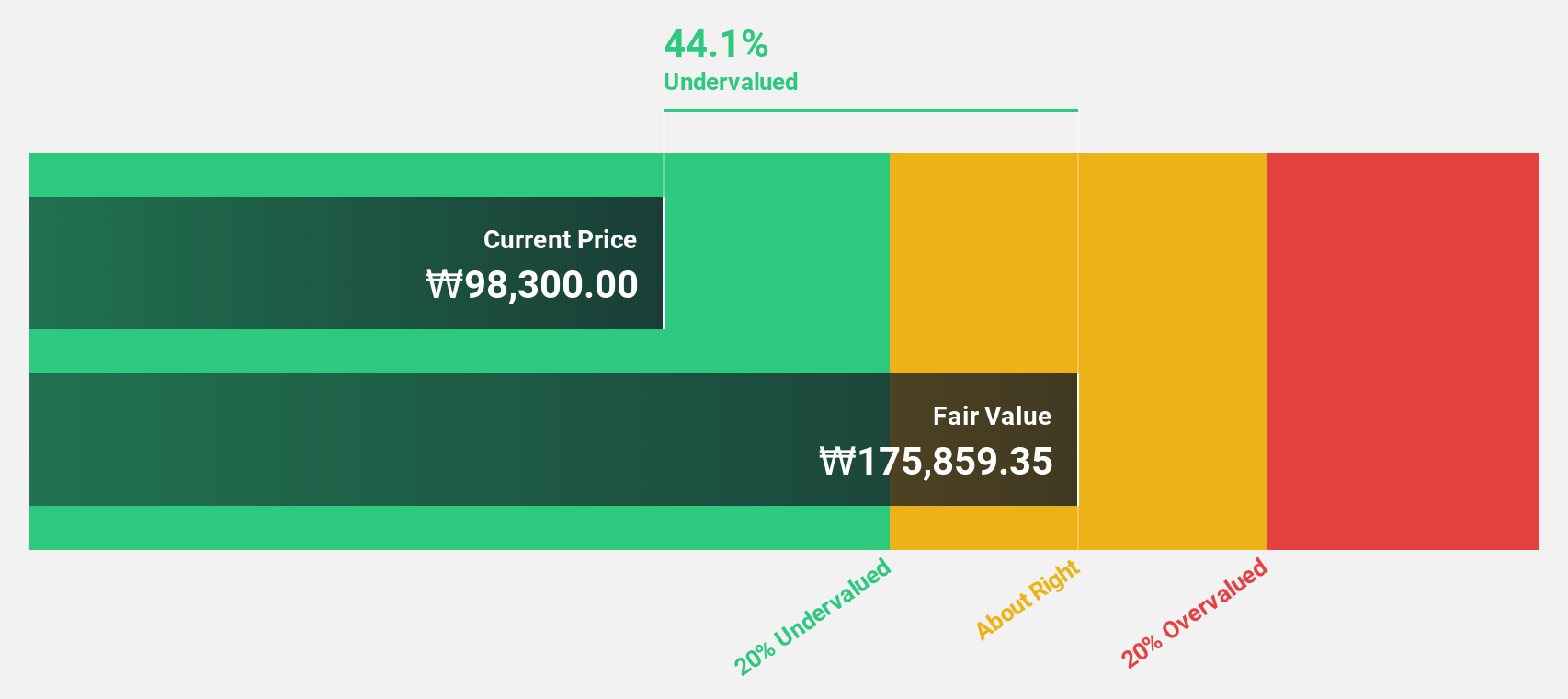

Estimated Discount To Fair Value: 39.7%

JUSUNG ENGINEERING Ltd. is trading at ₩24,750, significantly below its estimated fair value of ₩41,045.9, indicating it is highly undervalued based on discounted cash flow analysis. The company’s earnings are forecast to grow 21% annually over the next three years, although this growth rate lags behind the broader South Korean market's 29.1%. Despite a low future return on equity of 18.1%, revenue is expected to increase by 21.7% yearly, outpacing market averages.

- In light of our recent growth report, it seems possible that JUSUNG ENGINEERINGLtd's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of JUSUNG ENGINEERINGLtd.

Hana Materials (KOSDAQ:A166090)

Overview: Hana Materials Inc. manufactures and sells silicon electrodes and rings in South Korea with a market cap of ₩558.99 billion.

