- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A031980

PSK HOLDINGS Inc. (KOSDAQ:031980) Shares May Have Slumped 30% But Getting In Cheap Is Still Unlikely

PSK HOLDINGS Inc. (KOSDAQ:031980) shares have retraced a considerable 30% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 53%, which is great even in a bull market.

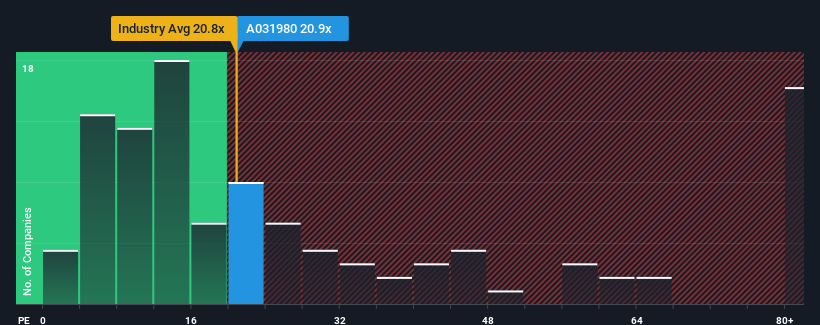

Even after such a large drop in price, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 12x, you may still consider PSK HOLDINGS as a stock to avoid entirely with its 20.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been pleasing for PSK HOLDINGS as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for PSK HOLDINGS

How Is PSK HOLDINGS' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like PSK HOLDINGS' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 15%. Pleasingly, EPS has also lifted 612% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth is heading into negative territory, declining 99% over the next year. Meanwhile, the broader market is forecast to expand by 33%, which paints a poor picture.

With this information, we find it concerning that PSK HOLDINGS is trading at a P/E higher than the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

What We Can Learn From PSK HOLDINGS' P/E?

Even after such a strong price drop, PSK HOLDINGS' P/E still exceeds the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that PSK HOLDINGS currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - PSK HOLDINGS has 4 warning signs (and 1 which is potentially serious) we think you should know about.

If you're unsure about the strength of PSK HOLDINGS' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A031980

PSK HOLDINGS

Manufactures and sells semiconductor manufacturing and flat panel display equipment worldwide.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives