- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A441270

KRX Spotlight On HB TechnologyLTD And Two More Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The South Korean market has shown robust performance, rising 2.0% over the past week and achieving an 11% increase over the last year, with earnings expected to grow by 30% annually. In such a thriving environment, companies like HB Technology LTD with high insider ownership can be particularly compelling, as this often signals strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

| Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 27.9% | 54% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

| Park Systems (KOSDAQ:A140860) | 33.1% | 35.6% |

| UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

| Vuno (KOSDAQ:A338220) | 19.5% | 105% |

| HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

| INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

| Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Here we highlight a subset of our preferred stocks from the screener.

HB TechnologyLTD (KOSDAQ:A078150)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HB Technology CO., LTD. operates in the manufacture and sale of inspection display equipment, serving both domestic and international markets, with a market capitalization of approximately ₩404.29 billion.

Operations: The company generates its revenue primarily through the production and sale of inspection display equipment, catering to markets in South Korea and abroad.

Insider Ownership: 13.8%

Earnings Growth Forecast: 38.8% p.a.

HB Technology LTD, a South Korean company, showcases significant growth potential with its earnings expected to increase by 38.77% annually. Despite past shareholder dilution, the company's revenue is also projected to grow at 44.4% per year, outpacing the broader Korean market significantly. However, it trades at 63.2% below its estimated fair value and has experienced high share price volatility recently. There's no recent insider trading data available to gauge current sentiment from insiders directly.

- Take a closer look at HB TechnologyLTD's potential here in our earnings growth report.

- The analysis detailed in our HB TechnologyLTD valuation report hints at an deflated share price compared to its estimated value.

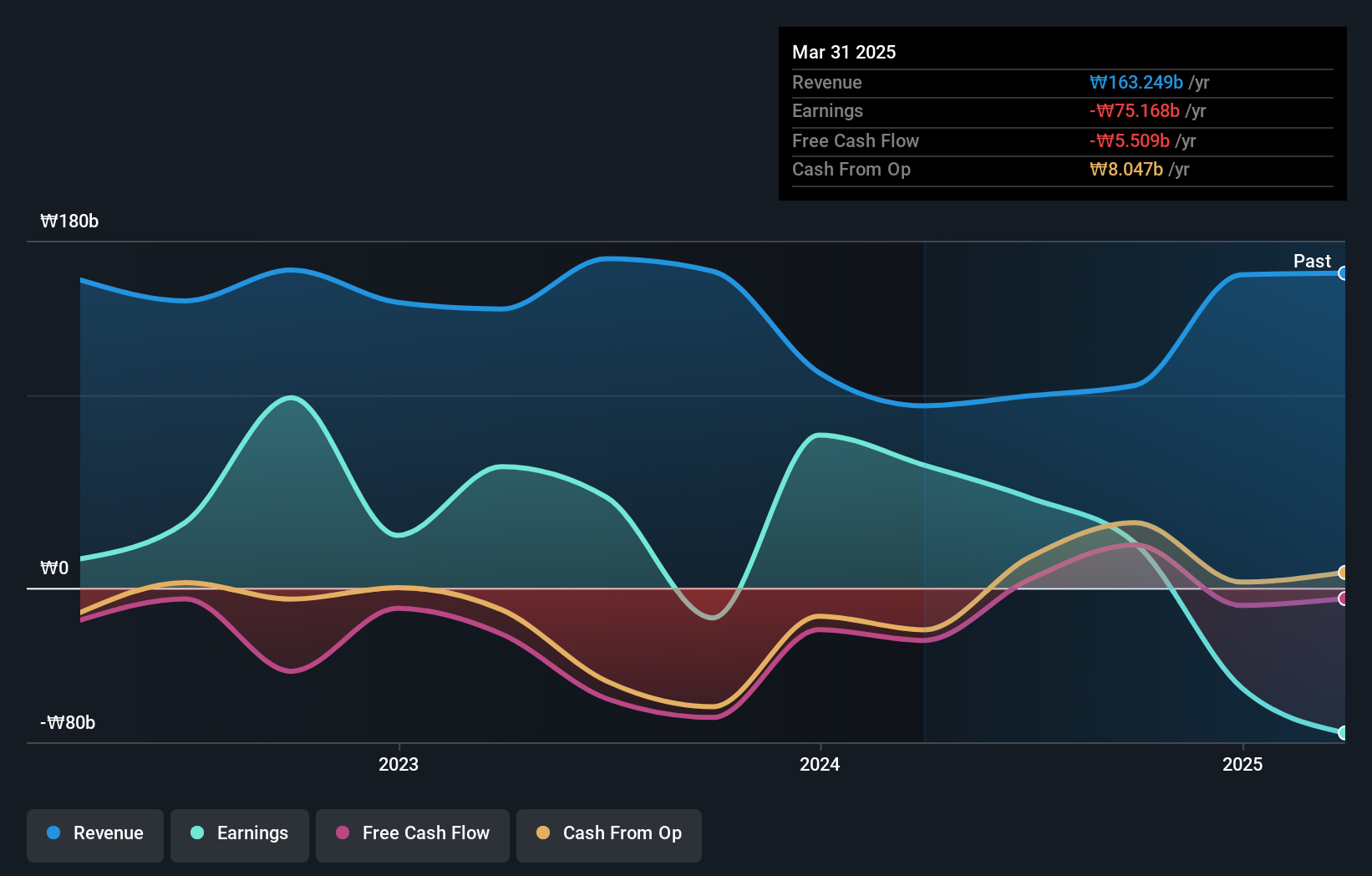

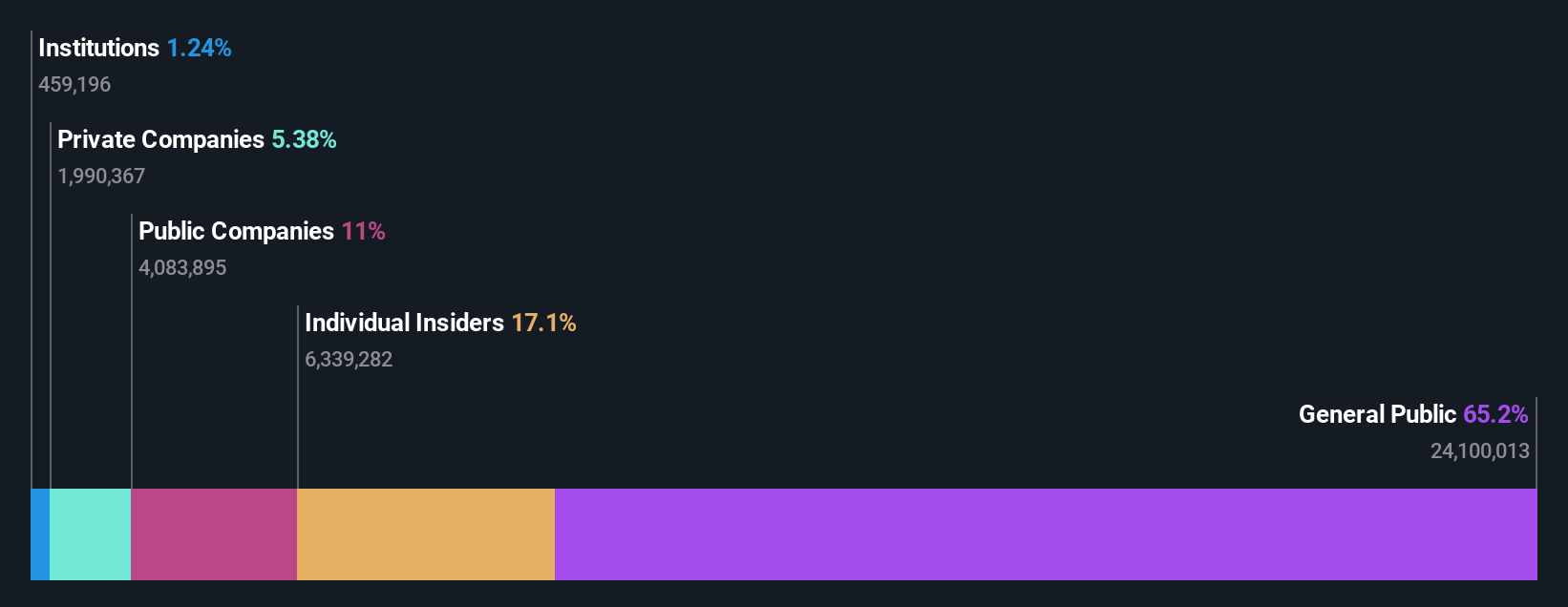

Fine M-TecLTD (KOSDAQ:A441270)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fine M-Tec CO., LTD. specializes in manufacturing and selling IT parts for mobile phones and other devices, with a market capitalization of approximately ₩354.20 billion.

Operations: The company generates its revenue primarily from the manufacturing and selling of components for mobile devices, totaling approximately ₩398.48 billion.

Insider Ownership: 17.3%

Earnings Growth Forecast: 36.4% p.a.

Fine M-Tec LTD, a South Korean company, is poised for robust growth with its revenue and earnings forecasted to increase by 26.8% and 36.4% annually, respectively—both rates exceeding the national market averages. Although trading at 82.4% below its estimated fair value suggests significant undervaluation, the company's share price has shown high volatility recently. Additionally, despite becoming profitable this year, shareholder dilution has occurred over the past year with no recent insider trading data available to assess current internal confidence levels directly.

- Get an in-depth perspective on Fine M-TecLTD's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Fine M-TecLTD shares in the market.

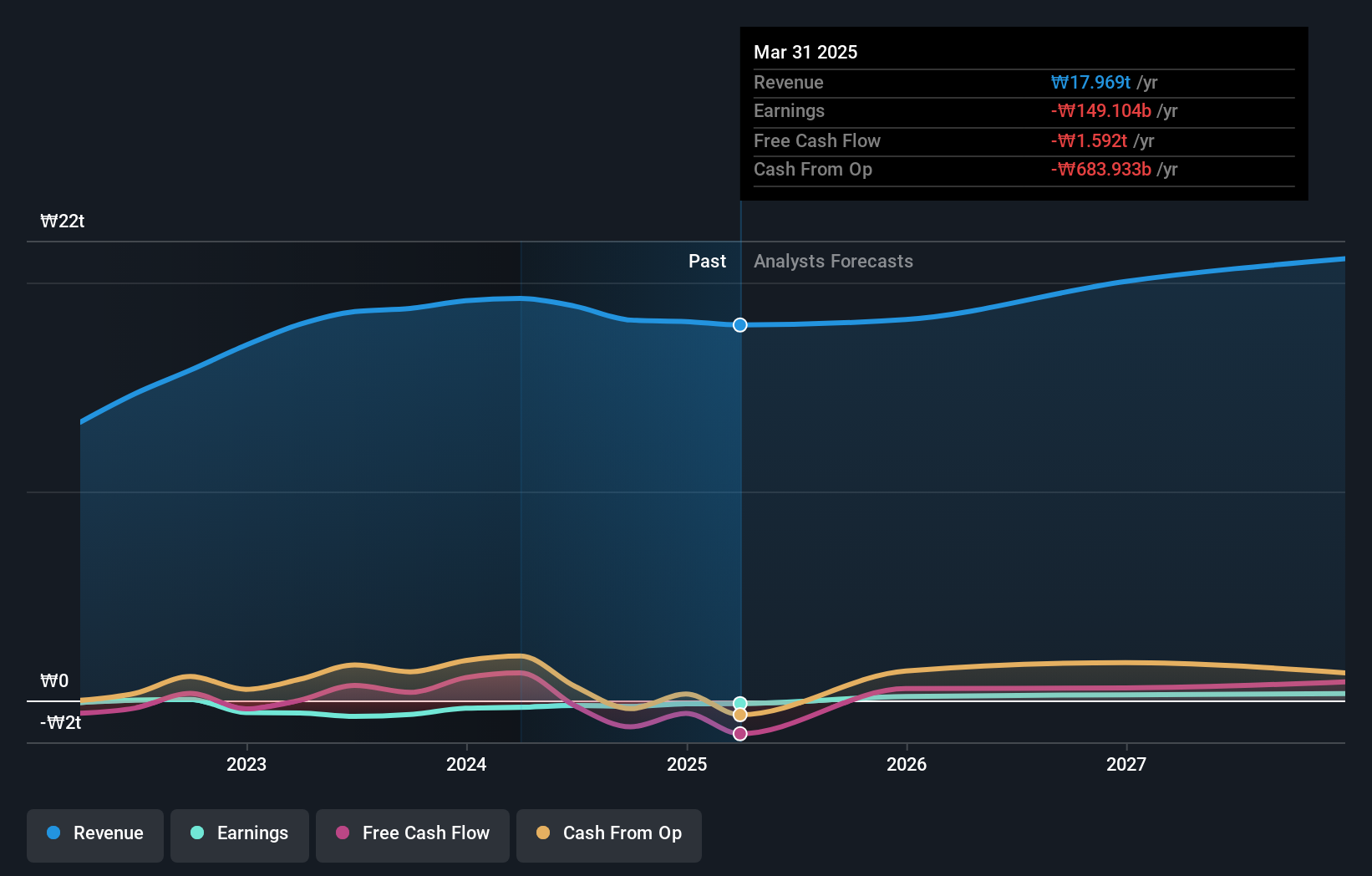

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across various global markets including South Korea, the United States, Asia, the Middle East, and Europe, with a market capitalization of approximately ₩3.56 billion.

Operations: The company's revenue is derived from its involvement in heavy industry, machinery manufacturing, and apartment construction across diverse global markets.

Insider Ownership: 38.9%

Earnings Growth Forecast: 72.9% p.a.

Doosan Corporation, despite a sluggish revenue growth forecast of 3.6% per year, is expected to see a sharp rise in earnings by 72.89% annually. Recently turning profitable, with net income reaching KRW 4.98 billion from a previous loss, the company's return on equity is also projected to be robust at 22.2%. However, its share price has been highly volatile over the last three months and it trades at 56.8% below its estimated fair value, indicating potential undervaluation or market skepticism.

- Click here to discover the nuances of Doosan with our detailed analytical future growth report.

- Our valuation report here indicates Doosan may be undervalued.

Make It Happen

- Gain an insight into the universe of 83 Fast Growing KRX Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A441270

Fine M-TecLTD

Engages in the manufacture and sale of information technology (IT) parts used for mobile phones and others.

Low and overvalued.

Market Insights

Community Narratives