- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A067310

KRX Growth Companies With High Insider Ownership And 47% Earnings Growth

Reviewed by Simply Wall St

The South Korean stock market has recently experienced a downturn, with the KOSPI index declining over three consecutive sessions and showing signs of continued pressure. Amidst this backdrop, investors might consider the resilience and potential growth of companies with high insider ownership, which can signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| SamyoungLtd (KOSE:A003720) | 25% | 30.4% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| S&S Tech (KOSDAQ:A101490) | 21.6% | 44.1% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 78.1% |

| Devsisters (KOSDAQ:A194480) | 27.2% | 73.5% |

| Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Here we highlight a subset of our preferred stocks from the screener.

Dongwha EnterpriseLtd (KOSDAQ:A025900)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongwha Enterprise Co., Ltd is a South Korean company specializing in the manufacture and sale of wood materials, with a market capitalization of approximately ₩768.46 billion.

Operations: The company generates its revenue primarily through the manufacture and sale of wood materials in South Korea.

Insider Ownership: 16.5%

Earnings Growth Forecast: 93.3% p.a.

Dongwha Enterprise Co., Ltd, despite recent struggles with a net loss reduction from KRW 11.49 billion to KRW 9.81 billion in Q1 2024, shows potential for recovery. The company's sales have increased significantly, and it is trading at a substantial discount to its estimated fair value. With expectations of becoming profitable within three years and forecasted revenue growth outpacing the Korean market, Dongwha could appeal to investors looking for growth opportunities with high insider ownership, although its debt is poorly covered by operating cash flow and projected return on equity remains low.

- Click here to discover the nuances of Dongwha EnterpriseLtd with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Dongwha EnterpriseLtd's current price could be quite moderate.

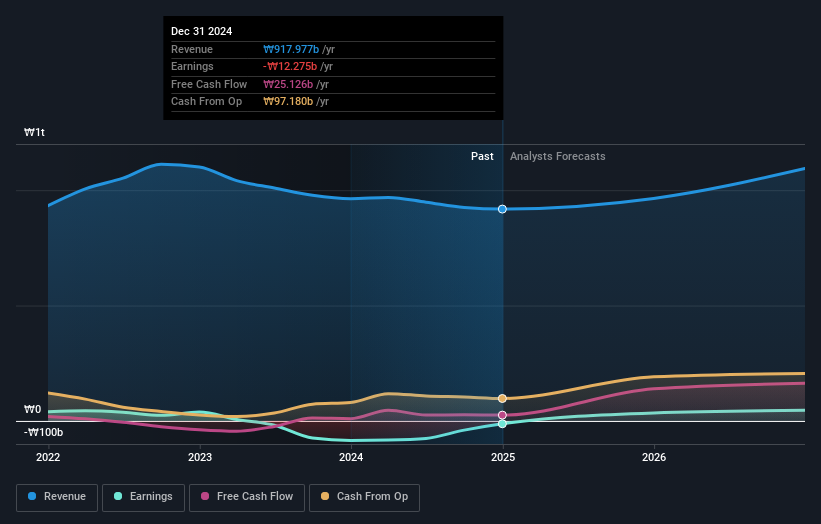

HANA Micron (KOSDAQ:A067310)

Simply Wall St Growth Rating: ★★★★★★

Overview: HANA Micron Inc. specializes in semiconductor back-end process packaging solutions, operating primarily in South Korea, with a market capitalization of approximately ₩1.00 trillion.

Operations: The company generates its revenue primarily from semiconductor back-end process packaging solutions.

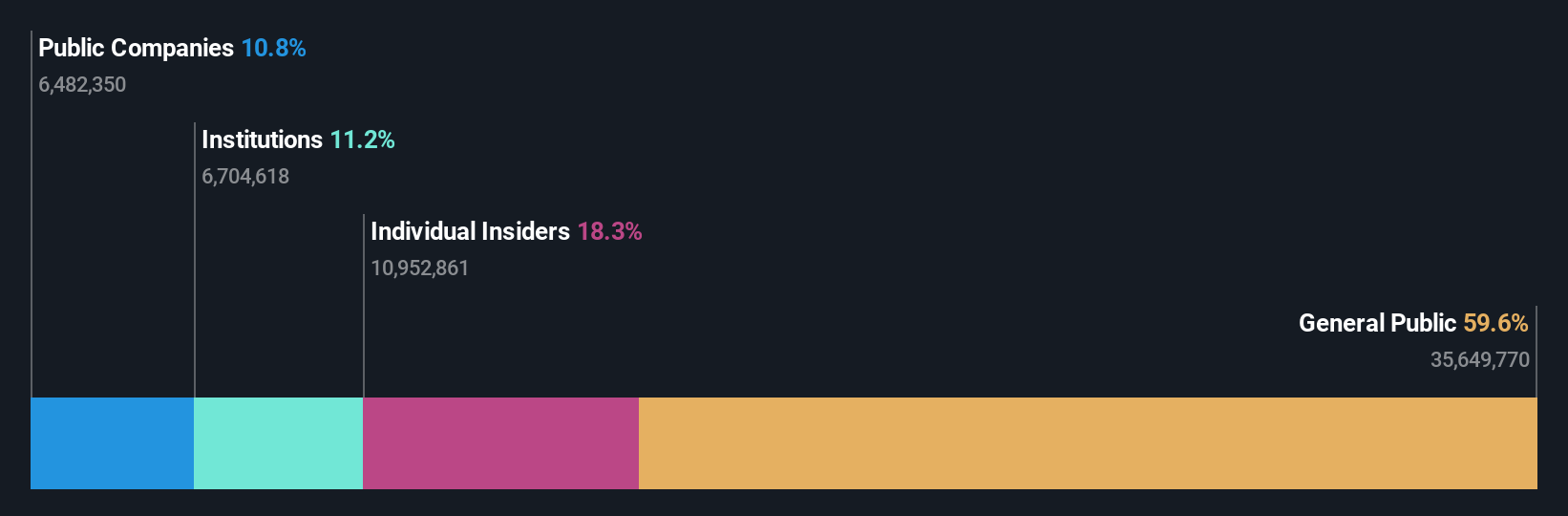

Insider Ownership: 19.8%

Earnings Growth Forecast: 76.8% p.a.

HANA Micron, amidst a challenging financial phase with significant revenue growth yet a recent shift to net losses, remains an intriguing prospect in South Korea's high insider ownership landscape. The company's aggressive revenue forecasts suggest robust future growth, potentially outstripping market averages significantly. However, recent earnings have underperformed, and the firm has experienced shareholder dilution through a substantial equity offering. This juxtaposition of high growth potential against current financial setbacks paints a complex picture for investors considering HANA Micron.

- Get an in-depth perspective on HANA Micron's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, HANA Micron's share price might be too pessimistic.

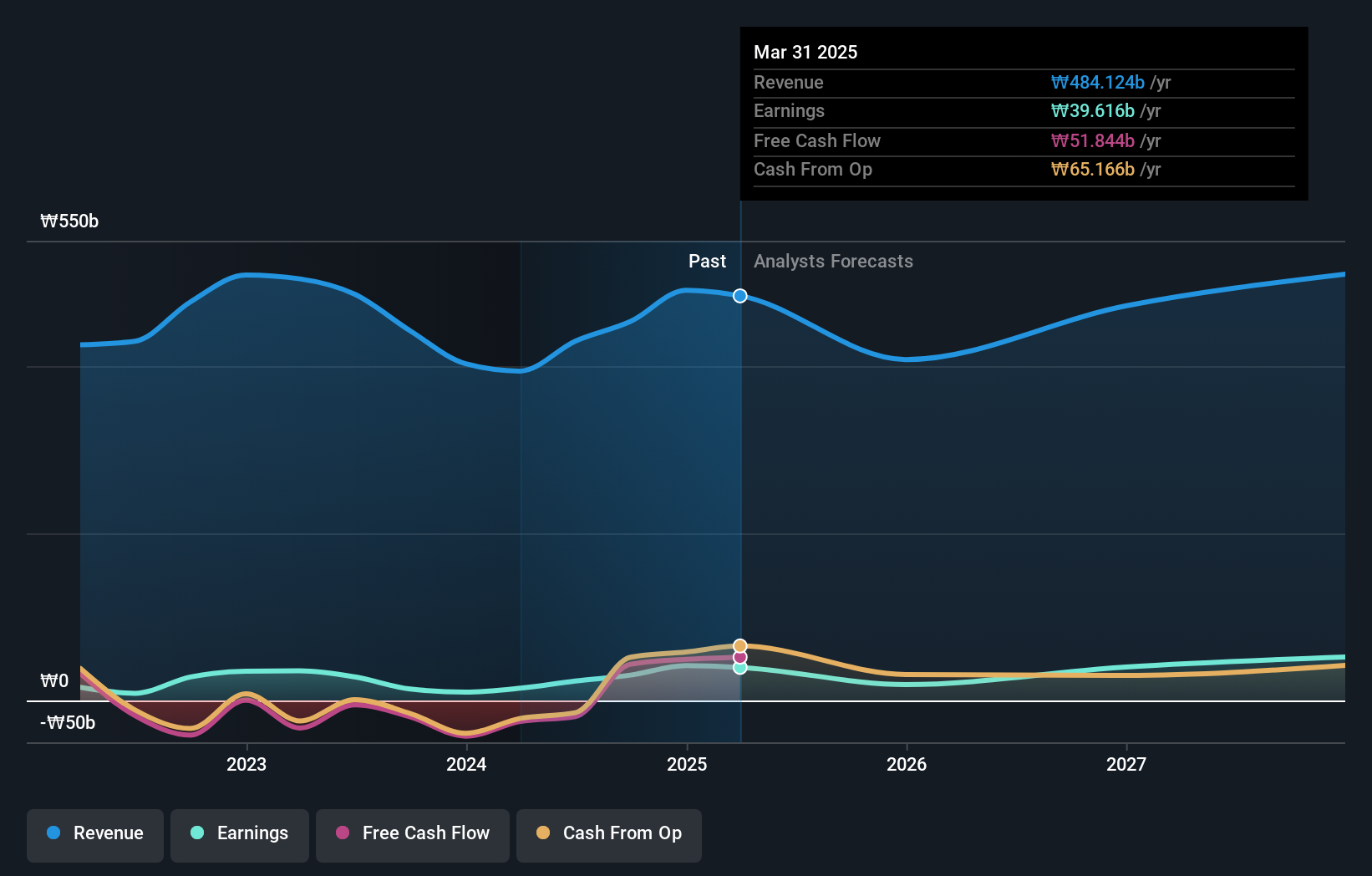

ZeusLtd (KOSDAQ:A079370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zeus Co., Ltd. operates in South Korea and globally, offering comprehensive solutions in semiconductors, robotics, and displays with a market capitalization of approximately ₩538.76 billion.

Operations: The firm's operational revenues are derived from its comprehensive offerings in semiconductors, robotics, and display solutions.

Insider Ownership: 25.5%

Earnings Growth Forecast: 47.7% p.a.

Zeus Co., Ltd. in South Korea, showcases substantial growth with its recent earnings skyrocketing and a significant share repurchase plan aimed at stock price stabilization and shareholder value enhancement. While the company's revenue dipped slightly from the previous year, its net income saw a very large increase. Forecasted to grow earnings by 47.73% annually, ZeusLtd is positioned above market expectations despite some concerns over profit margins and shareholder dilution from the past year.

- Delve into the full analysis future growth report here for a deeper understanding of ZeusLtd.

- Upon reviewing our latest valuation report, ZeusLtd's share price might be too optimistic.

Summing It All Up

- Click here to access our complete index of 80 Fast Growing KRX Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HANA Micron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A067310

HANA Micron

Provides semiconductor back-end process packaging solutions in South Korea.

Undervalued with high growth potential.

Market Insights

Community Narratives