- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A084850

Should ITM Semiconductor (KOSDAQ:084850) Be Disappointed With Their 14% Profit?

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the ITM Semiconductor Co., Ltd. (KOSDAQ:084850) share price is up 14% in the last year, that falls short of the market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for ITM Semiconductor

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, ITM Semiconductor actually shrank its EPS by 54%.

This means it's unlikely the market is judging the company based on earnings growth. Indeed, when EPS is declining but the share price is up, it often means the market is considering other factors.

However the year on year revenue growth of 14% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

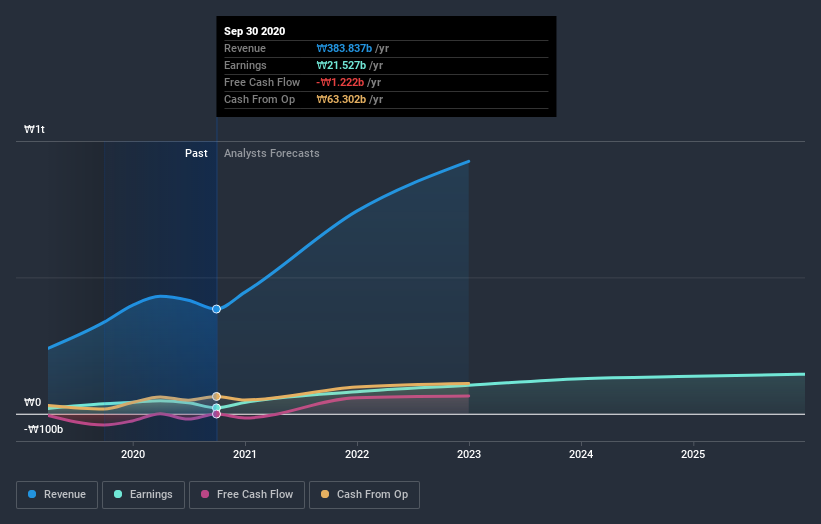

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at ITM Semiconductor's financial health with this free report on its balance sheet.

A Different Perspective

We're happy to report that ITM Semiconductor are up 14% over the year. Unfortunately this falls short of the market return of around 45%. The last three months haven't been great for shareholder returns, since the share price has trailed the market by 28% in the last three months. But a weak quarter certainly doesn't diminish the longer-term achievements of the business. It's always interesting to track share price performance over the longer term. But to understand ITM Semiconductor better, we need to consider many other factors. For instance, we've identified 2 warning signs for ITM Semiconductor that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade ITM Semiconductor, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A084850

ITM Semiconductor

Manufactures and sells components for secondary batteries worldwide.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026