- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A040910

Shareholders in ICD (KOSDAQ:040910) are in the red if they invested five years ago

ICD Co., Ltd. (KOSDAQ:040910) shareholders should be happy to see the share price up 23% in the last quarter. But that is little comfort to those holding over the last half decade, sitting on a big loss. Indeed, the share price is down 68% in the period. So is the recent increase sufficient to restore confidence in the stock? Not yet. But it could be that the fall was overdone.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Given that ICD didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years ICD saw its revenue shrink by 18% per year. That's definitely a weaker result than most pre-profit companies report. Arguably, the market has responded appropriately to this business performance by sending the share price down 11% (annualized) in the same time period. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. This looks like a really risky stock to buy, at a glance.

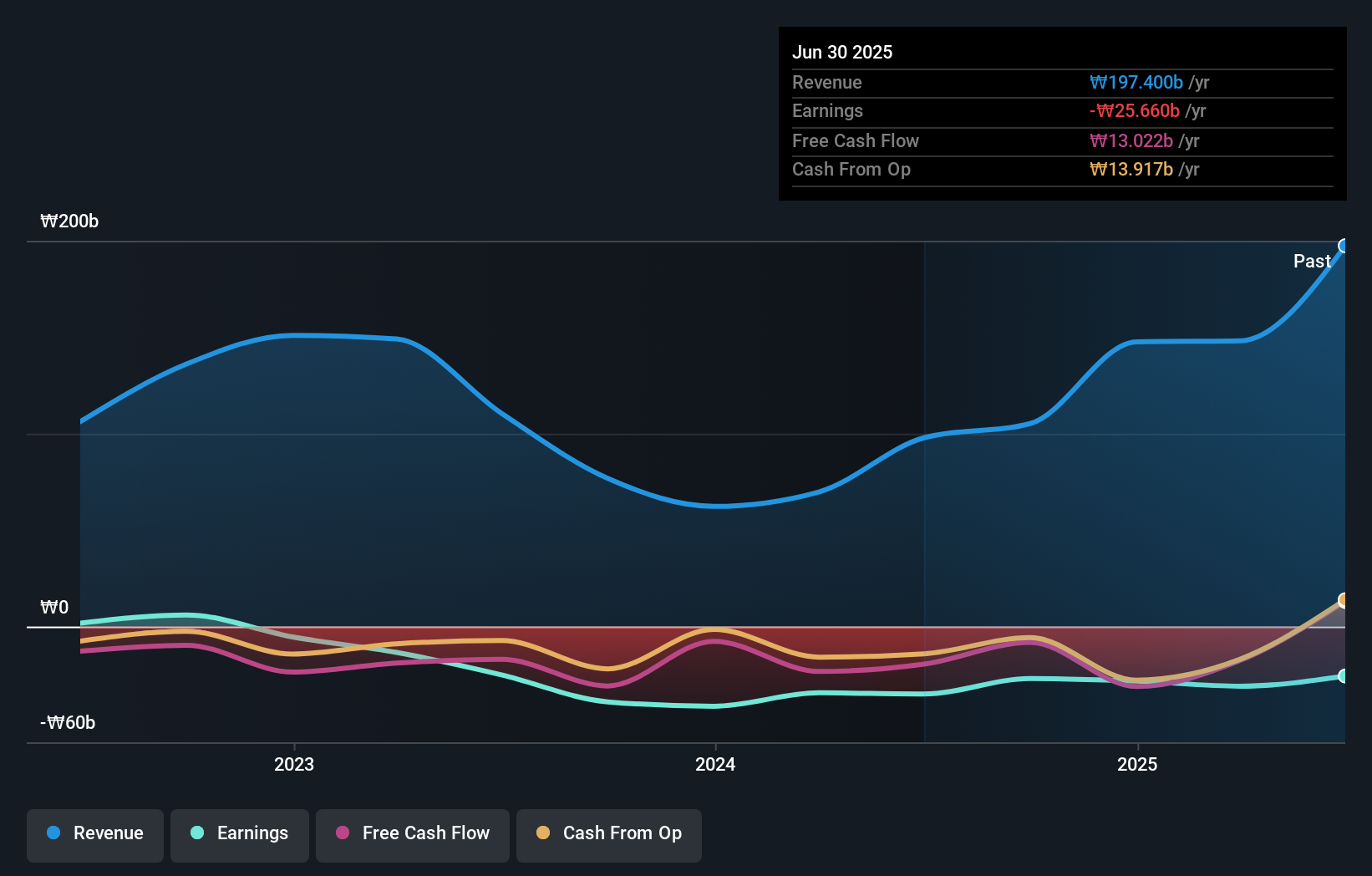

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling ICD stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Investors in ICD had a tough year, with a total loss of 2.2%, against a market gain of about 52%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 11% per annum loss investors have suffered over the last half decade. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand ICD better, we need to consider many other factors. Take risks, for example - ICD has 2 warning signs (and 1 which can't be ignored) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A040910

ICD

Engages in the manufacture and sale of AMOLED, LCD, and semiconductor equipment in South Korea and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives