- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A089790

Here's What We Make Of JT's (KOSDAQ:089790) Returns On Capital

If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This combination can tell you that not only is the company investing less, it's earning less on what it does invest. In light of that, from a first glance at JT (KOSDAQ:089790), we've spotted some signs that it could be struggling, so let's investigate.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for JT:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = ₩4.2b ÷ (₩54b - ₩17b) (Based on the trailing twelve months to September 2020).

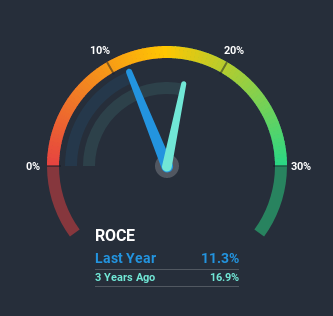

Therefore, JT has an ROCE of 11%. That's a relatively normal return on capital, and it's around the 9.8% generated by the Semiconductor industry.

See our latest analysis for JT

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of JT, check out these free graphs here.

How Are Returns Trending?

There is reason to be cautious about JT, given the returns are trending downwards. About five years ago, returns on capital were 18%, however they're now substantially lower than that as we saw above. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on JT becoming one if things continue as they have.

In Conclusion...

In summary, it's unfortunate that JT is generating lower returns from the same amount of capital. Since the stock has skyrocketed 196% over the last five years, it looks like investors have high expectations of the stock. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

JT does come with some risks though, we found 3 warning signs in our investment analysis, and 1 of those is potentially serious...

While JT isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading JT or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A089790

JT

Engages in the research, development, and sale of semiconductor process and automation equipment in South Korea and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives