- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A089030

Techwing, Inc.'s (KOSDAQ:089030) 31% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Techwing, Inc. (KOSDAQ:089030) shares have been powering on, with a gain of 31% in the last thirty days. The last month tops off a massive increase of 234% in the last year.

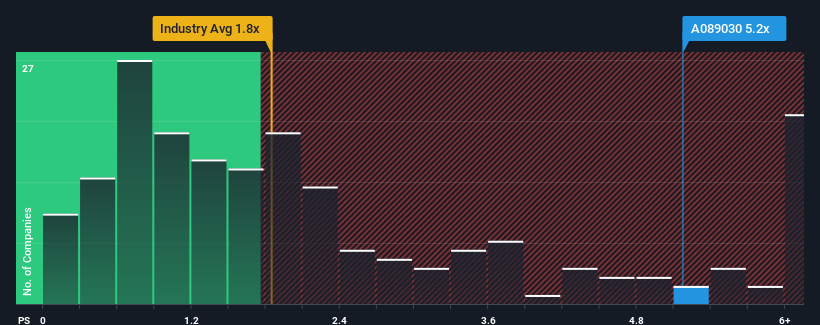

Since its price has surged higher, you could be forgiven for thinking Techwing is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.2x, considering almost half the companies in Korea's Semiconductor industry have P/S ratios below 1.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Techwing

How Has Techwing Performed Recently?

Techwing has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Techwing's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Techwing's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 50%. The last three years don't look nice either as the company has shrunk revenue by 38% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 33% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 65% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Techwing's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Techwing's P/S

Shares in Techwing have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Techwing trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Techwing (at least 1 which is significant), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Techwing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A089030

Techwing

Develops, manufactures, sells, and services semiconductor inspection equipment in South Korea and internationally.

Exceptional growth potential with low risk.

Similar Companies

Market Insights

Community Narratives