- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A095340

Why ISC's (KOSDAQ:095340) Shaky Earnings Are Just The Beginning Of Its Problems

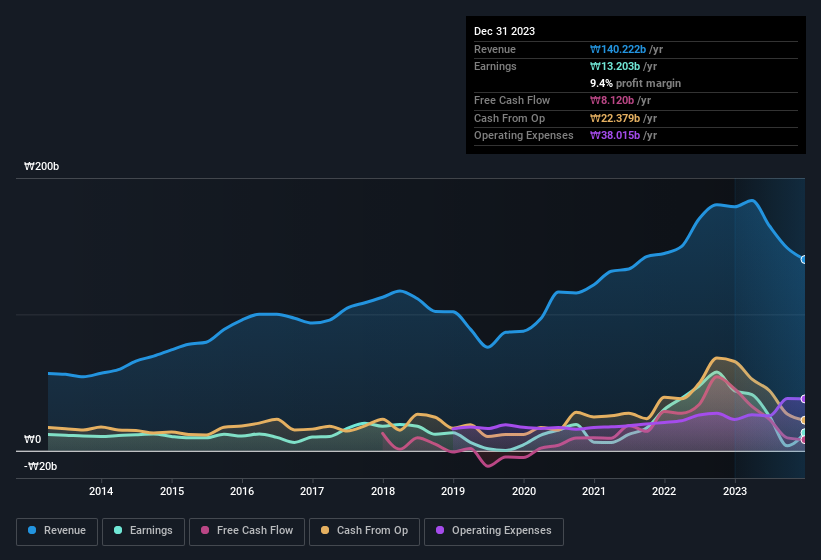

The market wasn't impressed with the soft earnings from ISC Co., Ltd. (KOSDAQ:095340) recently. We did some analysis, and found that there are some reasons to be cautious about the headline numbers.

View our latest analysis for ISC

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, ISC issued 23% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of ISC's EPS by clicking here.

How Is Dilution Impacting ISC's Earnings Per Share (EPS)?

ISC has improved its profit over the last three years, with an annualized gain of 110% in that time. But EPS was only up 65% per year, in the exact same period. Net profit actually dropped by 70% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 70%. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If ISC's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Finally, we should also consider the fact that unusual items boosted ISC's net profit by ₩1.7b over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On ISC's Profit Performance

In its last report ISC benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. For the reasons mentioned above, we think that a perfunctory glance at ISC's statutory profits might make it look better than it really is on an underlying level. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, we've discovered 3 warning signs that you should run your eye over to get a better picture of ISC.

Our examination of ISC has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A095340

ISC

Develops, manufactures, and sells semiconductor test sockets worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives