- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A082270

Investors push GemVax&KAELLtd (KOSDAQ:082270) 31% lower this week, company's increasing losses might be to blame

It certainly was a quite a shock to see the GemVax&KAEL Co.,Ltd. (KOSDAQ:082270) share price fall -31% in the last week. But that doesn't change the fact that the returns over the last year have been very strong. During that period, the share price soared a full 212%. So it is important to view the recent reduction in price through that lense. The real question is whether the business is trending in the right direction.

While the stock has fallen 31% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

GemVax&KAELLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year GemVax&KAELLtd saw its revenue grow by 7.6%. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 212%. The business will need a lot more growth to justify that increase. We're not so sure that revenue growth is driving the market optimism about the stock.

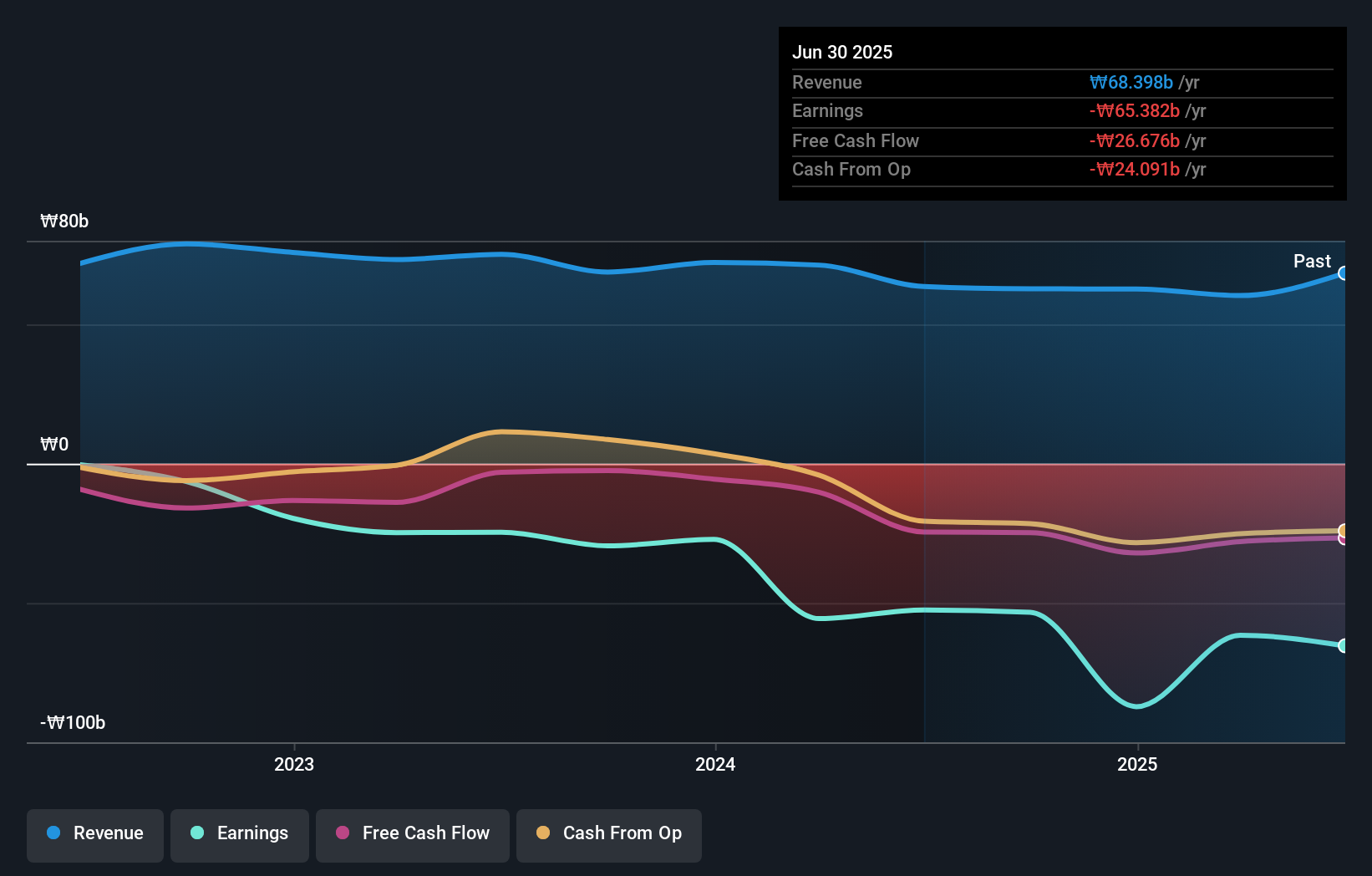

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling GemVax&KAELLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that GemVax&KAELLtd shareholders have received a total shareholder return of 212% over the last year. That gain is better than the annual TSR over five years, which is 8%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with GemVax&KAELLtd , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A082270

GemVax&KAELLtd

GemVax&KAEL Co.,Ltd engages in the manufacturing and selling of coating resins and filters for semiconductors and display production in South Korea.

Imperfect balance sheet with very low risk.

Market Insights

Community Narratives