- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A086390

Capital Allocation Trends At UniTest Incorporation (KOSDAQ:086390) Aren't Ideal

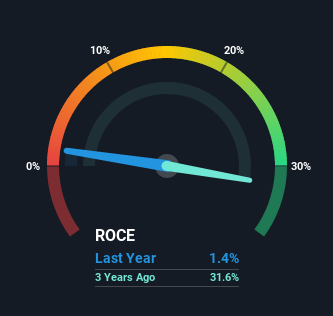

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at UniTest Incorporation (KOSDAQ:086390) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for UniTest Incorporation:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.014 = ₩2.5b ÷ (₩199b - ₩23b) (Based on the trailing twelve months to December 2020).

So, UniTest Incorporation has an ROCE of 1.4%. In absolute terms, that's a low return and it also under-performs the Semiconductor industry average of 8.8%.

See our latest analysis for UniTest Incorporation

In the above chart we have measured UniTest Incorporation's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What The Trend Of ROCE Can Tell Us

In terms of UniTest Incorporation's historical ROCE movements, the trend isn't fantastic. To be more specific, ROCE has fallen from 40% over the last five years. And considering revenue has dropped while employing more capital, we'd be cautious. If this were to continue, you might be looking at a company that is trying to reinvest for growth but is actually losing market share since sales haven't increased.

On a side note, UniTest Incorporation has done well to pay down its current liabilities to 12% of total assets. That could partly explain why the ROCE has dropped. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

In Conclusion...

From the above analysis, we find it rather worrisome that returns on capital and sales for UniTest Incorporation have fallen, meanwhile the business is employing more capital than it was five years ago. The market must be rosy on the stock's future because even though the underlying trends aren't too encouraging, the stock has soared 219%. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

On a final note, we've found 2 warning signs for UniTest Incorporation that we think you should be aware of.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A086390

UniTest Incorporation

Manufactures and sells semiconductor testing equipment in South Korea.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives