- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A039030

3 Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In the current climate, global markets are experiencing volatility with U.S. stocks facing declines due to cautious Federal Reserve commentary and political uncertainties, while European and Asian indices also reflect investor apprehension over interest rate outlooks. Amid these fluctuations, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors seeking to capitalize on market inefficiencies. A good stock in this context is one that demonstrates strong fundamentals but is temporarily undervalued due to broader market sentiments rather than company-specific issues.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$265.50 | NT$530.93 | 50% |

| Wasion Holdings (SEHK:3393) | HK$7.03 | HK$14.06 | 50% |

| Kuaishou Technology (SEHK:1024) | HK$42.45 | HK$84.87 | 50% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK451.11 | 49.8% |

| GlobalData (AIM:DATA) | £1.87 | £3.74 | 50% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.90 | 50% |

| T'Way Air (KOSE:A091810) | ₩2520.00 | ₩5038.37 | 50% |

| Medley (TSE:4480) | ¥3835.00 | ¥7639.79 | 49.8% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.61 | 49.9% |

| GRCS (TSE:9250) | ¥1415.00 | ¥2820.34 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

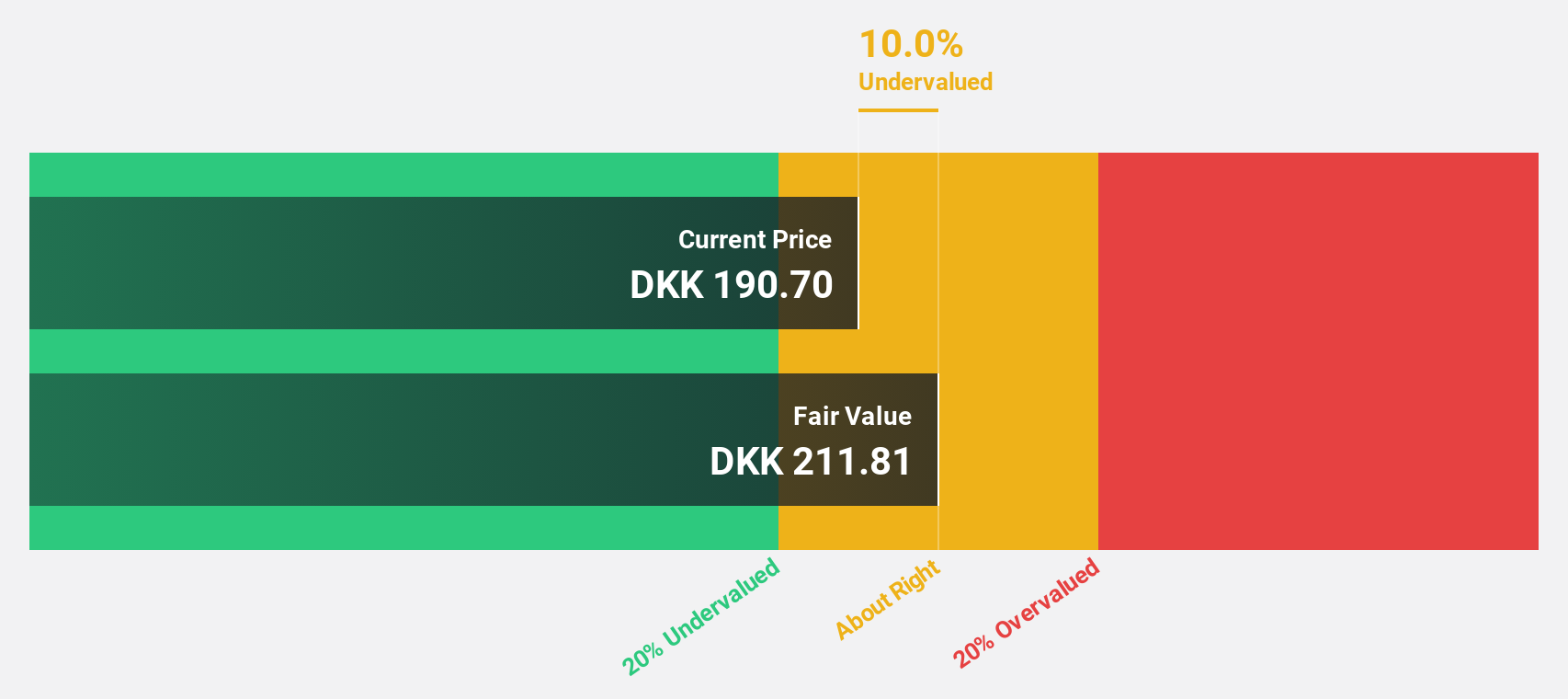

ALK-Abelló (CPSE:ALK B)

Overview: ALK-Abelló A/S is an allergy solutions company with operations in Europe, North America, and internationally, and it has a market cap of DKK34.75 billion.

Operations: The company's revenue is primarily derived from its allergy treatment segment, which generated DKK5.38 billion.

Estimated Discount To Fair Value: 23.3%

ALK-Abelló is trading at DKK 157.1, approximately 23.3% below its estimated fair value of DKK 204.93, indicating potential undervaluation based on discounted cash flow analysis. Recent earnings growth of 85.1% and projected annual profit growth of 27.3% suggest robust financial health relative to the Danish market's forecasted growth rates. Positive clinical trial results for its peanut allergy treatment and regulatory approval for ACARIZAX in children could further bolster future revenue streams.

- The growth report we've compiled suggests that ALK-Abelló's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of ALK-Abelló.

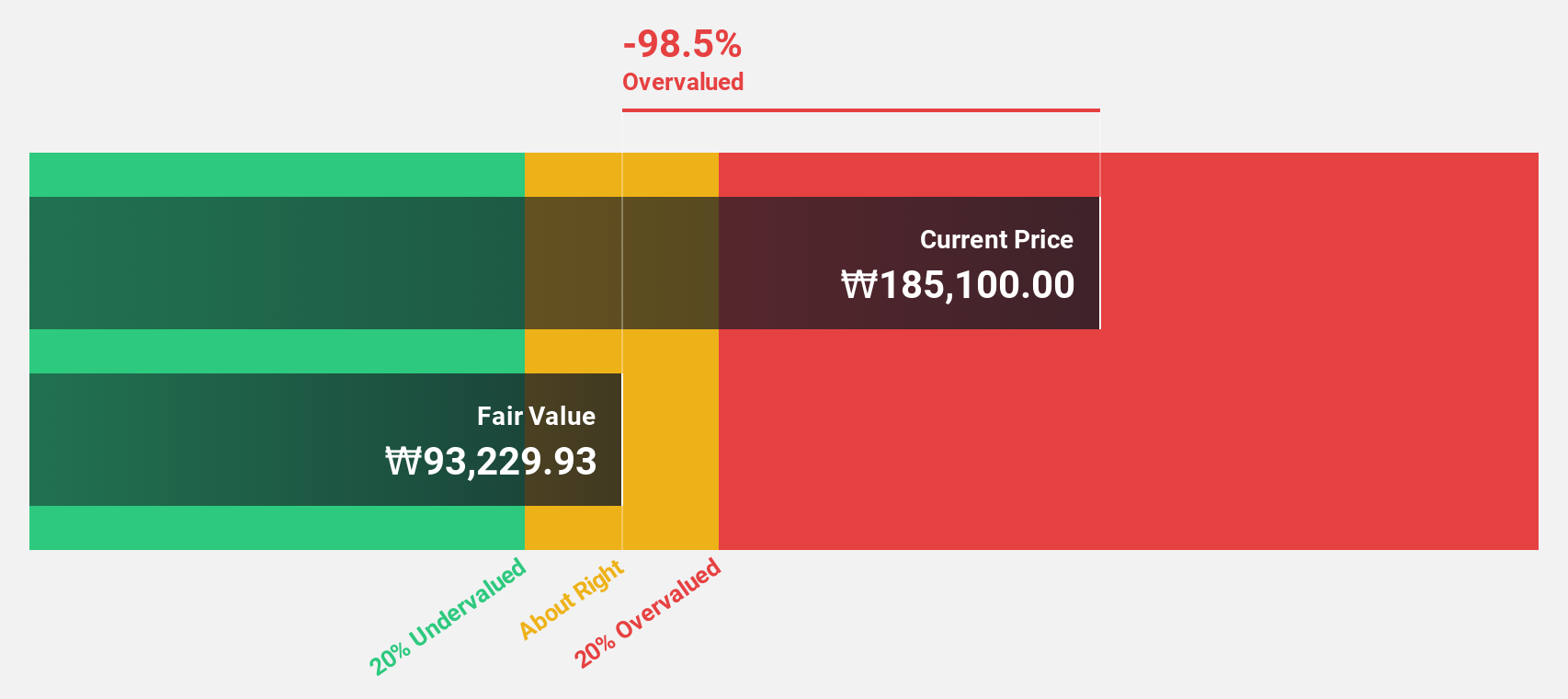

EO Technics (KOSDAQ:A039030)

Overview: EO Technics Co., Ltd. manufactures and supplies laser processing equipment worldwide, with a market cap of approximately ₩1.67 billion.

Operations: The company generates revenue primarily from its Semiconductor Machine Division, which accounts for ₩301.92 billion.

Estimated Discount To Fair Value: 29.1%

EO Technics is currently trading at ₩137,600, approximately 29.1% below its estimated fair value of ₩194,088.68 based on discounted cash flow analysis, highlighting its potential undervaluation. Despite a highly volatile share price recently, the company's earnings are forecast to grow significantly by 50.5% annually over the next three years, outpacing the Korean market's expected growth rate of 29.4%. However, its return on equity is projected to remain relatively low at 12.7%.

- Our growth report here indicates EO Technics may be poised for an improving outlook.

- Click here to discover the nuances of EO Technics with our detailed financial health report.

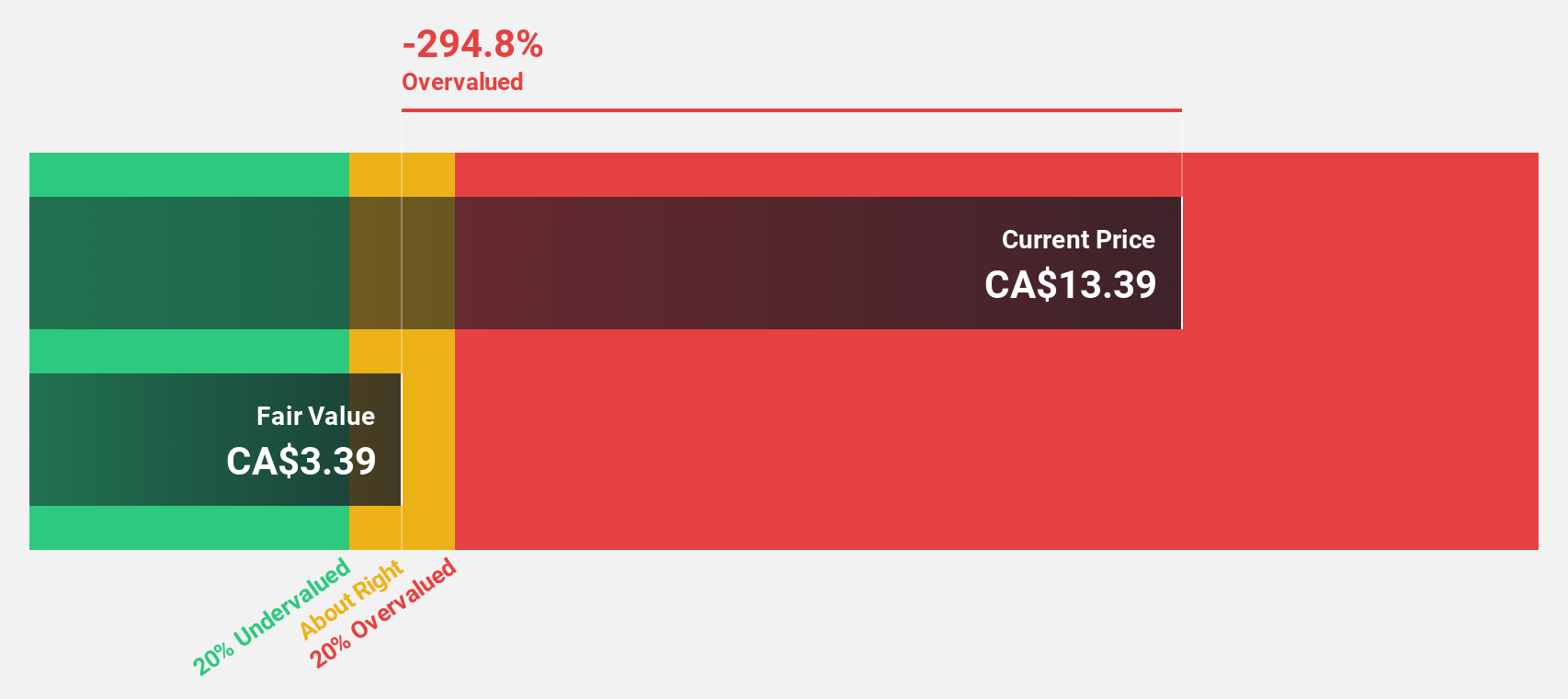

Capstone Copper (TSX:CS)

Overview: Capstone Copper Corp. is a copper mining company operating in the United States, Chile, and Mexico with a market cap of CA$6.75 billion.

Operations: The company's revenue segments include $236.80 million from Cozamin, $388.12 million from Mantoverde, $528.75 million from Pinto Valley, and $369.21 million from Mantos Blancos.

Estimated Discount To Fair Value: 19.4%

Capstone Copper's recent earnings reveal a return to profitability with US$12.5 million net income, up from a loss last year, and sales reaching US$419.4 million. The stock trades below its CA$11.23 fair value estimate at CA$9.05, suggesting undervaluation on cash flows despite insider selling and past shareholder dilution. With significant expected profit growth of 48% annually over three years, it outpaces the Canadian market's forecasted growth rate of 15%.

- Upon reviewing our latest growth report, Capstone Copper's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Capstone Copper's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Gain an insight into the universe of 872 Undervalued Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EO Technics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A039030

EO Technics

Manufactures and supplies laser processing equipment worldwide.

Flawless balance sheet with high growth potential.