- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A108230

TOPTEC Co., Ltd's (KOSDAQ:108230) Price Is Right But Growth Is Lacking

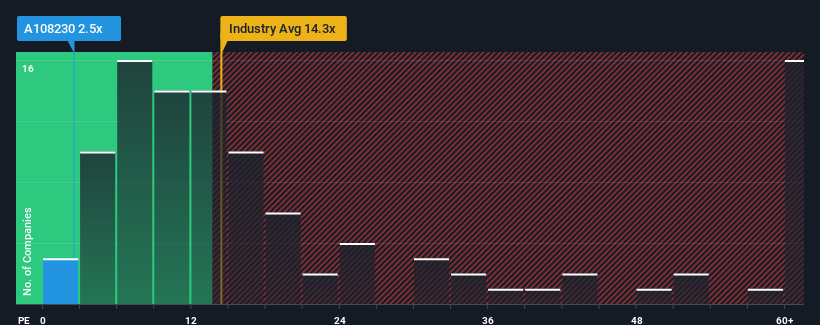

When close to half the companies in Korea have price-to-earnings ratios (or "P/E's") above 12x, you may consider TOPTEC Co., Ltd (KOSDAQ:108230) as a highly attractive investment with its 2.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

TOPTEC certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for TOPTEC

Is There Any Growth For TOPTEC?

In order to justify its P/E ratio, TOPTEC would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 217%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 33% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we can see why TOPTEC is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From TOPTEC's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of TOPTEC revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with TOPTEC (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if TOPTEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A108230

TOPTEC

Engages in the secondary batteries, smart factories, and displays/semiconductors businesses in South Korea and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026