Operations: Hana Materials generates revenue from the manufacturing and sale of silicon electrodes and rings in South Korea.

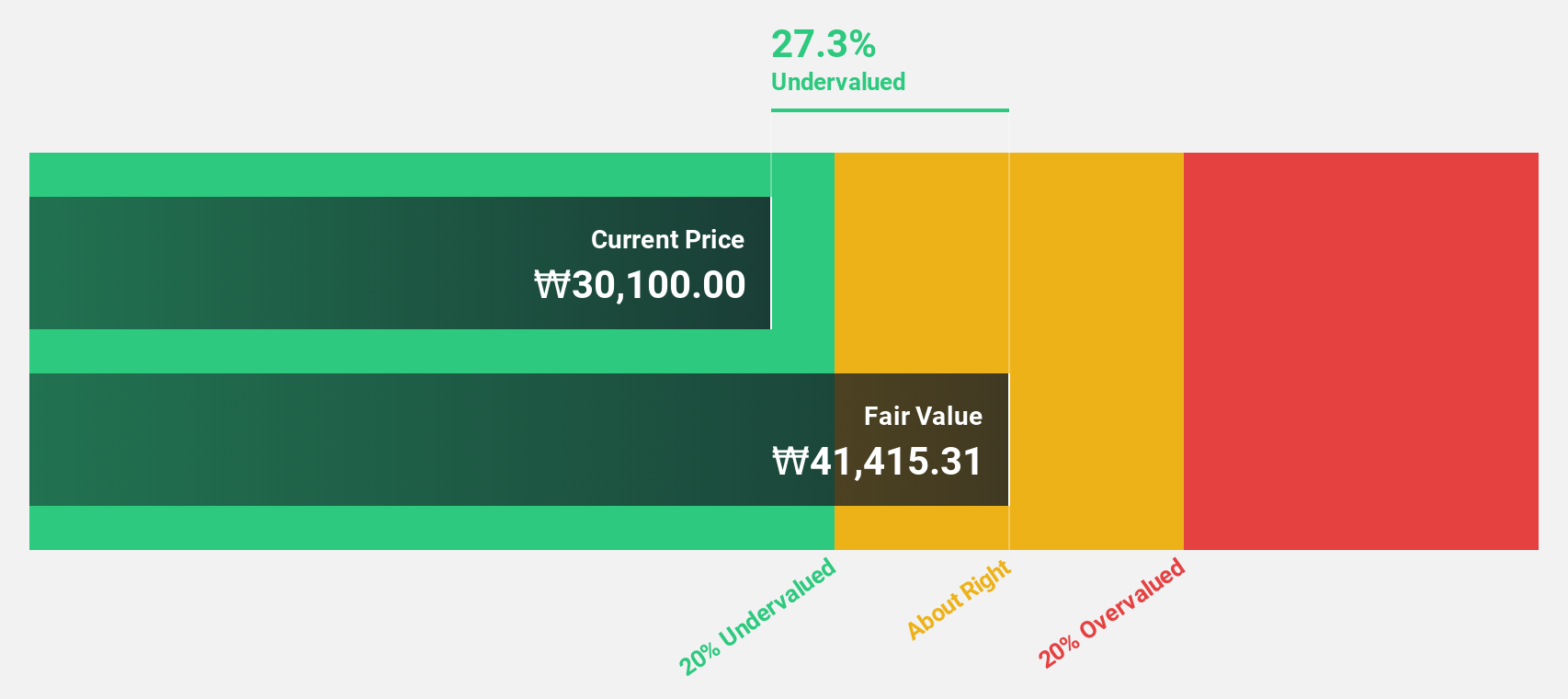

Estimated Discount To Fair Value: 35.7%

Hana Materials is trading at ₩28,600, well below its estimated fair value of ₩44,490.88, making it highly undervalued based on discounted cash flow analysis. Earnings are forecast to grow 50.1% annually over the next three years, significantly outpacing the South Korean market's average growth rate of 29%. However, profit margins have declined from 23.3% to 9.6%, and the company carries a high level of debt which could impact future financial flexibility.

- According our earnings growth report, there's an indication that Hana Materials might be ready to expand.

- Dive into the specifics of Hana Materials here with our thorough financial health report.

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on the research and development of drugs for central nervous system disorders, with a market cap of ₩8.52 billion.

Operations: The company generates revenue primarily from new drug development, amounting to ₩465.06 million.

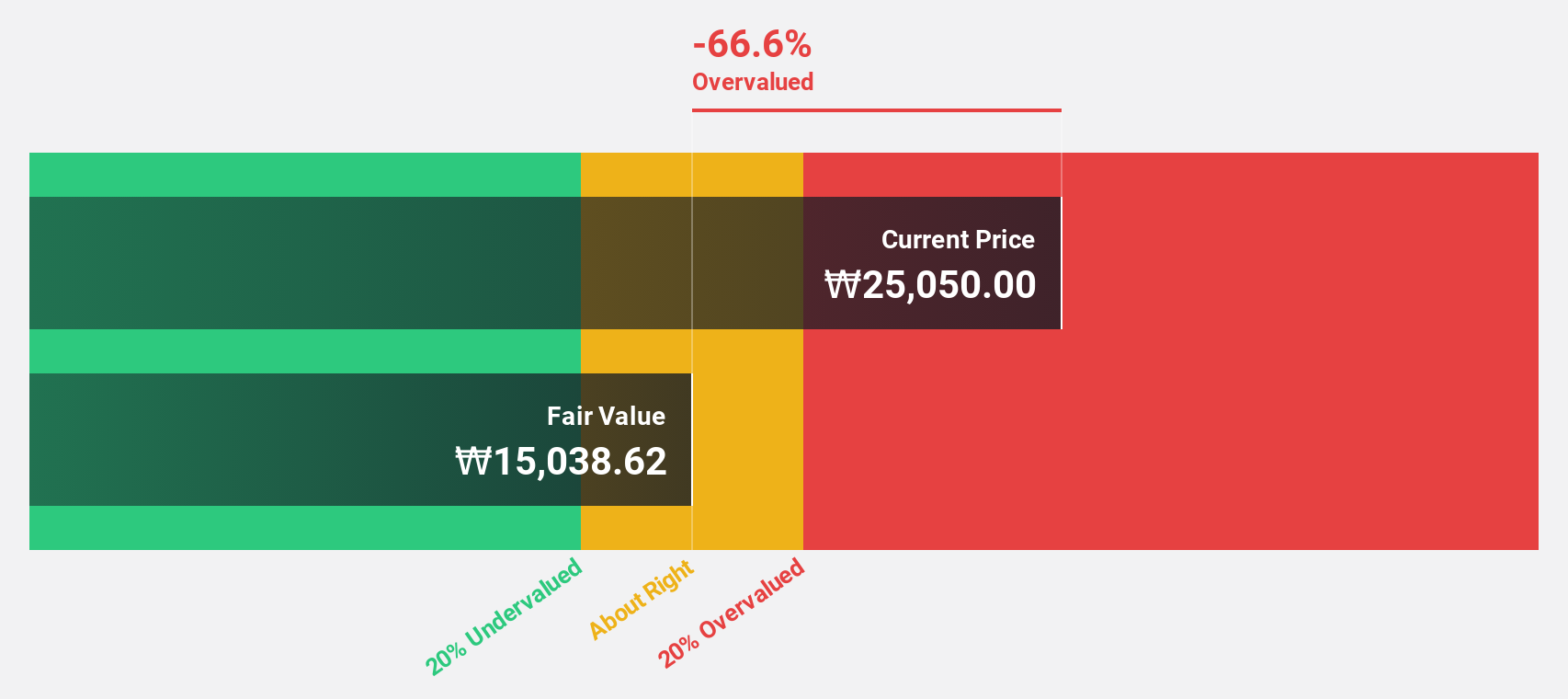

Estimated Discount To Fair Value: 39.5%

SK Biopharmaceuticals is trading at ₩108,800, significantly below its estimated fair value of ₩179,969.09 based on discounted cash flow analysis. The company became profitable this year and is expected to see earnings grow 70.04% annually over the next three years, outpacing the South Korean market's average growth rate of 29%. Revenue is also forecast to grow at 22.4% per year, faster than the market's 10.4%.

- Our growth report here indicates SK Biopharmaceuticals may be poised for an improving outlook.

- Navigate through the intricacies of SK Biopharmaceuticals with our comprehensive financial health report here.

Turning Ideas Into Actions

- Discover the full array of 35 Undervalued KRX Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A036930

JUSUNG ENGINEERINGLtd

Manufactures and sells semiconductor, display, solar, and lighting equipment in South Korea and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives