- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A064290

INTEKPLUS Co., Ltd. (KOSDAQ:064290) May Have Run Too Fast Too Soon With Recent 35% Price Plummet

The INTEKPLUS Co., Ltd. (KOSDAQ:064290) share price has fared very poorly over the last month, falling by a substantial 35%. For any long-term shareholders, the last month ends a year to forget by locking in a 61% share price decline.

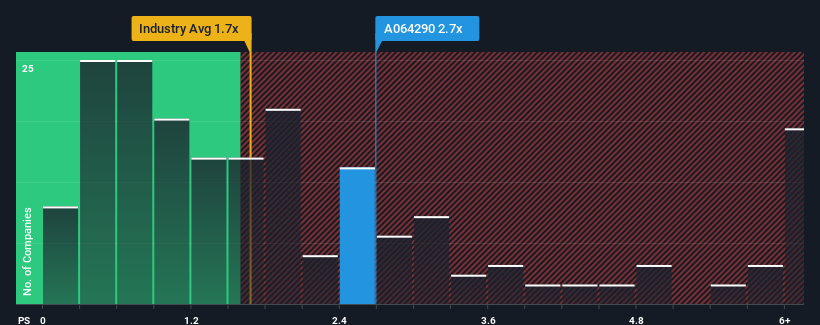

Even after such a large drop in price, when almost half of the companies in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.7x, you may still consider INTEKPLUS as a stock probably not worth researching with its 2.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for INTEKPLUS

How Has INTEKPLUS Performed Recently?

INTEKPLUS could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think INTEKPLUS' future stacks up against the industry? In that case, our free report is a great place to start.How Is INTEKPLUS' Revenue Growth Trending?

In order to justify its P/S ratio, INTEKPLUS would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 37% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 68% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 88%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that INTEKPLUS' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

INTEKPLUS' P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've concluded that INTEKPLUS currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with INTEKPLUS.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A064290

INTEKPLUS

Develops and supplies semiconductor packages and visual inspection equipment.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success