- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A061970

The Market Doesn't Like What It Sees From LB Semicon Inc.'s (KOSDAQ:061970) Revenues Yet As Shares Tumble 30%

To the annoyance of some shareholders, LB Semicon Inc. (KOSDAQ:061970) shares are down a considerable 30% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

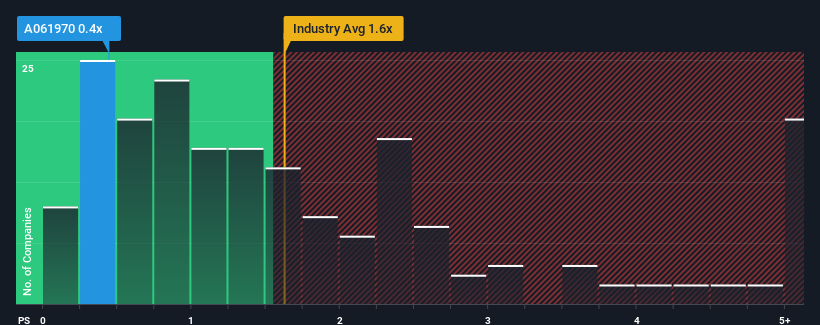

Following the heavy fall in price, given about half the companies operating in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") above 1.6x, you may consider LB Semicon as an attractive investment with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for LB Semicon

How Has LB Semicon Performed Recently?

While the industry has experienced revenue growth lately, LB Semicon's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on LB Semicon will help you uncover what's on the horizon.How Is LB Semicon's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like LB Semicon's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. As a result, revenue from three years ago have also fallen 7.3% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 11% over the next year. With the industry predicted to deliver 88% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why LB Semicon's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does LB Semicon's P/S Mean For Investors?

LB Semicon's recently weak share price has pulled its P/S back below other Semiconductor companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that LB Semicon maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for LB Semicon that you need to be mindful of.

If you're unsure about the strength of LB Semicon's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A061970

LB Semicon

Provides flip-chip wafer bumping technology solutions in South Korea.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026